Comparing Rental Properties And REITs

With interest rates low and uncertainty surrounding the stock market, retirees are turning to real estate to generate income. It’s estimated that one in ten retirees supplement their income with rental properties. REITs are also an attractive option for investing in real estate. In this article, we’ll break down the pros and cons of rental income and REITs.

Although you may have Social Security income and perhaps a pension, you may want to consider adding rental income as a possible source of funding in your golden years. Real estate can provide a balance to your investment portfolio of stocks and bonds.

ARE RENTAL PROPERTIES IN DEMAND?

If you’re considering buying a home for rental income, you first want to know if there’s demand in the market for rentals. In other words, are there renters out there who want to rent your property?

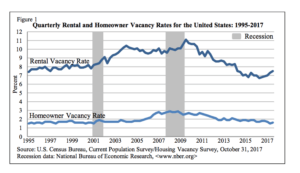

The answer is yes. Rental vacancy rates have been on a steady decline since the recession in 2009 as shown in the top line of the graph.

In fact, the rental home market is soaring today whereby single-family rentals have risen by 30% in the last three years and now make up 35% of all the rental units in the U.S. And, rising demand for rentals translates to a healthy supply of renters.

BENEFITS OF OWNING RENTAL PROPERTY IN RETIREMENT

Positive Cash Flow

Rental income typically pays a higher annual yield than dividend income and current bond yields. In general, income yield from investment properties can be anywhere from 6% to 8% per year.

Of course, if you’re just starting out in real estate investing, the positive cash flow will not begin in year one particularly if you have to take a mortgage out on each property. However, over time, you’ll gain equity in the home as the rental income pays your mortgage, taxes, and fees. As a result, the home will generate positive monthly cash flow. Over the years, you add to your portfolio by buying more properties repeating the process. With proper planning, you’ll have several properties generating income for you in retirement.

Let’s take a look at an example of a typical real estate portfolio.

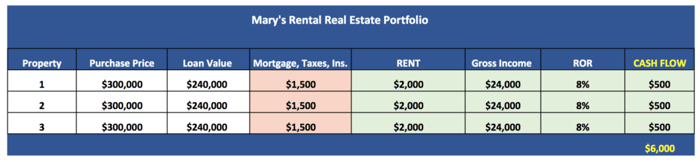

Mary invested in 3 single-family investment properties as shown in the table below.

- Mary paid 20% on each property.

- With a monthly rent payment of $2,000 per month, Mary is earning an 8% return on each of her $300,000 investments in each property.

- Mary also has a positive cash flow of $6,000 per year even with having a mortgage.

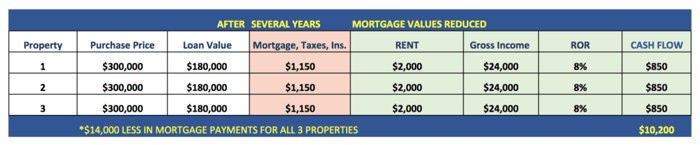

As Mary pays down her mortgage over the years and refinances, her positive cash flow improves particularly since her rent is likely to either remain the same or rise.

As we see below, Mary now has $10,200 in annual positive cash flow.

According to experts, ideally, you should earn 8% per year on the total value of your real estate properties. It’s not crazy to earn $200 to $1000 per month in positive cash flow.

Of course, your rate of return depends on how long you’ve owned the home, the value of the home, and the current mortgage owed on the property. Over time, your property values will rise while your mortgage balances decline improving your monthly cash flow.

BENEFITS TO A REAL ESTATE PORTFOLIO IN RETIREMENT VERSUS STOCKS & BONDS

Tax Benefits:

The first tax benefit has to do with what’s called depreciation. The age and wear of your building are both assigned a value which is called depreciation. Depreciation reduces the value of your property, allowing you to claim a lower property value and ultimately reduce your tax burden.

According to zillow.com, you can claim depreciation on the building only, not your land. But the depreciation expense is spread out over 27.5 years. So, if your tax assessed value of your land is $75,000, and the tax value for the house is $200,000, the depreciation expense that you can claim is $7,272 per year ($200,000/27.5). The depreciation expense reduces the total value of your property when filing your taxes, reducing your tax burden. With lower property taxes, your costs are lower giving you more income from the property.

Also, if the total depreciation amount is more than your total rental income for the year, you can claim a tax loss.

The second tax benefit is called a 1035 Exchange. When you sell a property, you have to pay taxes on the profits from the sale, and on any depreciation, you claimed over the years. However, if you use the proceeds from the sale to buy another investment property, you avoid paying the taxes from the sale of the first property. However, there are some stipulations that must be met to qualify. Nonetheless, the tax benefits of owning real estate make it an attractive investment for retirees.

You Can Use Other People’s Money:

With each property, you can take out a mortgage to buy the home minus your down payment. The benefit of leverage or borrowing allows you to earn a rate of return without paying the full price for the property. Leverage makes it easier to earn positive cash flow.

Inflation Hedge:

If your retirement investment portfolio consists of stocks and bonds, inflation erodes the overall yield or rate of return on the portfolio. Inflation is a measure of annual price increases in percentage terms.

For example, if a stock and bond portfolio generated an 8% return and inflation was 2%, the net rate of return was 6% for the portfolio. Rental income from investment properties, on the other hand, will rise over time along with inflation, but your mortgage payment will stay the same.

As a result, your income stream will increase over the years as you raise rents, but your expenses will either remain the same or decline as you eventually pay down the mortgage amount owed to the bank.

With a rental property, it’s possible to have steady income growth over time, stable-to-declining expenses, and appreciation of the property value that keeps up with inflation. This is why many retirees view rental income as an inflation hedge. The rising rental income from property ownership offsets the inflation rate that would normally erode the yield on your stock and bond portfolio.

Rental Properties Offer Increased Diversification:

With the financial market volatility and uncertainty, real estate ownership over the long-term can help you diversify your income stream. For example, if the stock market declines by 20% for two years in a row, you’ll still be collecting rent.

Rental Incomes Are Rising:

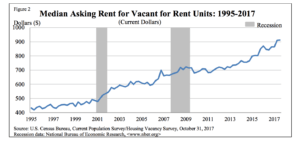

From the graph, we can see that asking rents have steadily risen over the years.

Rental properties provide a stable amount of rental income that increases over the years.

And with the uncertainty of the stock and bond markets, rental income is yet another source of monthly income, diversifying your wealth and exposure to any one market.

Real Estate Values Can Appreciate In Value Over Time:

Real estate appreciates over time at a greater rate than inflation. If you decide to sell the property, you have a high probability of earning capital gains on the sale. Combined with the rental income over the years, the combined rate of return can be impressive.

However, as we saw in 2009, the housing market can crash. It’s important to note that owning rental properties carries risk and is not as stable as a pension or Social Security. As stated earlier, owning rental properties for income diversifies your risk from stocks and bonds, but it’s not risk-free.

RULES OF THUMB WHEN BUYING RENTAL PROPERTIES FOR RETIREMENT INCOME

Buy Before You Retire.

Since the financial crisis, mortgage lending guidelines have gotten stricter. To get approved, banks typically require two years of employment history in the same position and a 20-30% down payment for rental properties. In addition to closing costs, the interest rate on a loan for an investment property is typically higher than a primary residence property. Before buying, get pre-approved from a bank and find out the interest rate you’ll likely be charged given your credit history and credit score.

Consider Living In The Property For One Year.

Owner-occupied properties enable you to qualify for more favorable terms on your mortgage. You can always move out later, rent the house out, and collect income from it.

Build A Savings Reserve Before You Buy.

A good rule of thumb is to set aside six months worth of monthly expenses. You have to plan for the water heater going out or minor repairs. To do this, total your monthly mortgage, your taxes, water, home insurance and add additional savings to cover potential repairs.

Purchase Good Properties And Get Help From An Expert.

When shopping for a rental to purchase, a local realtor can help you with the average rents being charged and the overall demand for housing in the area. If there is local demand for housing, the rentals will likely be in demand as well. The realtor should also be able to tell you what areas of town have a higher demand for rentals than others.

Buy a single-family home in an area with a good school district. If the school system is above average, there will likely be plenty families looking for properties. Also, a family with kids in the local schools are less likely to break the lease and should provide you with a steady stream of rental income.

Calculate Your Income Generated.

As a general rule of thumb, shoot for generating 6% to 8% per year of the total value of your property in income annually. Your return might be lower initially depending on your monthly mortgage payment. After consulting a real estate professional, you should have an estimate of the rent payment and the total value of the property. Combined with the monthly terms from your bank’s pre-approval, you should have a good idea of your rate of return and the monthly income that you can expect from the property.

If Buying Rental Properties Aren’t For You:

Maybe real estate is expensive in your area, or you don’t like the idea of managing properties in your retirement. Instead of buying a property outright, you could choose to invest in Real Estate Investment Trusts or REITs. A REIT is an investment company that invests in commercial real estate whereby the trust receives rental payments for the properties. A REIT is similar to an ETF for stocks and bonds in that the trust is likely to have many properties in the fund.

However, there are pros and cons to owning REITs versus owning property or investing in the financial markets.

THE PROS AND CONS OF REITS

REITs are a passive investment since you investing in an ETF or Exchange Traded Fund with many properties in the fund. Instead of owning a property where you have all the responsibility, you can invest in a REIT and let professionals invest the money for you.

REITs help you diversify your portfolio of stocks and bonds. While the stock market can go up and down, REITs offer the possibility where rental incomes will continue despite market corrections. As a result, REITs can offer a stable rate of return even when the financial markets are not performing well.

Also, since most rental properties are bought locally, investors can get overexposed to one local market. We only have to look at the financial crisis where we saw home values plummet in Detroit and other hard-hit areas. A REIT diversifies your investment holdings since the properties are located all over the country.

Low investment minimum of usually $1,000 gets you started with REITs. Also, just like many ETFs, you can sell your investment in a REIT more easily than selling an investment property.

Dividend payments are common with REITs adding to the overall rate of return. REITs are mandated by law to return 90% of taxable income to investors.

REITs don’t offer as high a rate of return as owning property outright and are subject to market risk if there’s a housing crash or recession. For a rental property, you might earn 8% per year whereas a typical rate of return on a REIT might be 4% per year.

REITs don’t have a tax benefit of owning a property outright, and you must pay capital gains taxes on your gains just as you would for stocks and bonds.

TAKEAWAYS

Owning rental properties as an income source in retirement can offer you a steady stream of income and diversify your portfolio by reducing your exposure to stocks and bonds. Of course, there are pros and cons of each investment. Stocks and bonds are easier to purchase than rental properties and on average offer a higher rate of return. However, with the higher return, comes a higher degree of risk or volatility from market corrections.

If you own a rental property in an area with a good school district and a high demand for rentals, you have a good chance of receiving a stable income stream for your investment. Of course, real estate prices can decline as we saw in the housing crash in 2009. So, owning property is not without risk, and you have to be willing to put in the work of being a landlord.

Whether you own a property or a REIT, you can diversify your retirement portfolio, reducing your overall risk to financial markets. But be careful not to have most of your net worth tied up in local real estate, as you may need to reposition your holdings to remain diversified. If you follow these guidelines, you should have a well-balanced portfolio that includes stocks, bonds, REITs and a monthly stream of rental income.