Table of Contents

- The Power of Optimizing Real Estate Income

- Primary Residence Strategies

- What About Secondary Homes?

- Investment Properties for Retirement Income

- What Kind of Investment Property Should You Buy?

- Thinking Clearly About Real Estate

- Asset Allocations: Real Estate as Stocks or Bonds

- Incorporate Ratios into Individual Assessments

- Existing Real Estate as Legacy Assets

- Conclusion

- Evaluate Your Real Estate Financial Footprint

- Take an Inventory of Your Properties

Real estate assets harbor tremendous potential. Properties you already own can transform into financial vehicles, generating wealth for everything from basic expenses to substantial legacies you leave the next generation.

Yet few capitalize on real estate’s full range of strategic advantages for retirement, and financial advisors often oversimplify this aspect of retirement planning. If optimized intentionally, your home, rental properties, and vacation homes constitute an untapped network of concrete resources.

The Power of Optimizing Real Estate Income

Consider clients like Wayne, who built up a diversified mix of assets, including his primary residence and rental properties. Or Jim, who leveraged his extensive holdings as potential buffers. Their examples demonstrate the power of optimizing real estate holistically.

Discover how to leverage properties owned to fund the retirement lifestyle you envision with flexible confidence.

In this article, we look at:

How to view your assets through the lens of "financial footprint" rather than specific properties

Key ratios to quantify real estate's impact on retirement math

Turning existing assets into tools for legacy planning beyond heirs.

How hybrid vacation-rental properties maximize flexibility between leisure and financial gain

Let's start by looking at primary residence strategies.

Primary Residence Strategies

Your primary home is likely your largest asset aside from your retirement portfolio. That substantial equity can provide key options for spending and legacy retirement planning.

Keeping Your Primary Residence

Many pre-retirees want to stay put indefinitely. Downsizing seems unnecessary when your space is paid off and adapted to your lifestyle. Keeping and living in your primary residence allows you to maintain close communities and friendships without disruptive moves.

The path in which you keep your primary residence allows you to leave your home to your heirs. Even if you eventually move to assisted living, keeping the property preserves future wealth transfer options.

Operating Expenses

If you choose to stay in your primary residence, remember to budget around 2% of the property value yearly for “operating” expenses, including property taxes, maintenance, utilities, and other miscellaneous expenses. Keeping the house in good shape helps preserve your equity.

This operating expense percentage will vary according to your personal situation, such as the state in which you live. In states that require higher property taxes, consider allocating more for operating expenses in your budget.

Another factor that might affect your planned operating expenses budget is the age of your home. Older homes require more maintenance, requiring a larger budget, whereas if your primary residence is relatively new at retirement, you might get away with paying less in operating expenses, especially during the first few years when maintenance and repair costs are likely to be low.

The ‘Katrina Protocol’

Also, consider implementing a “Katrina Protocol,” as I describe in my book, Be the Bird. Having home equity as a last-resort financial buffer provides security to keep retirement spending on track, especially if inflation spikes.

For example, client Jim owned $16 million worth of fully paid-off real estate across four properties. By modeling a private reverse mortgage as an emergency cash infusion, he felt more confident pursuing his retirement spending aims, knowing he had a robust buffer asset if ever needed.

I call it the Katrina Protocol because of the catastrophic hurricane that hit Louisiana. In the aftermath, New Orleans implemented massive infrastructure improvements to withstand future disasters. Likewise, having a backup plan provides confidence and peace of mind, even in worst-case retirement scenarios.

Optimizing your primary home for stability and legacy makes solid financial sense. However, evaluating your specific situation—especially long-term care projections and heirs’ needs—is critical to deciding the ideal approach.

What About Secondary Homes?

Secondary properties require unique strategies compared to your primary residence.

First and foremost, these can be enjoyed as additional residences - more space for visiting family, idyllic weekend getaways, or settling into a warmer climate part-time.

During periods of non-use, generating rental income helps offset ownership costs while boosting retirement cash flow. Investigate local regulations to operate legally as a landlord.

Selling secondary properties only if absolutely necessary remains a last resort to access capital in dire scenarios. But numerous options exist to enjoy these assets well into retirement.

Second homes may also constitute part of an effective legacy plan when retained until death. Inherited real estate transfers to heirs avoid probate delays compared to financial assets.

Under current law, your beneficiary's cost basis steps up to the market value upon inheritance, lowering their capital gains tax expenses should they choose to sell the property.

So, while liquidating secondary properties is an emergency lever to pull, don't underestimate their ongoing utility and legacy potential when optimized proactively.

To find out more about generating income in retirement through real estate and other options, you can check out my Retirement Income Course. It’s yours for completely free, no strings attached.

A Hybrid Approach to Maximize the Benefits of Secondary Residences In Retirement

A hybrid approach enables maximizing the benefits of secondary residences.

Rather than completely ceding access for long-term renters, you can "dial up or dial down" income flexibly. Reserve peak seasons or designated weeks to vacation and enjoy the property yourself.

Then, rent it out strategically during “shoulder” seasons or months you won't visit. Shoulder seasons commonly refer to the periods between peak and off-peak periods.

Off-peak rentals could also work, but there might not be significant demands during these periods. Even high-demand properties sit vacant at certain times of the year.

Examples of Generating Retirement Income While Maintaining Leisure Access

For example, families may flock to a beach condo all summer. But far fewer visitors clamor during spring or fall, allowing rental income generation while retaining access.

The same applies to a cabin or mountain home popular for winter ski trips but unused in warmer months.

Employing a hybrid vacation/rental model allows tailoring secondary properties to balance enjoyment and income generation.

You need not fully commit one way or the other. Instead, optimize scheduling to "have your cake and eat it too" when leveraging these assets.

Secondary Residence Operating Costs

As with primary residences, budget around 2-3% of the property's total value annually for ongoing operating expenses.

A $500,000 vacation home will incur about $10,000-$15,000 yearly for maintenance, utilities, taxes, and more. Budgeting 3% provides wiggle room.

Review historical utility bills, property tax records, and homeowners association fees when estimating expenses.

Always assign conservative budgets when projecting vacation home costs.

Investment Properties for Retirement Income

Acquiring dedicated rental properties beyond secondary residences can provide ongoing income. Commercial buildings, multi-family units, and single-family rentals generate cash flow when run effectively.

How much can you make from income from investment properties? Let’s look at some key ratios to begin projecting.

Key Rental Income Ratios

For dedicated rental assets, two handy recommended ratios provide initial income estimates.

The 1% Rule

The 1% Rule suggests monthly rent should equal at least 1% of the total property value. A rental property worth $1 million should generate at least $10,000 per month in rent for an annual total of at least $120,000.

The 1% Rule is essential because it estimates how much rent you can earn from a property.

The 50% Rule

The 50% Rule states that net cash flow should equal about 50% of rent after operating expenses. From that $120,000, you should expect to spend $60,000 in annual operating costs.

Those expenses include things like maintenance, repairs, insurance, property tax, vacancy losses and more. They don’t include principal or interest payments if you still have a mortgage on the property, so you will need to look at that separately if that is the case.

The 50% Rule is important because it helps prevent over-estimating the net income you will receive from a rental property.

Additional Considerations

When projecting income from rental properties, you should vet expenses thoroughly and run detailed calculations to verify precise income versus costs. Assign conservative rent rates when estimating potential cash flows. Treat these rules as starting points rather than absolute guarantees.

You can find out more about projecting rental income here.

As explained above, costs will eat up about half the income you earn from rent. Given the 1% Rule, projected income on a $2 million property should be at least $20,000 per month or $240,000 annually. And given the $50% Rule, the costs will be $10,000 per month on average for a total of $120,000 annually.

Hiring a property management service that will screen tenants, address maintenance concerns, and handle leases while minimizing landlord obligations will make your job as a landlord much easier. However, be sure to weigh costs against income to maximize cash flow.

What Kind of Investment Property Should You Buy?

Many different types of investment properties could satisfy your retirement income and personal situation.

When acquiring investment properties, consider the following:

Residential: Single-family homes, duplexes, townhomes. Lower capital requirements but more active management.

Multi-family: Apartment buildings, complexes. Higher upfront costs but economies of scale.

Commercial: Office spaces, retail stores, industrial warehouses. Hands-off but large capital needed.

New construction: Higher risk but potentially higher returns. Significant capital is required.

Existing properties: Proven assets with less uncertainty. Can find distressed deals.

You can also invest in rentals indirectly through partnerships and syndicates. While you split profits, this collaboration limits liability and leverages others' expertise. This strategy is ideal for passive investment with small capital outlays spread across a fund or portfolio of properties.

The key is balancing time commitment, expenses, and cash flow based on your real estate investing philosophy. Whether direct or indirect, rentals provide another income lever beyond secondary residences.

Thinking Clearly About Real Estate

Making optimal real estate decisions requires conceptualizing properties in financial terms beyond merely square footage.

Here is a quick recap of the opportunities we've covered so far:

Primary residences provide stability and potential legacy gifts if retained long-term.

Secondary homes offer contingency buffers via renting or selective liquidation, plus legacy potential.

Dedicated rentals generate ongoing income through long-term tenants or short-term vacation rentals.

A hybrid model allows flexible dialing of income up or down without fully sacrificing personal access.

Investment properties, either direct or via syndicates, constitute assets purely for cash flow and diversification.

With the 1% Rule, you can project that the monthly rent of an investment property will be around 1% of the total property value, but the 50% Rule means that half of that will be consumed by expenses.

Now, onto asset allocations and thinking about real estate in terms of stocks and bonds.

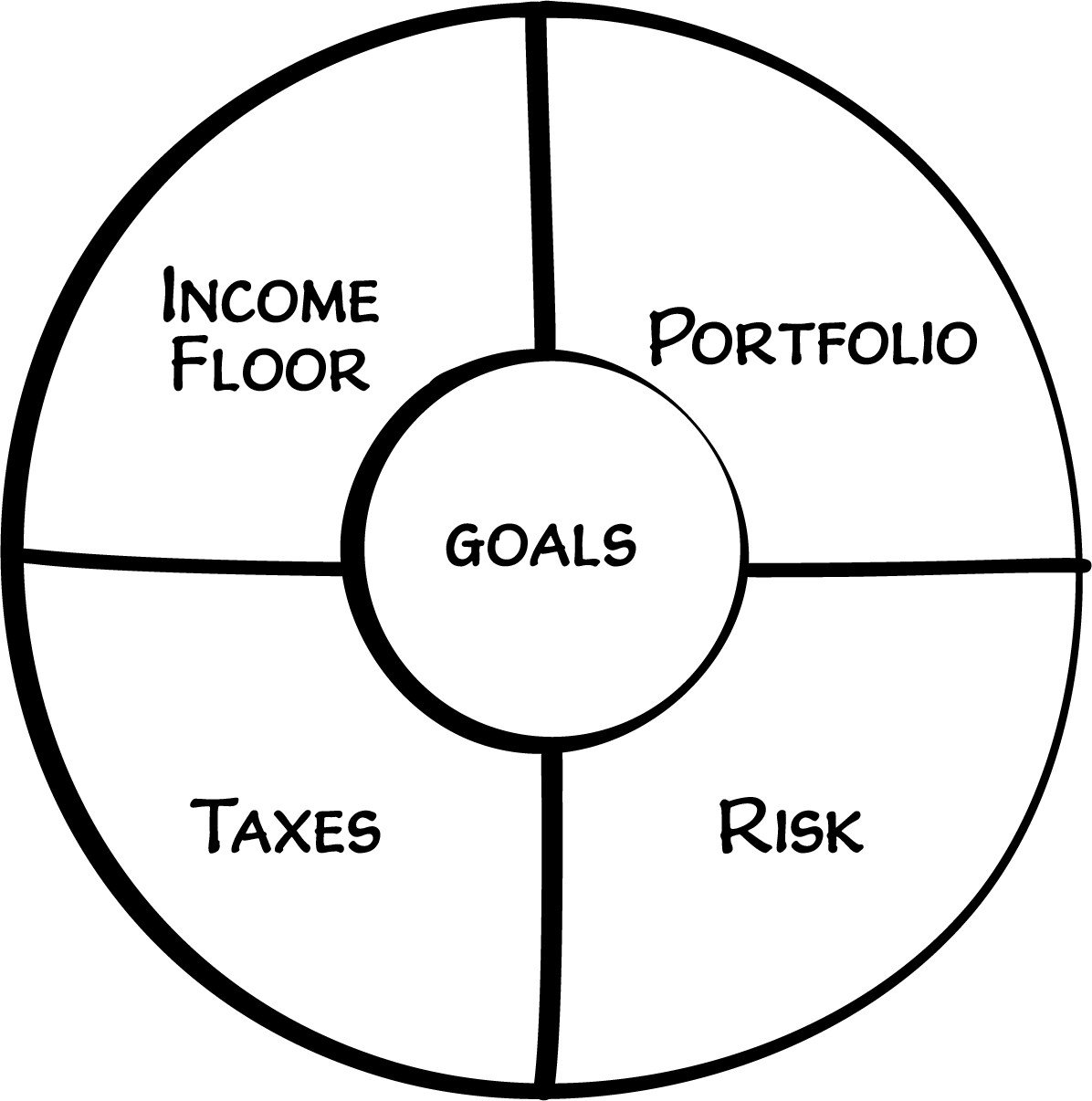

Asset Allocations: Real Estate as Stocks or Bonds

When assessing your real estate portfolio holistically, consider whether assets resemble stocks or bonds based on their risk-return profiles.

Commercial properties with stable, long-term tenants likely resemble bonds – consistently lower returns but less risk.

A new speculative development mirrors a stock – higher potential returns but more uncertainty.

This analogy helps guide overall portfolio allocations. If all real estate essentially acts as your "bond" allocation, you may opt for higher-risk equities in investment accounts.

Categorizing rentals this way also informs income planning. Conservative investors may only count bond-like assets toward income floors due to their reliability.

Incorporate Ratios into Individual Assessments

These rules provide estimates, but optimizing real estate requires assessing each property's purpose and parameters individually within your total financial picture.

For instance, investing $500,000 into a commercial building syndicate may generate more stable income than acquiring two $250,000 single-family home rentals directly. The tradeoff is less diversification and lower liquidity with a single large asset.

Thinking conceptually about your real estate, not just as homes but as financial assets, allows making strategic choices to align with your retirement lifestyle vision. The math provides guardrails—your specific goals and risk appetite determine ideal optimization.

Existing Real Estate as Legacy Assets

Rather than selling properties outright, leaving your primary residence, second home, or other real estate to heirs can make ideal legacy gifts.

Allowing children or other beneficiaries to inherit properties enables passing on assets directly while avoiding probate delays. Real estate assets transfer immediately upon death.

Financial accounts like IRAs and investment portfolios must go through court-supervised probate before beneficiaries gain access, often tying up funds for months.

Retaining income properties like rentals to gift to your heirs also constitutes a smart tax move. When inheriting real estate, your beneficiary's cost basis steps up to the current market value.

For example, if you originally paid $250,000 for a rental property now worth $1 million, your heir's cost basis resets to $1 million when inheriting. This eliminates embedded capital gains and provides greater flexibility to sell or leverage the property.

Optimizing existing real estate as legacy assets beyond just cash inheritances can provide heirs security and flexibility, but be sure to do more research on the taxes in retirement you will have to pay to your state to ensure favorable outcomes for your heirs.

Conclusion

Optimizing real estate you already own can provide stability, income, and legacy planning vehicles in retirement—but only if incorporated thoughtfully into comprehensive financial planning.

As we've explored, viewing properties based on financial utility beyond just square footage unlocks potential advantages. Your real estate constitutes a network of concrete assets that can be strategically aligned with your retirement lifestyle vision.

Evaluate Your Real Estate Financial Footprint

This requires assessing real estate holistically regarding your "financial footprint" rather than attachment to specific properties. As I often explain, total real estate equity matters more than which particular properties comprise it.

For instance, downsizing may change square footage but not financial footprint if reinvesting sale proceeds into a new residence. Relocating between equally valued homes has little net impact. Visualize your overall real estate equity as a flexible constant to optimize, not individual addresses.

Take an Inventory of Your Properties

With this financial footprint principle in mind, take an inventory of the real estate funding your retirement:

Review total property values and accumulated equity across assets. What is your collective real estate net worth?

Do current properties align strategically with your income, stability, contingencies, and legacy planning needs?

If acquiring new properties, carefully weigh costs, risks, and time commitments against potential benefits. Joining a syndicate may provide easier exposure than direct ownership.

Revisit assessments annually as properties and plans evolve over your retirement time horizon.

Regularly updating your real estate inventory allows you to innovatively optimize this concrete asset network to retire confidently.

If you are intrigued by these concepts of optimizing real estate in your retirement portfolio, answer a few quick questions to see if we're a mutual fit below.