How can I build a retirement budget that’s realistic?

While working over the years, you’ve probably thought about retirement. Maybe you’ve even dreamed about it, assuring yourself that one day, every minute of every day will be yours to do exactly what you want with it.

You’ve probably asked yourself when you will be able to retire.

While trying to answer that question, another might have presented itself: how much money you need to retire.

You aren't alone. These questions are typical for everyone as they begin to think about life after work. In this article, we’ll explore how to create a map or a budget to help put you on the right path towards retirement.

The Retirement Budget Debate

The topic of how much money you need to retire is a hotly debated one.

Some sources recommend at least $500,000 saved before retiring. Others say your retirement portfolio at retirement must have enough to replace at least 80% of your working income over 30 years.

I call these “magic number” solutions. They claim to be a sort of one-size-fits-all remedy to all your retirement questions. However, there’s a serious problem with most of these solutions: They’re arbitrary. They aren’t tailored to your personal retirement plan.

Realizing You Don’t Have Enough Money

From a financial standpoint, the worst thing that can happen to you in retirement is realizing you don’t have enough money. To prevent this scenario, you’ll need to know exactly how much your retirement will cost. In short, you need to build a retirement budget.

Building Your Retirement Budget

A good budget spreadsheet will lay out each of your expenses on a monthly basis to account for the timing of expenses. To get a realistic estimate of these costs, you’re going to gather the following documents:

Last year’s tax returns

Bank account statements for the last year

Credit card statements for the last year

Non-discretionary spending list

Your non-discretionary spending items comprise the “Needs,” as I discuss in my Needs, Wants, and Wishes framework.

Make a Spreadsheet or Use an Accounting Journal

Using these documents as a reference, I recommend making a spreadsheet or using an accounting journal and compiling a list of all your fixed and non-fixed expenses. Break these expenses up into monthly and non-monthly expenses. Monthly expenses include items like groceries, transportation, and cable, while non-monthly expenses cover areas such as property taxes and holiday gifts.

As mentioned earlier, you also want to categorize them as Needs, Wants, or Wishes.

For example, let’s assume that you spend $800 monthly on groceries and $300 on utilities. These fall into your Needs expenses. Your Needs expenses should be kept separate from those that satisfy your Wants and Wishes. While Needs expenses are your basic non-negotiables, Wants expenses include those items that make life comfortable, such as hobbies and travels. Your Wishes include your legacy items like charitable donations and inheritances.

By breaking up your expenses into Needs, Wants and Wishes, you can better prioritize your budget.

Optional Purchases

The next step in creating your retirement budget is to determine how much you currently spend on optional purchases, as well as the cost of any trips or similar activities you plan to engage in retirement. You can think of these as being items on your Want list.

There are two ways to handle this section of your budget: The Top-Down Approach and the Bottom-Up Approach.

Top-Down Approach

If you’ve ever overseen a large organization, you may be familiar with this approach. With the top-down approach, you establish annual spending limits, rather than trying to predict your future expenditures. This approach is dependent on how much you already have saved as well as other costs.

For most retirees, this spending limit is 70% of the amount earned while working. Once this limit has been established, you can work backward to calculate the exact dollar amount you can spend on optional items.

Bottom-Up Approach

The Bottom-Up approach tracks the expenses by category. Here, you would determine each purchase you have planned and calculate the annual expenditure. From there, you can decide whether or not you have enough to meet your costs.

Remaining Adjustments to Your Retirement Budget

Now you have a spreadsheet detailing your average monthly expenses. We’ve got nearly everything we need to calculate the costs of your retirement. However, there are still a few remaining adjustments.

Next, you need to review your healthcare expenses. The average 65-year-old retiree will need $165,000 to cover healthcare and medical expenses throughout retirement, according to Fidelity’s 2024 Retiree Health Care Cost estimate. A married couple will spend twice that on average: $330,000.

The cost of medical care for the average senior is projected to rise 40% higher by 2035, according to research published in Health Services Research. Rising healthcare costs will likely affect you and should be accounted for in your retirement budget.

Estimating The Cost Of Retirement

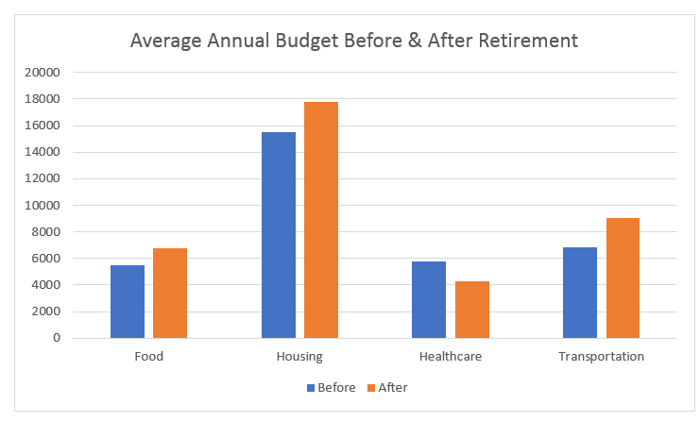

Now that you’ve created your monthly budget, you can use it to estimate the total cost of your retirement. You might be surprised at just how costly retirement is. Isn’t life as a senior supposed to be less expensive?

Contrary to popular belief, your annual cost of living doesn’t decrease by that much after retirement. In fact, some people spend just as much in retirement as they did while working.

The average retiree currently spends roughly $50,000 in living expenses annually, according to data compiled by the Bureau of Labor Statistics.

Takeaways

It can be tough to meet such standards without working. That’s why most financial advisors recommend creating a portfolio where your resources exceed your budget. A surplus will allow you to feel secure even when facing unexpected costs, allowing you to retire with optimism and relaxed confidence.

Remember, while the tips in this article can help create a retirement budget, there’s no substitute for the assistance of a dedicated financial planner. A financial planner can coach you through the process of estimating your retirement budget, which will provide insight into how much money you need to retire.

Ready to meet with a financial planner about your retirement budget? Answer a few quick questions to see if we're a mutual fit below.