Table of Contents

Picture this: you're sitting at your kitchen table. In front of you is a stack of envelopes. Each one is labeled for a different purpose - groceries, rent, utilities, vacation funds. These earmarks cover all your anticipated expenses, from the basic to the aspirational.

As you tuck a portion of your paycheck into each envelope, a sense of calm control washes over you. You know exactly where your money is going and how it's working towards your specific goals.

This simple but powerful budgeting method, known as the "envelope system," has been used by generations to set aside earmarks for specific purposes. Our grandparents intuitively understood the importance of categorizing funds based on their intended use, ensuring that they always had enough set aside for both essential needs and ambitious goals.

Unexpected Expenses, Dream Remodels, and Heirs’ Education

Imagine having a dedicated emergency fund to cover unexpected expenses, a separate account for your dream kitchen remodel, and a 529 plan to support your grandchildren's education. Knowing that these priorities are taken care of can free you to enjoy your retirement to the fullest without constantly worrying about where the money will come from.

In this post, we'll explore the concept of earmarked assets in-depth, discussing the key benefits and common types of dedicated accounts. We'll also examine the psychological phenomenon of mental accounting and how it can both help and hinder your financial decision-making.

By the end, we'll have a clear understanding of how earmarks can enhance your retirement plan and a roadmap for implementing this strategy in your own financial life. So, let's dive in and discover the power of giving every dollar a purpose.

What are Earmarked Assets?

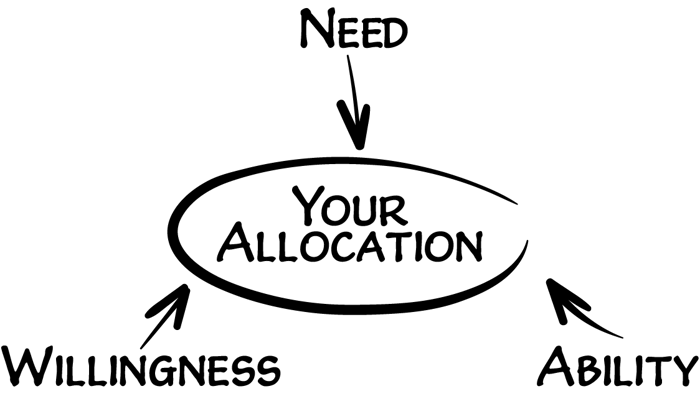

At their core, earmarks are a means of designating specific portions of your wealth to well-defined goals or purposes, separate from your general pool of retirement savings. It's a way of mentally and physically compartmentalizing your money based on its intended use, ensuring that you have dedicated funds set aside for the things that matter most to you.

Think of your overall retirement portfolio as a pie, with each slice representing a different goal or priority. You might have a slice for everyday living expenses, another for travel and leisure, and yet another for healthcare costs. By earmarking assets, you're essentially pre-cutting the pie, making sure that each slice is the right size to support its designated purpose.

Earmarks for Retirement

Earmarks can take many forms, from simple savings accounts to more specialized vehicles like 529 plans and donor-advised funds (more on these later). The key is that they are intentionally segregated from your primary retirement assets and invested appropriately based on their time horizon and risk profile.

One of the main advantages of earmarking is the clarity it provides. By having dedicated accounts for specific goals, you always know exactly how much you have available for each purpose. This can help with budgeting, decision-making, and overall peace of mind.

For example, if you have a separate "vacation fund," you can confidently book that once-in-a-lifetime trip without worrying about derailing your other financial priorities.

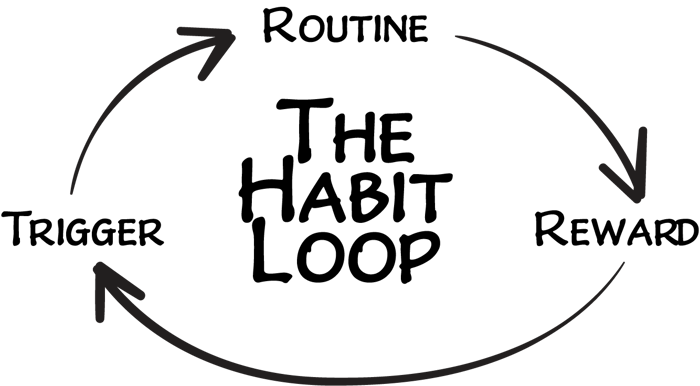

Earmarking can also provide a psychological benefit by creating a sense of purpose and motivation. When you know that a specific account is dedicated to a goal that's meaningful to you, such as leaving a legacy for your grandchildren or supporting a cherished charity, you may be more likely to prioritize funding it and less tempted to dip into it for other purposes.

Strike a Balance With Earmarks

However, it's important to note that earmarking is a form of "mental accounting," a psychological tendency to treat money differently based on its source or intended use. While mental accounting can be a useful budgeting tool, it can also lead to suboptimal financial decisions if taken too far.

For example, someone might diligently save money in a low-interest account for a specific goal while simultaneously carrying high-interest credit card debt. Rationally, it would make more sense to pay off the debt first, but the mental categorization of the savings as "untouchable" can lead to irrational behavior.

The key is to strike a balance – to use earmarking as a tool for clarity and intentionality while still maintaining flexibility and a big-picture perspective. By thoughtfully allocating assets to specific goals while also regularly reassessing and adjusting as needed, you can harness the power of mental accounting without falling prey to its pitfalls.

In the following sections, we'll explore some of the most common types of earmarks and how they can enhance your retirement plan. From emergency funds to donor-advised funds, each type of dedicated account serves a unique purpose in helping you achieve your financial and life goals.

Emergency Funds: Earmarks for the Unexpected Even in Retirement

No matter how carefully you step up to the plate, life has a way of throwing curveballs. That's why an emergency fund is one of the most important types of earmarked assets. This is a dedicated pool of money set aside specifically to cover unexpected expenses, such as a car repair, medical bill, or temporary loss of income.

Financial planners typically recommend keeping three to six months' worth of living expenses in a highly liquid, low-risk account, such as a high-yield savings account or money market fund. This ensures quick and easy access to the funds when needed without having to sell investments at an inopportune time or incur penalties for early withdrawals.

Having a robust emergency fund is especially important in retirement, when you may have less flexibility to increase your income or absorb financial shocks. By earmarking a portion of your assets for emergencies, you can protect your core retirement savings and maintain your standard of living even in the face of unexpected challenges.

While most of my clients want some "dry power" in the form of emergency cash, some prefer to use a HELOC, which is fine as well. The key is to have access to "emergency liquidity."

An emergency fund also provides a valuable psychological benefit: peace of mind. Knowing that you have a financial safety net in place can help reduce stress and anxiety, allowing you to enjoy your retirement years with greater confidence and security.

Earmarks for Upcoming Purchases

In addition to preparing for the unexpected, earmarking assets can also be a powerful tool for planning and budgeting for anticipated large purchases. These might include:

Buying a vacation home or rental property

Renovating your kitchen or bathroom

Purchasing a new car or RV

Taking a dream vacation or cruise

By setting aside funds in a dedicated account well in advance, you can ensure that you have the necessary resources available when the time comes without disrupting your regular cash flow or dipping into your core retirement savings.

For example, let's say you're planning to buy an RV in 3 years for extended travel in retirement. You estimate that you'll need $100,000 for the purchase. By earmarking a portion of your portfolio into a separate short-term bond ETF and making regular contributions, you can steadily build up the funds over time while earning a modest return.

The key advantage of this approach is that it allows you to spread the cost of a large purchase over time, making it more manageable and less disruptive to your overall financial plan. It also helps to ensure you're not tempted to use the money for other purposes.

Earmarks for specific purchases also provide a clear goal and timeline, which can be motivating and satisfying. As you see the dedicated account balance grow over time, you'll have a tangible sense of progress and achievement, making the eventual purchase feel like a well-deserved reward for your planning and discipline.

Of course, it's important to strike a balance and not get too granular with your earmarks. You don't necessarily need a separate account for every single purchase or goal – that could quickly become overwhelming and impractical to manage. Instead, focus on a few key priorities that are meaningful to you and align with your overall retirement vision.

You can create a more resilient and purposeful retirement plan by strategically earmarking assets for unexpected emergencies and anticipated purchases. In the next section, we'll explore two more specialized types of earmarked accounts: 529 plans for education and donor-advised funds for charitable giving.

529 Plans: Earmarks for Education

If you have grandchildren or other young family members, one of the most impactful ways to support their future is by investing in their education. 529 plans are tax-advantaged investment accounts specifically designed for this purpose.

There are two types of 529 plans– education savings plans and prepaid tuition plans.

By earmarking a portion of your assets into a 529 plan, you can help your loved ones achieve their academic dreams while also potentially reducing your own tax liability.

Key Benefits of 529 Plans

The key benefits of 529 plans include:

Tax-deferred growth: Your contributions' earnings grow tax-free over time, allowing your money to compound more quickly.

Tax-free withdrawals: When the funds are used for qualified education expenses, such as tuition, books, and room and board, the withdrawals are not subject to federal income tax.

State tax incentives: Many states offer additional tax benefits, such as deductions or credits, for contributions to their sponsored 529 plans.

High contribution limits: 529 plans allow for significant contributions, up to $15,000 per year per beneficiary ($30,000 for married couples) without triggering gift taxes.

Superfunding Your 529 Plan

One strategy to maximize the impact of your 529 contributions is to make a large upfront deposit, known as "superfunding." You can read more about how the IRS treats 529 contributions in this pamphlet.

This allows you to front-load the account and give the funds more time to grow tax-free. For example, you could contribute five years' worth of gifts in one year (up to $75,000 per beneficiary or $150,000 for married couples) without incurring gift taxes.

By earmarking a significant portion of your assets for education early on, you can create a lasting legacy for your grandchildren while also freeing up more of your own resources for other retirement goals. Plus, knowing that you've helped secure their educational future can provide a deep sense of purpose and satisfaction.

If the concept of earmarking funds interests you, this free guide will help you set up earmarks in conjunction with a holistic financial plan.

Free Sample Financial Plan and Guide

Donor-Advised Funds: Earmarks for Charitable Giving

For many retirees, charitable giving is a core value and an important part of their legacy. Donor-advised funds (DAFs) are a unique type of earmarked account that can help you support the causes you care about in a tax-efficient and flexible way.

Here's how DAFs work:

You make an irrevocable contribution of cash, appreciated assets, or other property to the DAF, which a public charity sponsors.

You receive an immediate tax deduction for the full value of your contribution up to the allowable limits.

The sponsoring organization invests the funds, and you can recommend grants to your favorite charities over time.

The charities receive the grants, and you can continue to make additional contributions and recommendations as your circumstances and priorities evolve.

Advantages of Donor-Advised Funds

One key advantage of DAFs is that they allow you to separate the timing of your tax deduction from your actual charitable grants. This can be particularly useful in years when you have a high income or significant capital gains, as you can "bunch" your contributions to maximize your deductions while still maintaining a steady stream of support to your chosen charities.

DAFs also offer flexibility and simplicity compared to other charitable giving vehicles, such as private foundations. With a DAF, you can support multiple charities from a single account, and you don't have to worry about the administrative burdens and legal requirements of running your own foundation.

By creating earmarks for charitable giving through a DAF, you can create a meaningful legacy and support the causes that matter most to you, all while potentially reducing your tax liability and simplifying your financial life. It's a win-win strategy that aligns your wealth with your values.

Donor-Advised Funds: An Example in Practice

To see how earmarks for DAFs can work in a real-life scenario, consider the story of Joe and Susie, a retired couple who came to me with a significant cash balance and a sense of uncertainty about how to best allocate it.

During our initial Discovery meeting, I learned several key facts about their situation:

They had an untapped home equity line of credit (HELOC) that they were comfortable using as an emergency fund.

They were planning to buy an RV in the near future to fulfill their dream of traveling the country.

They were charitably inclined and wanted to donate around $10,000 per year to their favorite causes.

With this information in hand, we set about creating a tailored earmarking strategy to align their assets with their goals and values. Here's what we did:

RV Fund: We allocated $200,000 of their cash into a short-term bond ETF earmarked specifically for their RV purchase. This ensured that the funds would be readily available when they were ready to buy while also providing some modest growth potential in the meantime.

Donor-Advised Fund: We contributed $200,000 to a donor-advised fund (DAF) to support their charitable giving goals. Based on their annual giving target of $10,000, this amount was sufficient to fund their donations for the next 20 years while also providing an immediate tax deduction.

Emergency Fund: Given their comfort with using their HELOC as an emergency backstop, we decided to keep just $25,000 in a high-yield savings account for unexpected expenses. This allowed us to allocate more of their assets towards their other goals and long-term investments.

Investment Portfolio: After earmarking funds for their RV purchase, charitable giving, and emergency fund, we were left with $275,000 to invest for their long-term financial security. We worked together to create a diversified portfolio that aligned with their risk tolerance and retirement income needs.

By taking the time to understand Joe and Susie's unique goals and circumstances and then creating a clear plan to earmark their assets accordingly, we were able to provide them with a tremendous sense of clarity and relaxed confidence.

They now had a roadmap for fulfilling their retirement dreams, supporting their cherished causes, and weathering any unexpected challenges along the way.

This is the power of earmarks in action – it allows you to transform an undifferentiated pool of assets into a purposeful, intentional wealth plan that truly reflects your values and aspirations.

Earmarking Funds for Retirement: the Bottom Line

Earmarking assets for specific purposes is a powerful tool for creating a more intentional, fulfilling, and financially secure retirement. By mentally and physically separating your wealth into distinct "buckets," each aligned with a clear goal or priority, you can gain greater clarity, confidence, and peace of mind.

We've explored several key types of earmarked assets in this post, including:

Emergency funds for unexpected expenses

Dedicated accounts for anticipated large purchases

529 plans for education savings

Donor-advised funds for charitable giving

Each of these serves a unique purpose and offers specific benefits, from tax advantages to psychological rewards. By incorporating them into your retirement plan, you can create a more resilient and purposeful financial foundation.

One Last Note on Earmarks

Of course, earmarking is not without its challenges. It's important to strike a balance between specificity and flexibility and to avoid the pitfalls of excessive mental accounting. The key is to use earmarking as a tool for clarity and intentionality while still maintaining a holistic perspective and a willingness to adapt as your circumstances change.

Ultimately, the power of earmarking lies in its ability to align your wealth with your values and priorities. By giving every dollar a purpose, you can ensure that your money is working hard to secure your financial future and to support the people, causes, and experiences that matter most to you.

So, take some time to reflect on your own retirement goals and aspirations. Consider which areas of your life could benefit from the clarity and intentionality of earmarked assets.

To begin the process of using earmarks to realize your retirement goals, just answer a few quick questions to see if we're a mutual fit below.