Table of Contents

- Minimize or Strategize?

- Taxes in Retirement: The Problem with the ‘Tax Prep’ Mindset

- But What About Tax Planning?

- The Power of Proactive Planning for Taxes in Retirement

- Looking Beyond Immediate Consequences

- The 7 Best Tax Planning Strategies for Taxes in Retirement

- Deal With Taxes in Retirement

- Putting It All Together: A Taxes in Retirement Planning Hierarchy

- Annual Tax Planning Calendar

- Conclusion

What are the best strategies for minimizing taxes in retirement?

Your first child is on the way, and amidst the flurry of emotions and preparations, you find yourself writing a check for $140,000 to a state you've never even visited. Sound crazy?

That's exactly what I did when my wife told me she was pregnant with our first child.

No, I hadn't lost my mind or developed a sudden affinity for Utah. Instead, I was making a strategic move to “superfund” my unborn child's 529 plan. You see, as a financial advisor, I'm always on the lookout for tax planning opportunities that can pay off big in the long run. And this was a prime example.

Minimize or Strategize?

Many people approach taxes in retirement with a singular goal: minimize what they owe each year. They spend hours gathering documents, filling out forms, and praying for a refund. But here's the thing - that approach, while understandable, is woefully shortsighted. It's the equivalent of driving a car while only looking at the few feet of pavement right in front of you.

Proactive tax planning—not just annual tax preparation—is the key to unlocking immense wealth in retirement. By taking a strategic, forward-looking approach, you can save millions of dollars and maximize your after-tax returns over the course of your lifetime.

In this post, we'll explore the transformative power of tax planning. We'll debunk common myths, reframe how you think about taxes in retirement and dive deeply into seven powerful strategies you can implement today to supercharge your retirement savings.

Whether you're already retired or still building your nest egg, these techniques can profoundly impact your financial future. So buckle up, grab a notepad, and get ready to see taxes in a whole new light. Trust me, your future self (and your bank account) will thank you.

Taxes in Retirement: The Problem with the ‘Tax Prep’ Mindset

Let's start by addressing the elephant in the room: taxes in retirement are complex, ever-changing, and often downright frustrating. It's no wonder that most people approach them with a sense of dread and a singular focus on minimizing what they owe each year.

This is where the traditional approach of tax preparation comes in. You know the drill– gathering W-2s, 1099s, and receipts, plugging numbers into TurboTax, handing everything over to your accountant, and crossing your fingers for a favorable outcome.

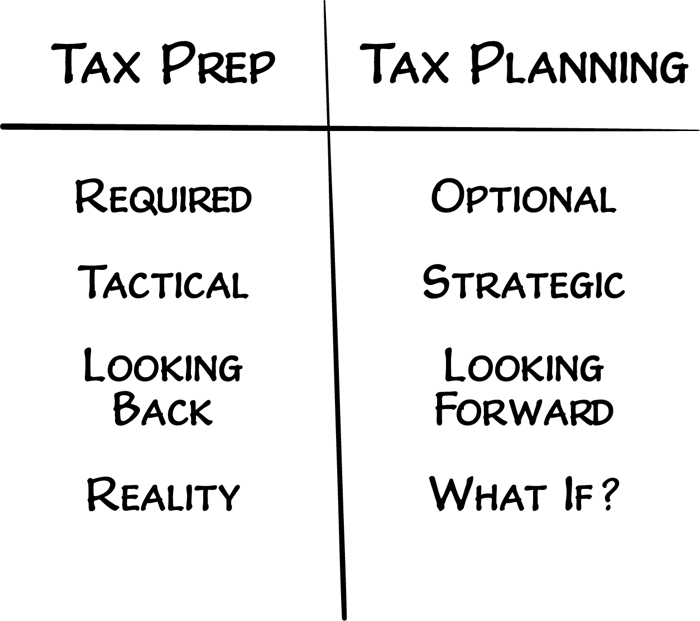

Don't get me wrong– tax preparation is a necessary task. But it's also inherently backward-looking and tactical in nature. It's focused on compliance and damage control, not proactive planning and optimization.

But What About Tax Planning?

In contrast, tax planning is about looking ahead and developing strategies to minimize your tax liability over the long term. Tax preparation is reactionary, while tax planning is anticipatory.

Here's a shocking statistic highlighting the cost of neglecting proactive planning:

Many of our clients will pay between $2 million and $5 million in taxes over their lifetime.

Let that sink in for a moment.

That's a staggering sum of money that could be put to much better use– funding your dream retirement, leaving a legacy for your loved ones, or supporting the causes you care about most.

The problem is that many retirees are so focused on minimizing their tax bill each year that they miss out on opportunities to maximize their after-tax wealth over the long haul. They're so busy looking at the trees that they fail to see the forest.

Two Investment Options

For example, let's say you have a choice between two investment options. Option A is tax-free but offers a lower rate of return, while Option B is taxable but has the potential for much higher growth.

If you're solely focused on minimizing taxes, you might be tempted to automatically choose Option A. But if you run the numbers, you may find that Option B actually leaves you with more money in your pocket after taxes, thanks to its superior returns.

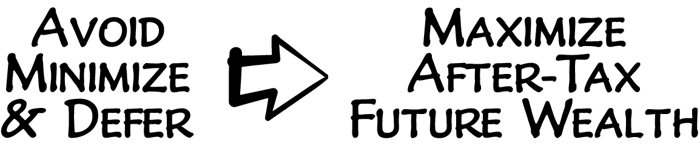

This is just one example of how a myopic focus on tax minimization can lead you astray. The key is to shift your mindset from tax avoidance to tax optimization - from a short-term, reactive approach to a long-term, proactive one.

In the next section, we'll explore this concept further and examine how embracing a strategic tax planning mindset can revolutionize retirement savings.

The Power of Proactive Planning for Taxes in Retirement

So how do you make the shift from a tax minimization mindset to a tax optimization one? It starts with reframing your goal. Instead of simply paying as little as possible each year, your objective should be to maximize your after-tax returns and wealth over the long term.

Let me illustrate with an example. Imagine you have the choice between two investments: a tax-free bond yielding 3% and a taxable stock fund with an expected return of 8%. At first glance, the tax-free option is the clear winner. After all, who wants to pay more taxes than they have to?

But let's run the numbers. Assuming a 25% tax rate, the after-tax return on the stock fund would be 8% x 0.75, which equals 6%. That's double the return of the tax-free bond. In this case, opting for the taxable investment leaves you with significantly more money in your pocket over time, even after accounting for the tax hit.

This is the power of proactive tax planning - it allows you to look beyond the immediate tax implications and focus on the big picture. You can make strategic decisions that optimize your wealth over the long haul by considering your current and future tax rates, investment horizon, and overall financial goals.

Roth Conversions for Proactive Taxes in Retirement

Another prime example of this concept in action is Roth conversions. When you convert funds from a traditional IRA to a Roth IRA, you pay taxes on the amount converted in the year of the conversion. At first blush, this might seem counterintuitive - why pay taxes now when you could defer them until later?

But here's the thing: Those converted funds will then grow tax-free in your Roth IRA, and you can withdraw them tax-free in retirement. If you expect to be in a higher tax bracket in retirement (which is likely for many high-net-worth individuals), paying the taxes upfront at a lower rate can result in significant savings down the line.

Looking Beyond Immediate Consequences

In essence, proactive tax planning is about playing the long game for maximum optimism and relaxed confidence in your retirement. It's about looking beyond the immediate tax consequences and considering the broader implications for your wealth over time. By adopting this strategic, forward-looking mindset, you can unlock a world of opportunities to maximize your after-tax returns and secure a more prosperous retirement.

Of course, this is easier said than done. Taxes are notoriously complex, and the strategies that work best for one person may not be optimal for another.

That's why working with a qualified financial advisor specializing in retirement tax planning is so important. They can help you navigate the intricacies of the tax code and develop a customized plan that aligns with your unique goals and circumstances.

Let’s explore seven specific tax planning strategies that can be incredibly effective for retirees. From Roth conversions to asset location to tax loss harvesting, these techniques can help you minimize your tax liability and maximize your wealth over the long term.

So grab a pen to take some notes—your future self will thank you.

The 7 Best Tax Planning Strategies for Taxes in Retirement

Now that we've established the importance of proactive tax planning, let's get tactical. Here are seven powerful strategies that can help you optimize your taxes in retirement and keep more of your hard-earned money in your pocket.

Roth Conversions

As we touched on earlier, converting funds from a traditional IRA to a Roth IRA can be a smart move if you expect to be in a higher tax bracket in retirement. By paying the taxes upfront at a lower rate, you can enjoy tax-free growth and withdrawals down the line. I counseled one couple in their 60s, John and Betty, who were able to save a significant amount on required minimum distributions (RMDs) by implementing a series of annual Roth conversions.

Timing is also important in Roth Conversions. There are various factors associated when to execute Roth Conversions.

HSA Optimization

Health Savings Accounts (HSAs) are triple tax-advantaged - contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. By maximizing your HSA contributions and investing the funds for long-term growth, you can build a powerful tax-free savings vehicle for healthcare costs in retirement.

Beyond the obvious doctor visits, you can use HSAs to fund expenses like acupuncture, ambulance costs, hearing aids, prescription drugs, psychological therapy, and some long-term care services, according to a government-sponsored HSA fact sheet.

Withdrawal Sequencing

The order in which you tap your various retirement accounts can have a big impact on your tax liability. As a general rule, it's best to withdraw from taxable accounts first, then tax-deferred accounts (like traditional IRAs and 401(k)s), and finally tax-free accounts (like Roth IRAs). This allows your tax-advantaged accounts to continue growing for as long as possible.

For air traffic controllers and retirees, sequencing is important.

Asset Location

Not all investments are created equal from a tax perspective. By strategically placing your assets in different account types (taxable, tax-deferred, or tax-free), you can minimize your tax liability and maximize your after-tax returns. For example, holding tax-inefficient investments, such as bonds and REITs, in tax-deferred accounts can help you avoid paying taxes on the income each year.

Donor-Advised Fund Bunching

If you're charitably inclined, bunching several years' worth of donations into a single tax year, ideally when you are in a very high tax bracket, through a donor-advised fund (DAF) can allow you to itemize deductions and reduce your tax liability. You can then distribute the funds to your favorite charities over time while claiming the full deduction upfront.

529 Superfunding

Similar to bunching charitable donations, superfunding a 529 college savings plan allows you to front-load several years' worth of contributions (up to five years) into a single tax year. This can help you maximize the tax-free growth potential of the account and potentially reduce your estate tax liability.

Tax Loss Harvesting

No one likes to see their investments lose value, but there can be a silver lining from a tax perspective. By strategically selling losing investments and using the losses to offset capital gains (or up to $3,000 of ordinary income), you can reduce your tax liability in the current year.

Deal With Taxes in Retirement

These are just a few of the many strategies that can be employed in a comprehensive retirement tax plan. The key is to work with a knowledgeable advisor who can help you identify the techniques that are most applicable to your situation and implement them in a coordinated, tax-efficient manner.

Of course, it's not enough to simply be aware of these strategies—you need a framework for implementing them. That's what we'll cover in the next section, where we'll discuss how to prioritize these techniques based on your age and financial situation and provide a sample annual tax planning calendar to keep you on track.

Want to learn more about taxes in retirement and other financial concepts? Click below to take my course. I’ve made it totally free of charge.

Putting It All Together: A Taxes in Retirement Planning Hierarchy

With so many potential tax planning strategies to consider, it can be overwhelming to know where to start. That's why it's helpful to have a framework for prioritizing the techniques that will impact your unique financial situation.

One way to approach this is by thinking about tax planning as a hierarchy, with the most foundational strategies at the bottom and the more advanced techniques at the top.

Read on for a sample hierarchy that can serve as your starting point.

Maximize Tax-Advantaged Accounts

Start by ensuring you're taking full advantage of tax-advantaged savings vehicles like 401(k)s, IRAs, and HSAs. These accounts offer powerful tax benefits and should form the foundation of your retirement savings strategy.

Optimize Your Asset Location

Next, focus on placing your investments in the most tax-efficient accounts. As a general rule, hold tax-inefficient assets (like bonds and REITs) in tax-deferred accounts and tax-efficient assets (like stocks) in taxable accounts.

Implement Roth Conversions

If you expect to be in a higher tax bracket in retirement, consider implementing a series of Roth conversions to minimize your future tax liability. This is especially powerful in years when your income is lower than usual (e.g., during the early years of retirement before RMDs kick in).

Manage Your Withdrawals

As you begin tapping your retirement accounts, be strategic about the order in which you withdraw funds. Generally, it's best to start with taxable accounts, then move on to tax-deferred accounts, and finally, tax-free accounts like Roth IRAs.

Incorporate advanced strategies

Once you've covered the basics, consider incorporating more advanced strategies like donor-advised fund bunching, 529 super-funding, and tax loss harvesting. These techniques can provide incremental benefits and help you optimize your tax situation even further.

Of course, the specific hierarchy that works best for you will depend on factors like your age, income level, and overall financial goals.

For example, you may prioritize Roth contributions over tax-deferred savings if you're younger and in a lower tax bracket. If you're nearing retirement and have a large balance in tax-deferred accounts, Roth conversions may take precedence.

That's why working with a knowledgeable financial advisor who can help you create a customized tax planning roadmap is so important. They can take into account your unique circumstances and help you prioritize the strategies that will have the greatest impact on your long-term wealth.

Annual Tax Planning Calendar

To give you a sense of what this might look like in practice, here's a sample annual tax planning calendar:

January

Review your prior year's tax return and identify opportunities for improvement. Update your financial projections for the coming year.

February

Gather all necessary tax documents and review them for accuracy. Make any necessary changes to your withholding or estimated tax payments.

March

Meet with your financial advisor to discuss your tax planning strategy for the year ahead. Identify key opportunities and action items.

April

File your tax return (or extension) and make any required tax payments.

May-June

Review your investment portfolio and rebalance as needed. Consider opportunistic Roth conversions if applicable.

July-August

Assess your year-to-date income and expenses. Adjust your projections and tax planning strategy as needed.

September-October

Review your charitable giving plan and consider bunching donations through a donor-advised fund if applicable. Harvest any tax losses in your investment portfolio.

November-December

Make any final tax planning moves before year-end. This may include additional Roth conversions, charitable donations, or realizing capital gains/losses.

By breaking your tax planning down into manageable steps throughout the year, you can stay on top of your finances and make steady progress toward your long-term goals. Working with a trusted advisor to implement a comprehensive strategy can save you millions of dollars over your retirement.

Conclusion

We've covered a lot of ground in this post, from the importance of proactive tax planning to specific strategies you can use to optimize your taxes in retirement. But if there's one key takeaway, it's this: taxes are not something to be feared or avoided - they're an opportunity to be embraced and optimized.

By shifting your mindset from reactive tax preparation to proactive tax planning, you can unlock a world of opportunities to maximize your wealth and achieve your long-term financial goals. Whether it's through Roth conversions, strategic asset location, or charitable giving strategies, there are countless ways to make the tax code work in your favor.

Of course, this is not a journey you have to embark on alone. Navigating the complex world of taxes can be overwhelming, especially when you're juggling multiple accounts, investments, and income streams. That's why it's so important to partner with a knowledgeable financial advisor who specializes in retirement tax planning.

A qualified advisor can help you create a customized tax planning strategy that takes into account your unique goals, risk tolerance, and financial situation. They can guide you through the intricacies of the tax code and help you implement strategies to maximize your after-tax returns while minimizing your stress and anxiety.

Practical Next Steps

If you're ready to take control of your retirement taxes and start maximizing your wealth, here are some practical next steps to consider:

Schedule a consultation with a fiduciary advisor: Look for an advisor who is legally obligated to act in your best interests and has experience in retirement tax planning.

Gather your financial documents: This may include tax returns, investment statements, and income/expense projections.

Educate yourself on key concepts: While you don't need to become a tax expert overnight, familiarizing yourself with key concepts like marginal vs. effective tax rates, tax brackets, and common deductions can help you have more productive conversations with your advisor.

Start implementing strategies one at a time: Planning for taxes in retirement is not a one-and-done exercise - it's an ongoing process that requires regular attention and adjustment. Start by implementing one or two key strategies (like maximizing your tax-advantaged accounts or optimizing your asset location), then build on your progress over time.

Remember, the goal is not to eliminate taxes entirely; it's to pay your fair share while keeping as much of your hard-earned money in your pocket as possible. You can do just that by approaching taxes with a strategic, proactive mindset and working with a trusted advisor.

Don't let the complexity of the tax code hold you back from achieving your financial goals. Embrace the opportunity to optimize your taxes and start building the retirement of your dreams today. Your future self (and your bank account) will thank you.

Ready to get serious about your strategy for taxes in retirement? Answer a few quick questions to see if we're a mutual fit below.

See if We're a Fit