Table of Contents

- A Game Changer for Minimizing Tax Burdens

- The Basics of Roth Conversions

- Roth Conversions in Action

- Why Roth Conversions are Powerful for Retirees

- Factors to Consider When Doing a Roth Conversion

- How to Execute a Roth Conversion Strategy

- Roth Conversions as Part of a Comprehensive Retirement Plan

- Last Thing: Be Proactive

What are Roth Conversions, and can they reduce my taxes?

The scenario: you're 65, newly retired, and feeling good about your financial situation. You've diligently stuffed your 401(k) and traditional IRA for decades, and you're ready to start enjoying the fruits of your labor.

And then, your tax advisor drops a bombshell.

"You know, with all the money you've got in those tax-deferred accounts, you're sitting on a ticking tax time bomb."

That might be a bit dramatic, but this is precisely the situation that one of my clients, Sarah, found herself in a few years ago. Like many hardworking professionals, she had been so focused on saving for retirement that she hadn't given much thought to the tax implications of all that money sitting in her traditional IRA.

It wasn't until we started working together that she realized she could be facing a massive tax bill down the road, thanks to required minimum distributions (RMDs) and potentially higher tax rates in the future.

Fortunately, there was a solution: Roth conversions.

By strategically converting a portion of her traditional IRA to a Roth IRA each year, Sarah was able to take control of her tax destiny and set herself up for a more financially secure retirement.

A Game Changer for Minimizing Tax Burdens

Roth conversions can be a game-changer for retirees looking to minimize their tax burden and maximize their wealth. Yet, this strategy is often overlooked, especially by older investors who assume Roth accounts are only for younger folks just starting to save.

In this post, we'll dive deep into the world of Roth conversions. We'll cover the basics of how

they work, the unique benefits they offer for retirees, and the key factors to consider when deciding if this strategy is right for you. We'll also walk through a step-by-step process for executing a Roth conversion and explore how this tactic fits into a comprehensive retirement income plan.

By the end, we’ll have a clear understanding of whether Roth conversions deserve a place in your retirement tax toolkit —and how to get started if the answer is yes.

It’s time to explore this powerful strategy for taking control of your taxes in retirement.

The Basics of Roth Conversions

We need to understand the fundamentals before we can appreciate the potential benefits of Roth conversions. At its core, a Roth conversion involves transferring money from a traditional IRA (or other tax-deferred retirement account) into a Roth IRA.

The key difference between these two types of accounts comes down to when you pay taxes:

With a traditional IRA, you get a tax deduction on your contributions upfront, but you pay taxes on your withdrawals in retirement.

With a Roth IRA, you don't get an upfront deduction, but your money grows tax-free, and you can withdraw it tax-free in retirement, assuming you meet certain conditions This financial instrument is named after former Delaware Senator William Roth.

When you do a Roth conversion, you're essentially choosing to pay taxes on the money now in exchange for tax-free growth and withdrawals down the road.

Roth Conversions in Action

Let's say you have $100,000 in a traditional IRA, and you're in the 24% tax bracket. If you convert the full amount to a Roth IRA, you'll owe 24% on the conversion in taxes, which in this case would be $24,000. That $100,000 will then grow tax-free in your Roth account, and you'll be able to withdraw it tax-free in retirement.

Key Point 1: You Don’t Have to Convert Your Entire Balance at Once

It's important to note that you don't have to convert your entire IRA balance at once. In fact, as we'll discuss later, it often makes sense to spread your conversions out over several years to minimize the tax impact.

Key Point 2: Your Investments Don't Change

When you do a Roth conversion you can move your current investments from your traditional IRA directly to your Roth IRA. You have the option of paying the tax bill from your traditional IRA assets or using outside funds. Thus, money can stay invested in the same place; it's just now designated as Roth money instead of traditional IRA money.

Key Point 3: You Must Take Any RMDs Before Roth Conversion

One final note on the mechanics of Roth conversions: if you're age 73 or older and subject to required minimum distributions (RMDs), you must take your RMD for the year before doing a conversion. Your RMD cannot be converted to a Roth; it must be taken as a taxable distribution first.

Now that we've covered the basics let's explore why Roth conversions can be such a powerful strategy for retirees specifically.

Why Roth Conversions are Powerful for Retirees

While Roth conversions can be a smart tax move for investors of any age, they offer some particularly compelling benefits for retirees. There are three key reasons for this.

Locking in Current Tax Rates

Many retirees find themselves in a lower tax bracket in the early years of retirement before RMDs and Social Security kick in. By doing Roth conversions during this window, you can take advantage of those lower rates and avoid paying higher taxes on your IRA withdrawals down the road. This strategy helps you lock in a low rate of taxation on your traditional IRA money now, as opposed to exposing your portfolio to a much higher rate of taxation later.

Reducing the tax burden of RMDs

Once you reach age 73, you're required to start taking minimum distributions from your traditional IRA each year. These RMDs are taxable and can push you into a higher tax bracket, especially if you have a large balance. By gradually converting your traditional IRA to a Roth in the years leading up to RMDs, you can reduce the size of those mandatory withdrawals and the associated tax hit. My clients, John and Cynthia, significantly reduced their future RMDs by doing annual Roth conversions in their 60s.

The next reason to embark on an aggressive Roth Conversion strategy is that Roth IRAs have no RMDs. Your money can simply continue to grow and grow, and you can leave it there for as long as you want.

In addition to these specific benefits, Roth conversions can all help retirees "diffuse the ticking tax time bomb" of growing tax-deferred accounts. By chipping away at your traditional IRA balance over time, you can gain more control over your lifetime tax bill and reduce the risk of a major tax surprise in retirement.

Creating a Tax-Free Legacy

If you don't need all the money in your IRA for your own retirement spending, Roth conversions can be a powerful way to leave a tax-free inheritance to your heirs. Since Roth IRAs have no RMDs for the original owner, you can let the money grow tax-free for as long as you live. And when your heirs inherit the account, they'll have ten additional years of tax-free growth and tax-free withdrawals, which avoids these withdrawals being taxed at their rate.

Real World Example

Let's look at a real-world example of how this can play out. Mary, a 70-year-old retiree, had built up a sizable traditional IRA balance over her career. When we first started working together, she was concerned about the looming tax burden of her RMDs, which were set to begin in a few years.

By implementing a strategic Roth conversion plan, we were able to gradually shift a portion of Mary's IRA to a Roth each year, taking advantage of her relatively low tax rate in the pre-RMD years. As a result, Mary was able to reduce her taxable RMDs and create a tax-free income stream to supplement her retirement spending. She also gained peace of mind knowing that she was leaving a tax-efficient legacy for her children and grandchildren.

One Size Does Not Fit All

Roth conversions aren't a one-size-fits-all solution. There are several key factors to consider when deciding if and when to execute a conversion strategy, which we'll explore in the next section.

Curious about how Roth conversions fit into a broader retirement strategy? In my book Be the Bird, I explore this topic in depth alongside other key retirement decisions.

Factors to Consider When Doing a Roth Conversion

While Roth conversions can offer significant benefits for retirees, they're not right for everyone. Before pulling the trigger on a conversion, it's crucial to consider the following factors:

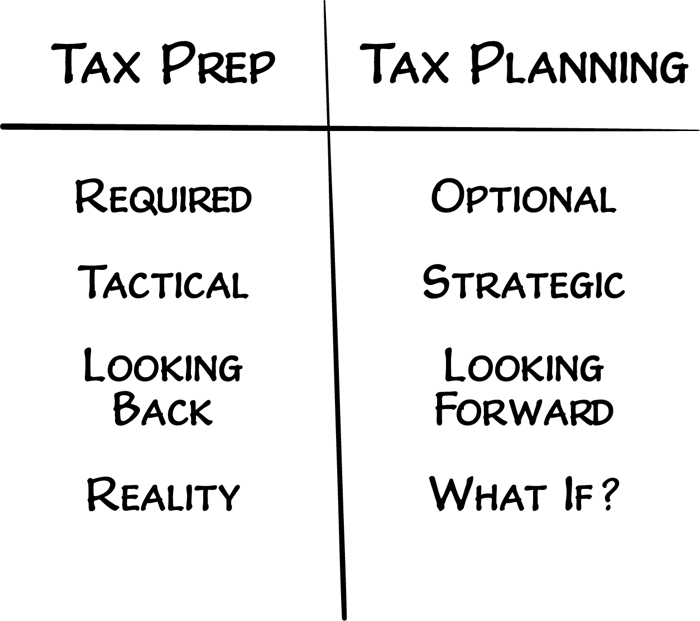

Current vs. Future Tax Rates

The main benefit of a Roth conversion is paying taxes at today's rates to avoid higher rates in the future. But if you expect your tax rate to be lower in retirement than it is now, a conversion may not make sense. That's why it's essential to project your taxable income in retirement (including RMDs, Social Security, pensions, etc.) and compare it to your current Federal and State tax brackets.

"Filling up" Lower Tax Brackets

One common strategy is to do Roth conversions to the top of your current tax bracket or to fill up lower brackets in years when your income is unusually low. For example, let's say you're married, and your taxable income is $100,000, putting you in the 22% Federal tax bracket.

Additionally, your Standard Deduction, would be $30,000 tax-free that could be used to offset a conversion, bringing the total conversion to $136,700 without moving into a higher tax bracket.

Medicare Premiums and Other Considerations

Roth conversions can impact more than just your tax bill. The increased income from a conversion could also trigger higher Medicare premiums or affect other income-based tax benefits. There are a couple of "hidden taxes" that sometimes pop up for people executing a Roth Conversion such as Medicare costs that would also increase as a direct result of that addition.

Tax Diversification

Even if you don't expect significantly higher tax rates in the future, Roth conversions can still be valuable from an overall tax planning perspective. Having a mix of taxable, tax-deferred, and tax-free accounts in retirement gives you more flexibility to manage your income and tax liability from year to year.

Let's look at an example of how these factors might play out in practice. John, age 62, is considering a Roth conversion. He's currently in the 24% tax bracket but expects to be in the 22% bracket once he retires and his income drops. Based on his projections, John decides to convert just enough to fill up the 22% bracket each year until he retires.

By taking this measured approach, John is able to take advantage of his lower tax rate in retirement while still maintaining some tax diversification. He also avoids triggering higher

Medicare premiums by spreading the conversions out over several years.

Complex and Unique Problem

Ultimately, the decision of whether and how much to convert to a Roth is a complex one that depends on your unique financial situation and goals. That's why it's so important to work with a qualified financial planner or tax professional to crunch the numbers and develop a customized strategy.

Take care to hire a financial advisor who is knowledgeable and experienced in retirement portfolio strategies like Roth conversions.

In the next section, we'll dive into the nuts and bolts of how to execute a Roth conversion and some key things to keep in mind along the way.

How to Execute a Roth Conversion Strategy

Now that we've covered the benefits of Roth conversions and the key factors to consider, let's dive into the process of executing a conversion.

Decide How Much to Convert

Based on your analysis of current vs. future tax rates, income projections, and other factors, determine the total amount you want to convert to a Roth in each year. Remember, you don't have to convert your entire traditional IRA balance at once. In fact, it often makes sense to spread the conversions out over several years to manage the tax impact.

Open a Roth IRA Account

If you don't already have a Roth IRA, you'll need to open one with a custodian, such as a bank, brokerage firm, or credit union. You can typically do this online or by filling out a paper application.

Request the Conversion

Contact your IRA custodian and tell them you want to do a Roth conversion. They'll provide you with the necessary paperwork and guide you through the process. You'll need to specify the amount you want to convert and which investments you want to move over to the Roth.

Pay the Taxes

The amount you convert will be added to your taxable income for the year, so you'll need to set aside money to pay the associated taxes. You can either pay the taxes out of the converted funds, which will reduce the amount going into the Roth or from other sources, such as a savings account or taxable brokerage account.

Report the Conversion on Your Tax Return

You'll receive a Form 1099-R from your IRA custodian showing the amount of the conversion. You'll need to report this on your tax return for the year of the conversion.

Example: How a Multi-Year Roth Conversion Might Play Out

Let’s look at a hypothetical example of how a multi-year Roth conversion strategy might play out.

Sarah, 65, has $500,000 in a traditional IRA. She's currently in the 22% tax bracket but expects to be in the 24% bracket once RMDs kick in at age 73. Working with her advisor, Sarah decides to convert $50,000 per year to a Roth for the next seven years (ages 65-72). This allows her to fill up the 22% bracket each year while still leaving some room for other taxable income.

By age 70, Sarah will have converted a total of $350,000 to the Roth, reducing her traditional IRA balance to $150,000 (assuming no growth for simplicity). This will significantly reduce her RMDs and the associated tax hit in the future. It will also provide her with a tax-free bucket of money to draw from in retirement.

This is just one example of how a Roth conversion strategy might be implemented. The specific approach will depend on your unique circumstances and goals. The key is to start the planning process early and revisit your strategy regularly as your situation evolves.

I cover Roth conversions and other financial strategies for retirement in my book Be the Bird. Click below to get your copy.

Roth Conversions as Part of a Comprehensive Retirement Plan

While Roth conversions can be a powerful tool on their own, they're even more effective when integrated into a comprehensive retirement income plan. By considering Roth conversions in the context of your overall income, expenses, and tax situation, you can create a more efficient and sustainable retirement cash flow.

Tax-Free Income Stream

One key benefit of Roth conversions is that they allow you to create a tax-free income stream in retirement. By gradually shifting money from your tax-deferred accounts to a Roth, you're essentially prepaying your retirement taxes and setting yourself up for tax-free withdrawals down the road. This can be especially valuable if you expect to have significant expenses in retirement (such as travel or healthcare costs) that would otherwise be taxable withdrawals.

Manage Overall Tax Liability

Roth conversions can also help you manage your overall tax liability in retirement. By strategically drawing from a mix of taxable, tax-deferred, and tax-free accounts, you can minimize your tax bill and keep more of your hard-earned money. For example, you might draw from your taxable or tax-deferred accounts in years when your income is lower (and your tax rate is lower) while saving your tax-free Roth withdrawals for years when your income is higher.

It's important to consider Roth conversions in the context of other tax planning strategies as well. For example, suppose you're doing conversions to fill up a lower tax bracket. In that case, you'll want to make sure you're also taking advantage of other tax-saving opportunities (such as harvesting capital losses or bunching charitable deductions) in those same years.

You'll also want to think about how Roth conversions fit into your overall Social Security and Medicare planning. The additional income from a conversion could impact when you decide to claim Social Security benefits or trigger higher Medicare premiums. A qualified financial planner can help you navigate these interactions and make informed decisions based on your specific situation.

Ultimately, the goal is to create a retirement income plan that maximizes your after-tax cash flow while minimizing your risk and complexity. Integrating Roth conversions into this broader framework allows you to create a more resilient and efficient plan that supports your lifestyle goals and legacy wishes.

Next Steps

If you're intrigued by the potential benefits of Roth conversions and wondering if they might be right for your retirement plan, there are five steps you can take to start the decision-making process.

Gather Your Financial Information

To make informed decisions about Roth conversions, you'll need a clear picture of your current income, expenses, assets, and tax situation. Gather your most recent tax returns, investment statements, and other relevant financial documents.

Project your Retirement Income and Expenses

Think about what your retirement lifestyle might look like and estimate your retirement budget. Consider factors such as travel plans, healthcare costs, and any major purchases or gifts you anticipate.

Consult with a Financial Planner or Tax Professional

Roth conversions can be complex, with many moving parts and potential pitfalls. Working with a qualified professional can help you navigate the process with confidence and avoid costly mistakes. Look for an advisor who is well-versed in retirement tax planning and has experience with Roth conversions specifically.

Develop a Customized Conversion Strategy

Based on your financial projections and goals, work with your advisor to create a personalized Roth conversion plan. This might involve a single conversion or a series of conversions over several years, depending on your situation.

Review and Adjust Your Plan Regularly

Your financial circumstances and goals may change over time, so it's important to revisit your Roth conversion strategy periodically. Do a check-in with your advisor at least annually to assess your progress and make any necessary adjustments.

Last Thing: Be Proactive

Remember, everyone's retirement situation is unique. What works for one person may not be the best approach for another. The key is to educate yourself, seek guidance from trusted professionals, and make informed decisions based on your specific needs and goals.

By taking a proactive approach to retirement tax planning and considering strategies like Roth conversions, you can create a more secure and enjoyable retirement. You'll have peace of mind knowing that you're making the most of your hard-earned savings and setting yourself up for a financially confident future.

Ready to take the next step and explore whether Roth conversions and other retirement portfolio strategies are right for you? Answer a few quick questions to see if we're a mutual fit below.