Table of Contents

Picture this: you're sitting in your college dorm room, trying to decide what to do with the $500 your grandmother just gifted you. Your buddy suggests investing in individual stocks—he's got a hot tip on a company poised to be the next big thing.

But you're not so sure. You remember your economics professor talking about the efficiency of markets and the futility of trying to beat them consistently.

This was the dilemma I found myself in as a young student at Stanford. I was fascinated by the idea of investing but confused by the seemingly contradictory messages I was hearing. It wasn't until I took a class with the legendary Professor Bill Sharpe that everything clicked into place.

Sharpe, a Nobel laureate and one of the fathers of modern portfolio theory, showed me the power of indexing—owning a broadly diversified portfolio that tracks the entire market.

He convincingly argued that for most investors, trying to pick individual stocks was a loser's game. It is better to focus on crafting an overall portfolio that aligns with your goals and risk tolerance.

That lesson has stuck with me throughout my career in finance. And it's one I hope to impart to you in this post. Your investment portfolio is a critical tool in funding the wants and wishes that will make your retirement dreams a reality. But to harness its power effectively, you need to approach it with the right strategy.

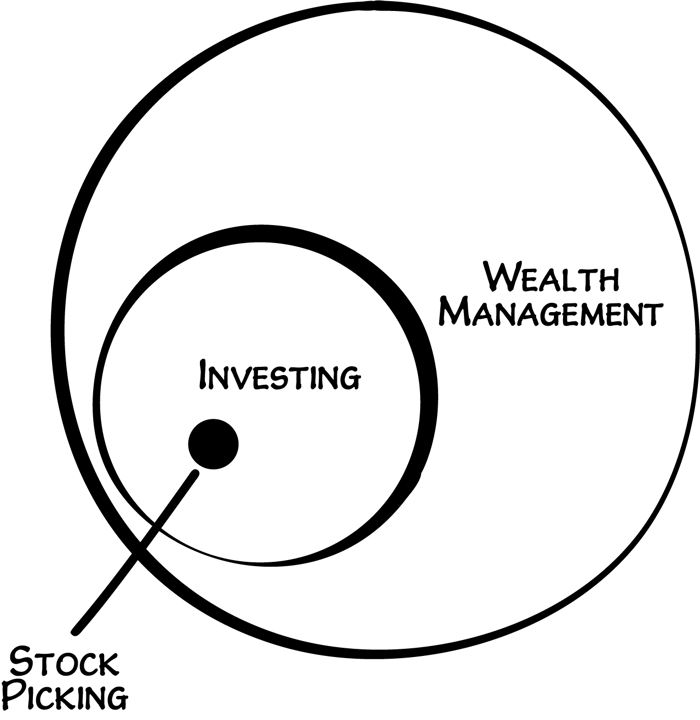

We'll explore the three main approaches to investing – stock picking, portfolio management, and wealth management – and help you determine which one is right for you. We'll dispel some common myths about investing prowess and show you how to create a retirement portfolio built to last.

So, whether you're just starting to think about retirement or you're already there, join me on this journey to uncover the winning approach for your investment portfolio. Your future self will thank you.

Your Portfolio's Role in Retirement

Before discussing the different investment strategies, let's clarify your portfolio's role in retirement. Many people miss this critical distinction.

Think of your retirement income as a two-tiered pyramid. The base is your income floor—the reliable stream of guaranteed income that covers your essential expenses. This typically comes from sources like Social Security, pensions, and annuities. Your income floor is your "sleep at night" money—it ensures your basic needs are always met, no matter what.

But what about all those other things that make retirement fun and fulfilling? That's where your investment portfolio comes in. If your income floor is the foundation, your portfolio is the engine that powers your retirement dreams.

Your portfolio is your "risk money" – the portion of your wealth that's invested in the markets to fuel your discretionary spending. This is the money that allows you to travel, pursue hobbies, spoil your grandkids, and check off those bucket list items.

The key here is that your portfolio is untethered from your essential needs. Because your income floor has you covered, you can invest your portfolio for long-term growth without worrying about short-term volatility derailing your lifestyle.

This distinction is so important because it informs how you approach investing in retirement. With your needs taken care of, you can afford to be more aggressive with your portfolio, knowing that temporary market downturns won't jeopardize your basic security.

Your Portfolio Is Your Ride

Of course, this doesn't mean you should be reckless with your retirement portfolio. But it means you can focus on investing strategies prioritizing growth and wealth accumulation rather than just preservation.

Think of it like planning a road trip. Your income floor is your reliable car that gets you from point A to point B safely. Your portfolio is the fun stuff – the scenic detours, the unexpected adventures, the memories that make the journey worthwhile.

So, as we explore the different investment approaches, keep this framework in mind. Your portfolio is a powerful tool, but it's just one piece of the retirement puzzle. By understanding its unique role and relationship to your income floor, you can make more informed decisions about how to invest it for maximum impact.

With that foundation in place, let's explore the first investment approach—one that Hollywood and the media have glamorized but that rarely lives up to the hype: stock picking.

The Illusion of Stock Picking Skill

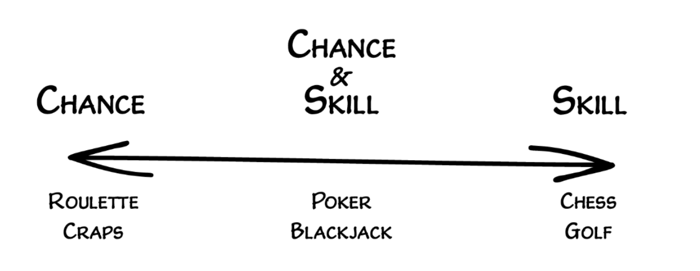

Picture a room full of 1,000 people flipping coins. Each person represents a fund manager trying to beat the market by picking winning stocks. They flip their coin, and those who get heads continue to the next round, while those who get tails are out.

After 10 rounds of flipping, only one person remains standing. This lucky individual is hailed as a stock-picking genius, showered with media attention and investor money. But was it really a skill that got them there, or just random chance?

This thought experiment, shared by Nobel laureate Daniel Kahneman in his book "Thinking, Fast, and Slow," perfectly encapsulates the problem with stock picking. Some fund managers will outperform the market in any given year due to sheer luck. But the longer the time horizon, the more luck evens out and the less likely any individual is to consistently beat the market.

This is exactly what Professor Sharpe taught me, and academic research has repeatedly reinforced this lesson. Take the study by Professor Laurent Barras and colleagues, which analyzed the performance of 2,076 actively managed U.S. equity mutual funds over a 32-year period. They found that only 0.6% of the funds showed evidence of stock-picking skill after accounting for fees. The rest were indistinguishable from luck.

Or consider the famous experiment by the Wall Street Journal, where they pitted professional

money managers against dart-throwing monkeys in a stock picking contest. After 6 months, the monkeys had outperformed the pros!

The point is that while it's tempting to believe in the myth of the brilliant stock picker who can consistently outsmart the market, the evidence just doesn't support it. Even the fund managers who do outperform in any given year are rarely able to sustain that performance over the long term.

And yet, the allure of stock picking persists.

Why is that?

Part of it is the appeal of a good narrative. We love stories of individuals who beat the odds through sheer intelligence and insight. Think of famous investors like Warren Buffett or Peter Lynch, who are often held up as proof that stock picking can be a path to riches.

But as we'll see in the next section, even these legendary figures aren't quite what they seem. Their success is often more attributable to factors like luck, leverage, and a long investing horizon than any innate stock-picking skill.

The other reason stock picking remains popular is that it's a great business model for the financial industry. Fund managers and advisors can charge hefty fees for their supposed expertise, even if the actual results don't justify the cost. As Jack Bogle, the founder of Vanguard, famously said, "In investing, you get what you don't pay for."

Is it all Chance?

So, if stock picking is such a losing proposition, why do so many people still pursue it? The answer, I believe, lies in a fundamental misunderstanding of the role of luck in investing. We tend to attribute success to skill and failure to external factors when, in reality, the markets are far more random than we'd like to believe.

This isn't to say that skill doesn't exist in investing. As we'll discuss later, there are ways to tilt the odds in your favor through smart portfolio management and wealth planning strategies. But the idea that anyone can consistently beat the market through sheer stock-picking prowess is, in my view, a dangerous illusion.

So, if you find yourself tempted to chase the next hot stock or follow the latest guru's picks, remember the coin-flipping analogy. You might get lucky and flip heads a few times in a row, but eventually, the odds will catch up with you. And in retirement, when your portfolio is the engine funding your lifestyle, that's a risk you simply can't afford to take.

I've created a free course '10 Easy Steps to Retirement Income for Life' that explores how to build and maintain a retirement portfolio that aligns with your goals.

The Warren Buffett Exception

Whenever I argue against stock picking, there's one name that invariably comes up as a counterexample: Warren Buffett. The Oracle of Omaha, as he's known, is often held up as proof that skilled investors can consistently beat the market through sheer talent and hard work.

And it's true, Buffett's track record is remarkable. Over his decades-long career, he's delivered compound annual returns of around 20%, handily outperforming the S&P 500. His holding company, Berkshire Hathaway, has grown from a struggling textile mill to a behemoth with a market cap of over $700 billion.

So, does Buffett disprove the idea that stock picking is a loser's game? Not quite. While there's no denying his investing acumen, a closer look at Buffett's success reveals that it's not solely attributable to stock selection skill.

First, Buffett has benefited from an incredibly long investing horizon. He bought his first stock at age 11 and is still going strong at 91. That's 80 years of compounding returns, a timeframe that's simply not available to most investors.

Second, Buffett has been able to use leverage to amplify his returns. Through Berkshire Hathaway's insurance operations, he's had access to cheap, stable funding that he's used to finance his investments. This "float" has allowed him to juice his returns in a way that's not replicable for the average investor.

Third, Buffett's style of investing, known as value investing, has benefited from a decades-long tailwind. By focusing on undervalued, unglamorous companies, Buffett has profited as the market eventually recognized their worth. However, this approach doesn't always outperform, as evidenced by the recent underperformance of value stocks relative to growth.

Finally, and perhaps most importantly, Buffett himself has been a vocal advocate of indexing for the average investor. In his 2013 letter to Berkshire Hathaway shareholders, he wrote, "The goal of the non-professional should not be to pick winners but should rather be to own a cross-section of businesses that in aggregate are bound to do well."

He even went so far as to make a million-dollar bet that a simple S&P 500 index fund would outperform a basket of hedge funds over a 10-year period (spoiler alert: he won).

The point is that while Buffett's success is undeniably impressive, it's not a realistic model for most investors to emulate. His unique circumstances and investing style make him more of an exception than a rule.

Even if you believe that Buffett's success is purely a function of skill, the question remains: How do you identify the next Warren Buffett ahead of time?

The fact is, for every Buffett, countless other fund managers have tried and failed to consistently beat the market.

This is why I believe that for most investors, trying to pick the next Buffett is a fool's errand. You're far better off focusing on building a diversified portfolio that harnesses the power of the entire market rather than trying to find the needle in the haystack.

Of course, this doesn't mean there's no place for active management in a retirement portfolio.

As we'll discuss in the next section, there are ways to incorporate elements of skill-based investing while still maintaining a broadly passive approach. The key is to be realistic about the limits of stock picking and focus on the factors within your control.

So, while it's fun to marvel at Buffett's outsized success, don't let it fool you into thinking that stock picking is the path to retirement riches. As the man himself has said, "The most important quality for an investor is temperament, not intellect." In my experience, the temperament that wins in the long run is one of discipline, patience, and humility in the face of an uncertain market.

Portfolio Management: A Step in the Right Direction

If stock picking is a game of chance, then portfolio management is where skill starts to come into play. Rather than trying to find the next hot stock, portfolio managers focus on building a diversified mix of assets that can deliver reliable returns over time.

Modern Portfolio Theory (MPT) revolutionized how we think about investing by shifting the focus from individual securities to the overall portfolio. According to MPT, it's not the characteristics of a single investment that matter most, but rather how each investment contributes to the risk and return of the entire portfolio. This mindset shift is crucial because it allows investors to build portfolios that optimize risk-adjusted returns by combining assets with different attributes.

The key principle behind portfolio management is the idea of the "efficient frontier." Developed by Professor Harry Markowitz in the 1950s, the efficient frontier represents the set of portfolios that offer the highest expected return for a given level of risk. By carefully balancing risk and return, portfolio managers aim to create optimally positioned portfolios for long-term growth.

One of the most popular approaches to portfolio management is indexing – simply owning a broad, diversified basket of stocks that track the entire market. By buying an index fund, you're effectively owning a slice of every public company weighted by market capitalization.

The beauty of indexing is that it's a low-cost, tax-efficient way to capture the returns of the entire market. You're not trying to beat the market, but rather to harness its long-term growth potential. And because index funds have low turnover and minimal expenses, they can offer a significant edge over actively managed funds in the long run.

Of course, indexing is just one approach to portfolio management. Other skilled managers may use techniques like factor investing, which involves tilting the portfolio towards certain characteristics (like value or momentum) that have been shown to outperform over time. They may also employ more tactical strategies, like adjusting the mix of stocks and bonds based on market conditions.

How Bonds Work In a Modern Portfolio

Bonds play a vital role in providing stability and reducing overall volatility. If stocks are the gas pedal propelling growth, bonds are the brakes keeping risk in check. By including an appropriate allocation to high-quality bonds, investors can create a balanced portfolio that weathers market turbulence while still achieving long-term goals. Bonds serve as ballast, helping to steady the ship during stormy seas.

The key difference between these approaches and stock picking is that they're based on sound economic principles and empirical evidence rather than hunches or hot tips. By focusing on the drivers of long-term returns, skilled portfolio managers can help investors build wealth steadily and efficiently over time.

Take a Look at this Sample Portfolio

Building a diversified investment portfolio is a lot like making salsa. Just as great salsa requires a variety of ingredients to achieve the desired flavor, a robust portfolio needs a mix of diverse assets to optimize risk and return. Each asset class, from US stocks to international bonds to real estate, adds a unique dimension to the portfolio. And just like how a salsa would be incomplete without a splash of hot sauce, a portfolio needs exposure to alternative investments to truly be well-rounded

One example of a diversified approach is the 7Twelve Portfolio, which includes seven core asset classes and utilizes twelve specific mutual funds or ETFs.

By spreading investments across a broad range of assets, the 7Twelve Portfolio aims to provide investors with a steady, reliable return stream while minimizing the impact of market volatility.

It’s Not One and Done

As nice as it sounds, portfolio management is not without its challenges. Managers must grapple with the ever-present tradeoff between risk and return and must constantly adapt to changing market conditions. They must also resist the temptation to tinker too much with the portfolio, as excessive trading can erode returns through taxes and transaction costs.

Moreover, even the most skilled portfolio managers are still subject to the vagaries of the market. While they may be able to tilt the odds in their favor, they can't eliminate risk entirely.

And in the short run, even a well-constructed portfolio can experience significant volatility and drawdowns.

That's why I believe portfolio management, while a step in the right direction, is still not the optimal approach for most investors. To truly build lasting wealth and security in retirement, you need a more comprehensive framework—one that goes beyond just investing to encompass every aspect of your financial life. And that's where wealth management comes in.

Wealth Management: The Winning Approach

If portfolio management is about optimizing your investments, then wealth management is about optimizing your entire financial life. It's a holistic, comprehensive approach that considers your portfolio and your income, expenses, taxes, estate plan, and overall life goals.

At its core, wealth management is about aligning your money with your values and priorities. It starts with a deep understanding of what matters most to you—whether that's traveling the world, leaving a legacy for your family, or pursuing a passion project. Once those goals are clearly defined, every financial decision is made with an eye toward achieving them.

One of the key elements of wealth management is creating a reliable income floor. As we discussed earlier, this is the guaranteed income stream covering your essential retirement expenses. By ensuring that your basic needs are always met, an income floor provides the foundation for a secure and fulfilling retirement.

With your income floor in place, a wealth manager can then help you optimize your investment portfolio for growth. This may involve using some of the portfolio management techniques we discussed earlier, like indexing or factor investing. However, it also involves considering the broader context of your financial situation, like your tax bracket, risk tolerance, and time horizon.

A skilled wealth manager will also help you navigate the complex world of taxes and estate

planning. They can help you minimize your tax burden through strategies like asset location, tax-loss harvesting, and Roth conversions. They can also ensure that your assets are properly structured and titled to maximize your legacy and minimize the impact of estate taxes.

However, perhaps the most important role of a wealth manager is to provide ongoing guidance and support. Retirement is not a one-time event but rather a decades-long journey filled with ups and downs. A good wealth manager will be there every step of the way, helping you stay on track toward your goals and adjust your plan as needed.

This is why I believe wealth management is most investors' winning approach. By taking a comprehensive, holistic view of your financial life, a skilled wealth manager can help you achieve a level of security and fulfillment that's simply not possible with a narrower focus on investing alone.

Have Your Cake and Eat it Too

While a disciplined, diversified approach to investing is crucial, it's important to acknowledge that we're only human.

Many investors feel the urge to "explore" opportunities outside of their core portfolio, whether it's dabbling in private equity deals, picking individual stocks, or investing in a friend's startup. And that's okay!

The key is to limit these "explore" investments to a small portion of your overall portfolio (e.g., 5-10%) and to view them as "fun money" rather than a core strategy.

By keeping your explorer hat on a tight leash, you can scratch that itch without jeopardizing your long-term financial plan.

Of course, wealth management is not a panacea. It still requires discipline, sacrifice, and a willingness to make tough choices. And like any professional service, it comes with costs that must be weighed against the potential benefits.

But in my experience, the rewards of wealth management far outweigh the costs. By aligning your money with your deepest values and goals, you can achieve a sense of purpose and satisfaction that goes beyond mere financial success. You can build a legacy that will last for generations and live a truly rich retirement in every sense of the word.

So, if you're serious about making the most of your retirement years, I urge you to consider a wealth management approach. Find a trusted advisor to help you clarify your goals, create a comprehensive plan, and provide ongoing guidance and support.

And most importantly, stay focused on what matters most – not the day-to-day fluctuations of the market but the people, experiences, and causes that give your life meaning and joy.

Deciding Which Game to Play With Your Portfolio

So, which investment approach is right for you? As with most things in life, the answer is that it depends.

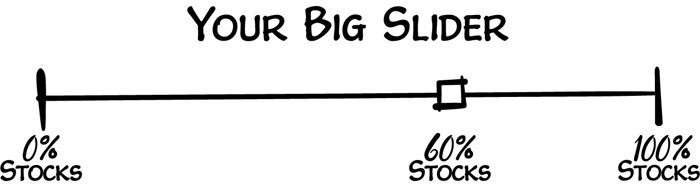

If you're just starting out and have a relatively small portfolio, indexing may be the simplest and most effective way to build wealth over time. By owning a broadly diversified mix of stocks and bonds, you can capture the market's long-term returns without the costs and risks of active management.

As your portfolio grows and your financial life becomes more complex, you may benefit from a more sophisticated approach like factor investing or tax-efficient asset allocation. This is where a skilled portfolio manager can add value by helping you optimize your investments for your specific goals and circumstances.

However, for most investors, wealth management is the ultimate goal. A wealth manager can help you align your money with your deepest values and aspirations by taking a holistic, comprehensive approach to your financial life. They can provide the guidance, discipline, and expertise needed to navigate the complex challenges of retirement and help you build a legacy that will last for generations.

Of course, wealth management is not for everyone. It requires a significant level of trust, engagement, and commitment from both the advisor and the client. And it typically involves higher costs than a purely passive approach like indexing.

Ultimately, the right approach for you will depend on your unique circumstances, goals, and preferences. If you value simplicity and low costs above all else, indexing may be the way to go.

Portfolio management may be a good fit if you're willing to pay a bit more for personalized advice and a more tailored approach. And if you're looking for a truly comprehensive, holistic approach to your financial life, wealth management is the ultimate destination.

The key is to be honest with yourself about what you value most and what you're willing to invest – both in terms of time and money – to achieve your goals. And remember, no matter which approach you choose, the most important thing is to stay disciplined, stay diversified, and stay focused on the long-term.

Conclusion

In the end, investing is not about beating the market or making a quick buck. It's about building a life that's rich in every sense of the word – a life filled with purpose, passion, and joy.

Your investment portfolio is a tool to help you achieve that life. But like any tool, it's only as effective as the hand that wields it. By understanding the different investment approaches available to you and by choosing the one that aligns with your unique goals and values, you can put your portfolio to work in a way that truly matters.

If there's one thing I hope you take away from this post, it's this: investing is not a game of chance but a game of skill. The ultimate skill is not in picking stocks or timing the market but in knowing yourself, your goals, and your values.

Whether you choose to index, work with a portfolio manager, or embrace a wealth management approach, the key is to stay focused on what matters most. Don't get caught up in the market's day-to-day noise or the latest hot stock tip. Instead, keep your eyes on the horizon and stay committed to building a portfolio that will support you and your loved ones for years to come.

And remember, you don't have to go it alone. Seek out the guidance and support of trusted professionals who can help you navigate the complexities of investing and financial planning. Whether it's a financial advisor, a portfolio manager, or a wealth manager, find someone who shares your values and who will be a true partner in your journey.

Because in the end, that's what investing is all about: not just building wealth, but building a life that's truly worth living. A life filled with meaning, purpose, and joy. A life that's not just measured by the size of your portfolio, but by the depth of your relationships, the impact of your legacy, and the richness of your experiences.

So go out there and build that life. Embrace the power of investing, but never lose sight of what truly matters. And most importantly, enjoy the journey – because that's where the real wealth lies.

If you'd like to explore how these portfolio strategies might work for your situation, I'd be happy to discuss them with you.