Table of Contents

Retirement finance involves allocating limited capital across competing priorities. Your resources must simultaneously fund essential living expenses, discretionary comforts, legacy goals, and contingency plans.

Without a framework guiding allocation, retirees often feel aimless and overwhelmed by limitless possibilities. How much should go toward guaranteed income versus growth investing? What portion should be reserved as a buffer?

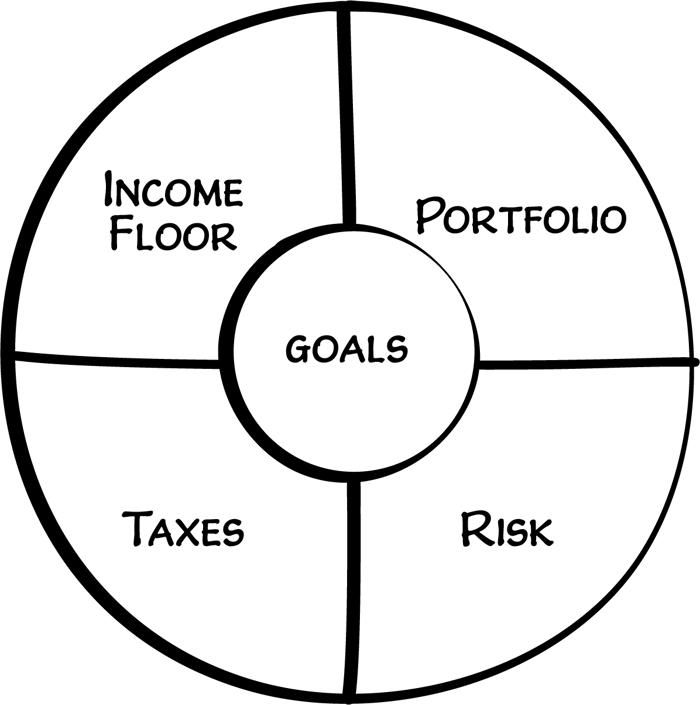

Holistically categorizing retirement capital into four "assets" brings much-needed organization.

This 4 assets model divides retirement finances into:

Real estate - Additional properties beyond your primary home that can provide buffers

Earmarks - Reserves set aside for specific goals like an emergency fund

Income floor - Reliable and predictable income sources covering essential needs

Investment portfolio - Growth-oriented investments for funding wants and wishes

Coordinating these assets enables fully customized plans aligned with your retirement

philosophy.

This framework transforms retirement finance from a chaotic mix of resources into organized systems with defined jobs.

Let's examine each of the four assets and how they work to remove chaos and empower the retirement lifestyle you envision.

Visualize a Mental Balance Sheet

There is no one correct way to categorize retirement assets. But traditional account-by-account thinking is too limiting. Instead, research shows separating resources into mental "accounts" provides immense psychological benefits.

Visualizing a mental balance sheet with segmented accounts leads to clarity on optimal allocation. You gain confidence knowing essentials are covered in protected accounts, enabling you to securely enjoy growth from investments.

Mental accounting provides a clear line of sight into how lifetime income streams can fund retirement spending needs. This technique is deeply rooted in human behavior - we innately compartmentalize resources and attach meanings to those subdivisions.

Leveraging this tendency through purposeful mental accounting as part of the 4 assets framework creates custom financial plans aligned to your retirement philosophy. Coordinating efforts across the four assets and their corresponding mental account categories enables fully customized outcomes.

Real Estate Assets - Your Buffer Against Uncertainty

Real estate, including your primary residence, is an important potential buffer asset for retirement planning. The equity in properties you own can provide critical financing options during periods of market stress or unexpected costs.

Having real estate as part of your asset mix facilitates several options for responding to changing conditions:

Tapping home equity through strategic borrowing options like lines of credit or reverse mortgages

Selling secondary properties beyond your primary residence to generate funds

Renting out extra properties to create cash flow

To employ real estate effectively as a buffer asset, you must clearly grasp key factors like your equity stake, income potential, and tax implications of any actions.

For example, a vacation home that is occasionally rented out when not in use can provide a stream of supplemental income. This rental cash flow helps weather unexpected expenditures or market downturns.

Even if you only own your primary residence, the equity still holds value as a potential buffer. You may never need to tap into the equity of your primary residence, but it can be a powerful buffer if catastrophic expenses or unforeseen accidents pop up.

Tapping into your primary residence’s equity is generally closer to a last resort strategy than something to lead with, but it is good to know it is there if you need it.

One client I worked with, Jim, had a real estate portfolio worth $16 million across 4 fully paid-off properties. This provided confidence that he could access funds during major market volatility without needing to sell assets at the wrong time.

Some key technical points on utilizing real estate strategically include:

Maintaining a strong equity position to maximize financing options

Understanding tax implications of selling or borrowing against properties

Researching market rents and occupancy rates to project income potential

Accounting for maintenance, insurance, association fees, and other costs

Consulting with financial and legal experts on employing real estate strategically

In particular, equity and income potential determine real estate's efficacy as a buffer asset.

Properties with greater equity and income potential, whether primary residence or secondary, provide more robust protection against sequence of return risk.

If you ever need to downsize and move, the equity built up into your home can make that transaction much smoother.

To the next level, real estate may be able to fund your wants and wishes if you have income-generating properties or if you have a secondary home that you can sell to take a lump sum pushing you past your income needs.

Regardless of your real estate holdings, you should budget around 2% of the property’s value for operational expenses annually to ensure your bases are covered.

Earmarked Assets - Reserves for Specific Goals

Earmarking assets refers to designating a portion of your portfolio for specific planned uses, separate from general retirement spending needs. Common earmarked accounts include emergency reserves, known upcoming purchases, education funds, and charitable donor-advised funds.

Emergency Funds

Retaining an emergency cash reserve is prudent even in retirement. You should consider maintaining 3-6 months' worth of living expenses in safe assets like savings accounts for contingency purposes.

Likewise, if you know you have an upcoming large purchase, you may decide to earmark funds specifically for that goal. For example, you could be saving up to buy a vacation home in 3 years. Keeping these funds separate from general retirement spending provides clarity.

Charitable Giving & Education

Other longer-term earmarked accounts include 529 education savings plans and donor-advised funds (DAFs) for charitable giving. With a 529 plan, you can make a large upfront contribution that grows tax-free and disperse it as needed for education costs.

With a DAF, a lump-sum charitable donation realizes immediate tax benefits while also designating funds you can grant to causes over time.

The key with earmarked assets is remembering they have a designated job – these reserves should not be casually accessed for discretionary spending needs. Maintaining the separation of these accounts provides psychological benefits alongside practical utility.

For instance, a client retains a 3-6 month emergency fund in a savings account, has a separate account earmarked for a kitchen remodel next year, and has funded a 529 plan for his grandchild using an upfront $100,000 contribution to maximize tax-deferred growth over time.

Earmarking assets provide clarity of purpose and confidence. Reserves for known or potential needs constitute a key area of retirement resources.

If you're curious about how these assets work together, I go into much more detail in 'Be The Bird', where I explore the complete framework for retirement security.

Building a Secure Income Floor

Predictable income that covers essential spending is crucial for relaxed confidence in retirement. This income floor provides both functional mitigations of risks like market volatility and longevity and psychological comfort, knowing basic costs are funded.

Constructing a robust income floor provides three core benefits:

It inoculates you from interest rate risk

It provides behavioral benefits by reducing the temptation to overspend from your investment portfolio

It delivers psychological comfort knowing essentials are funded

The most common sources are Social Security and traditional pensions. But you also have options for creating additional lifelong income through vehicles like SPIAs and FIAs.

Maximizing Social Security

Social Security provides an invaluable inflation-adjusted, lifetime income stream. Married couples qualify for spousal benefits, and delaying claiming until age 70 can increase payments by 76%.

As my book states, "The beauty of the payments is that they'll never run out, and they make your income floor robust and predictable."

For those in good health, deferring Social Security can substantially boost income.

Pensions - Consistent Payments You Can't Outlive

Pensions provide consistent lifetime income that you cannot outlive. Opting for monthly payments over a lump sum preserves this benefit for a steady income and enables you to make more

One powerful example from my book is an inflation-protected pension covering all essential costs. This allowed investing 100% in stocks since the pension formed a secure base. Pensions provide freedom to pursue growth without income risk.

Creating Your Own Personal Pension

Those without sizable employer pensions can create "personal" pensions by purchasing an income annuity. These self-designed pensions generate reliable lifelong income akin to a traditional pension from an employer.

There are two primary instruments for building personal pensions:

SPIAs

Single Premium Immediate Annuities allow purchasing guaranteed lifetime income from an insurance provider via an upfront premium payment. SPIAs begin making regular income payments immediately or on a deferred date.

SPIAs effectively exchange a lump-sum premium for an income stream you cannot outlive. This provides pure longevity insurance, allowing you to transfer income risk to an insurer.

FIAs

Fixed-indexed annuities offer guaranteed lifetime income like SPIAs. However, FIAs provide more upside potential and account liquidity than SPIAs through built-in growth options and surrender periods.

For example, one client annuitized $500,000 at 65 to create $20,000 in annual FIA income until she passes. Another client uses an FIA to receive income but retains control of the account principal.

No single strategy is right for everyone. But used prudently, annuities enable crafting personal pensions to supplement Social Security and employer benefits as part of an overall income floor.

Caution Around Commission-Based Annuities

When considering annuities as part of an income floor strategy, it is important to work only with advisors who offer commission-free products.

Unfortunately, annuities have developed a poor reputation in many retirement planning circles because salespeople can earn large commissions for selling them. This results in conflicts of interest and aggressive sales tactics.

Products with high commissions built into pricing reduce overall returns for clients. Our firm exclusively recommends commission-free annuities when appropriate based on an individual's unique circumstances and risk tolerance.

The rise of no-commission annuities has made these instruments more beneficial for clients when used by fee-only advisors like us.

But always be wary of excess commissions that could dilute annuities' value within an income floor.

Ladders - Structured Cash Flow From Maturities

While they should not be confused with lifetime pensions, bond ladders provide structured cash flow in retirement. Ladders are created by purchasing securities maturing on sequential dates.

Bond Ladders

These consist of purchasing individual bonds or bond ETFs with staggered maturities. Using specific year-maturing bond ETFs creates an even surer bet for the stability of your income floor. Invesco and iShares have amazing low-cost specific year-maturing investment-grade corporate ETFs that include hundreds of bonds and are a great option.

As each bond matures, it throws off regular income, creating pension-like paychecks.

For example, you could construct a 10-year ladder generating $30K annually by investing $250K across bonds maturing in sequential years. This throws off 10 payments of $30K. Using specific year-maturing bond ETFs creates an even surer bet for income floor stability.

MYGA Ladders

MYGAs, or multi-year guaranteed annuities, function similarly to bond ladders but offer a higher rate of return potential alongside guarantees, with tradeoffs like reduced liquidity.

With a MYGA, you purchase a guaranteed annuity from an insurance company instead of purchasing ETFs. A MYGA typically has a higher rate of return than a bond fund, which is great for increasing the amount of money you’ll have access to.

The downside to a MYGA is that it's not liquid. If you purchase a MYGA and change your mind, you must pay a substantial penalty to access that money again. For this reason, I only recommend a MYGA if you are certain it's the right strategy for you. If you think you might change your mind, stick with a traditional bond ladder.

Ladders as Bridge to Social Security

Whatever method you choose, there are two ways to think about your ladder. One is as a bridge to Social Security. Let’s say you retire at age 62 and plan on deferring Social Security until age 70. You can build an 8-year ladder that gets you from 62 to 70, and then let Social Security take over!

This works best if Social Security and your pension will cover most of your essential costs.

Long-Term Ladder Strategy

The second option is to think about a ladder as a long-term strategy past age 70, such as to age 80 or beyond, especially if you lack a sizable pension. In this case, you’ll need to replenish your ladder using your investment portfolio.

For example, imagine you built a ladder with $100,000 per rung to get you to age 70. If your

Social Security benefit at 70 is $40,000, then each new ladder rung after that only needs to be $60,000 to maintain your spending. When you rebalance your portfolio annually, you simply sell investments to purchase another ladder rung.

Ladders help fill income gaps not met by true pensions and Social Security. Used together, ladders and annuity pensions enable crafting a robust income floor aligned with your risk appetite.

Investing for Growth of Wants and Wishes

Your Core Portfolio of Low-Cost Diversified Assets

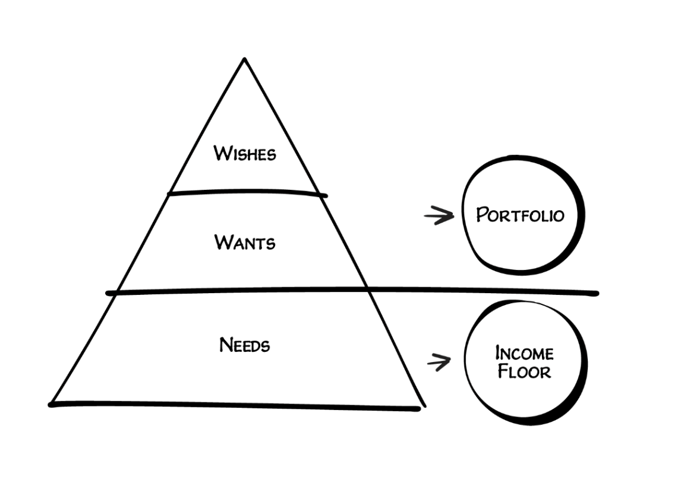

The Growth Portfolio constitutes surplus investable assets not required to cover essential costs funded by the Income Floor. This portfolio pursues growth to support discretionary spending on retirement. Wants and Wishes through strategic investing.

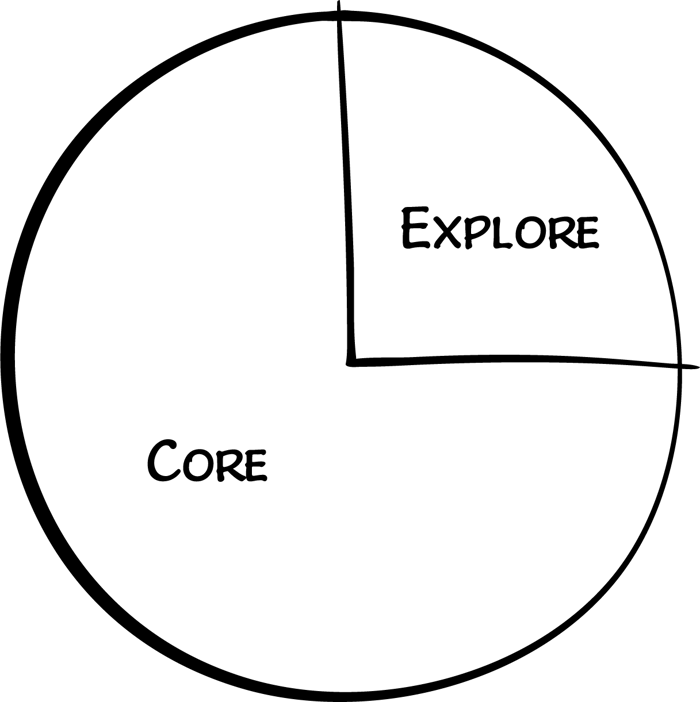

As covered earlier, research shows even professional investors cannot consistently outperform the market. Index funds and ETFs aligned to your risk tolerance allow you to participate in market returns efficiently at minimal cost.

I advise constructing the Growth Portfolio based on principles of low costs, broad diversification, and a passive investment philosophy. Paying exorbitant fees to traditional advisors who pick expensive, actively managed mutual funds can significantly drag down long-term performance.

The Purpose of the Growth Portfolio

The Growth Portfolio serves a unique purpose compared to the other assets in the 4 assets framework. While Real Estate acts as a buffer and the Income Floor secures essential spending, the Growth Portfolio enables continuing to grow wealth to achieve aspirational retirement objectives.

With basic lifestyle costs guaranteed through pensions, social security, and annuities, the Growth Portfolio is free to pursue market returns for funding discretionary wants and wishes. This asset empowers confidence to enjoy retirement fully without worrying about jeopardizing your secured Income Floor.

Invest Where You Wish with an Explore Portfolio

Within your Growth Portfolio, you may also choose to allocate a small "Explore" portion, around 10%, to tactically try higher-risk investments for potential added returns or simply to invest in securities that you like.

The Bottom Line

Planning for a fulfilling retirement can seem daunting, but breaking it down into the 4 assets framework brings clarity and confidence. We all hope to enjoy our later years with financial security, pursuing meaningful goals, and enjoying life's comforts. The 4 assets approach makes this vision an achievable reality.

By categorizing your resources into an organized system—real estate, earmarked funds, an income floor, and growth investing—you gain control over your finances.

Each asset has a specialized role in securing the retirement lifestyle you envision, and with the right approach, stress fades when essentials are covered, key goals protected, and growth potential captured.

Visualize how your assets align into a cohesive whole, supporting your needs, mitigating risks, and enabling wishes.

See how guaranteed income can cover fixed costs while growth investing pursues discretionary dreams.

Know that buffers are in place for rainy days, and special accounts reserved for future plans.

The 4 assets approach provides a clear structure and reassuring strategy. Following this integrated framework allows you to shape the confident retirement you deserve.

With finances sorted into customized categories, you are empowered to focus on the meaningful goals and fulfilling days that define your next chapter.

If you're interested in discussing how these four assets might work in your own retirement plan, I'm happy to explore that with you.