Table of Contents

- Sharon and Alexander– A Love for Sailing and Their Son

- Why Set Retirement Goals? The Psychological Benefits

- Values Inform Retirement

- Understand Your Retirement Philosophy

- Make Your Goals SMART

- Estimate Your Spending Power

- The 4% Retirement Spending Rule: Some Caveats

- Categorize Your Retirement Goals: Needs, Wants, and Wishes

- Estimate Your Spending Power

- The 4% Retirement Spending Rule: Some Caveats

- Lean on Four Pillars to Support Your Retirement Goals

- Recognize the Implicit Goals Guiding You

- The Bottom Line: Values-Driven Retirement Goals Lead to Relaxed Confidence

Retirement opens up a whole new world of possibilities: finally, you can pursue those passions you've daydreamed about and discover new meaning after years of routine. But without defining clear retirement goals rooted in your deepest values, your golden years can quickly begin to feel aimless.

Anchoring your aspirations to your inner compass provides much-needed direction. And planning your days around your principles promises deep fulfillment.

Sharon and Alexander– A Love for Sailing and Their Son

I'll never forget this one couple I worked with some years back, Sharon and Alexander. They both shared this tremendous love of sailing - it was their biggest passion in life. Their core values centered on adventure, exploring the farthest corners of the globe, and exposing their teenage son to diverse cultures. Together we carved out an intentional goal of them sailing clear around the world as a family.

By first taking the time to clarify Sharon and Alexander's deepest values, I could help them construct a tailored financial plan to fully fund their dream voyage through strategic bond investments and other approaches. Today, Sharon, Alexander, and their son are out sailing across the vast Pacific Ocean, living out such a meaningful retirement goal completely aligned with what they value most in this life.

Examples like Sharon and Alexander make crystal clear why intentional goal-setting is so vital for an engaged, fulfilling retirement. Defining goals rooted authentically in your most cherished values has been proven to instill optimism and relaxed confidence for the unknown journey ahead. By following the steps outlined here, you, too, can find your true north.

Why Set Retirement Goals? The Psychological Benefits

Many reach retirement after years of determined saving into vehicles like 401(k)s and IRAs. But now comes the major shift from the accumulation mindset to purposeful "decumulation" in retirement.

Just as intentional savings grew your assets, intentional spending can now fund your lifestyle.

However, without clearly defined objectives, retirement's endless possibilities feel aimless and out of reach. Goals provide the psychological benefits of clarity, purpose, and direction, like a compass for a sailor.

Setting intentional goals prevents restlessly drifting through open days. Goals create focus and clarify priorities amid limitless options. Defining goals makes time feel precious again when each day has a purpose.

Milestones mark progress, creating inherent fulfillment. Goals provide motivation even in retirement's headwinds, affirming you are on course.

So, how does one determine the right goals for a fulfilled retirement?

The process begins by precisely identifying personal values, those principles underlying who you are. Clarifying your values provides direction when you come to a fork in the road.

Values Inform Retirement

Core values provide a compass to set meaningful goals aligned with your ideal retirement. Values reflect timeless principles guiding priorities and decisions. Precisely defining values separates surface desires from the true bedrock of your deepest-held principles.

While values overlap between people, each of us prioritizes them differently. Core values may include compassion, connection, creativity, or financial stability.

Values shape goals and daily choices. Finance-specific values like avoiding debt or saving diligently inform retirement aims. Sharon and Alexander valued cultural exploration with family. This led them to set a goal of sailing around the world before their son reached adulthood.

Identify Your Values

Here's a simple yet powerful values identification activity to try:

List the values most meaningful to you – things like family, spirituality, generosity, learning, etc. Dig deep to mine what really matters to you.

Review your list and highlight the five to seven core values holding the most significance for you.

Write one or two sentences explaining why each selected value is important and what it means to you.

Rank these clarified values in order of priority for you.

You now have an inventory of values serving as the “north” of your compass. From here, you can plot the course to your retirement with relaxed confidence.

Check out my free video series on how successful retirees align their finances with their values for more information about finding your “true north” in retirement. Free Retirement Planning Videos

An Ongoing Process Before and During Retirement

Regularly reflecting on your values keeps you vitalized as life inevitably evolves. Most importantly, defining goals focused on your authentic values creates a purposeful, engaged retirement.

Regularly observe your behaviors through the lens of your values. Ask yourself how you use your values to live a more fulfilled life. Depending on the values you chose, your questions could look something like this:

Does generosity lead me to volunteer often?

Do relationships anchor my most memorable family trips?

Does attaining financial stability drive me to save diligently?

Articulating and revisiting your values inventory is the first step in aligning your retirement goals and making major daily decisions. Your values become guideposts leading toward the retirement life you truly envision.

Understand Your Retirement Philosophy

Now that you have clarified your values, it’s time to formulate your retirement philosophy.

Your retirement philosophy represents your viewpoint on how to approach your later years. It encompasses perspectives on spending, work/leisure balance, investing, and adventure.

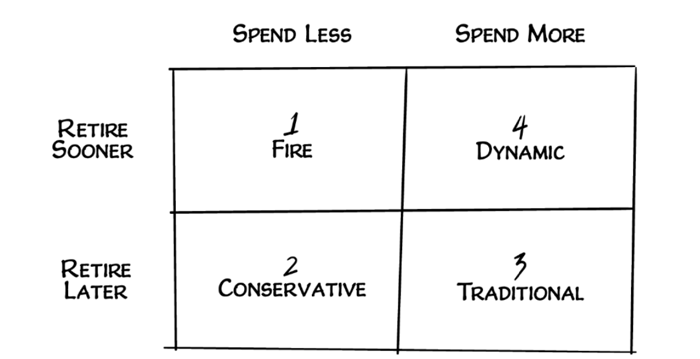

Consider which philosophy best aligns with your values and vision:

FIRE

"Financial Independence, Retire Early" focuses on maximizing investments to enable early retirement, often by your 40s. This path resonates with those valuing freedom and frugality over hard work and spending. However, extreme saving may involve sacrifices. Carefully evaluate if this rigorous approach suits your values.

Conservative

This philosophy emphasizes preserving assets and generating low-risk income streams, often necessitating working into your 70s. The trade-off is enhanced security later, though potentially at the cost of pursuing passions sooner. This approach resonates with those prioritizing stability.

Traditional

Working until your 60s and smoothly maintaining your pre-retirement lifestyle defines this path. It enables predictability by following conventional wisdom around retirement saving and investing. This philosophy fits those valuing continuity.

Dynamic

Regularly alternating work and leisure activities as interests evolve characterizes this philosophy. It provides flexibility to pursue new directions but requires financial buffers to pivot. This resonates with those who embrace change.

No Right Answer, Only Choices

Please note - there is no "right" answer.

Rarely does one philosophy perfectly capture an individual's perspective. Consider your values and shape a personalized hybrid philosophy guiding your vision. Then, set aligned goals and work backward to make this retirement blueprint a reality.

While these philosophies present distinct approaches, you need not adhere rigidly to just one. Elements from multiple philosophies may resonate with your values and vision.

For example, you may aim to retire early, aligning with FIRE, but intend to work part-time in retirement for fulfillment rather than solely maximizing leisure. This balances the FIRE and Traditional philosophies.

Or you may plan to retire at a traditional age but sustain a more dynamic and flexible approach to work and spending in retirement. This blends Traditional and Dynamic elements.

Make Your Goals SMART

Consultant George T. Doran proposed the S.M.A.R.T. framework in 1981 as a means of determining goals and objectives in business management.

The SMART methodology has proven over time so effective that we can use it for crucial personal activities like retirement planning, too. We can use SMART goals to clarify our values and align our philosophies with those values.

SMART is a powerful acronym for the five elements that strengthen retirement goal-setting:

Specific: Precisely define the goal details like what, why, who, when, and how. Vague goals breed confusion. Clearly articulating the specifics creates focus.

Measurable: Include quantifiable targets and metrics to tangibly measure progress. Defining numerical milestones enables tracking achievement.

Achievable: Ensure the goal is realistically feasible given your circumstances. Align goals with your skills, resources, and retirement timeline.

Relevant: Confirm the goal aligns with your values and retirement philosophy. Goals resonating with your core principles inspire follow-through.

Time-bound: Set a defined timeframe, including a start and end date. A timeline generates urgency and prompts action.

Constructing SMART retirement goals translates vague aspirations into defined roadmaps. Plans become actionable through clarity on specifics, metrics, alignment, and deadlines.

For example, saying, "I want to launch a consulting practice," lacks essential details.

In contrast, here is a SMART goal:

"I will launch a marketing consulting practice by Q1 next year. Acquire five clients and generate $3,000 monthly revenue within the first 12 months."

The above example defines an aim incorporating all five SMART elements. Such rigor provides clarity on how to achieve the goal. Progress tracking becomes possible through defined metrics. Milestones mark the path forward.

Applying the SMART framework lends focus so you can proactively pursue goals rather than drifting aimlessly. SMART goals power purposeful retirement.

Estimate Your Spending Power

Before detailing comprehensive goals, estimate your spending ability. The 4% Rule provides a great starting point. Here's how it works:

Total your retirement portfolio value

Multiply this sum by 4% to initially estimate sustainable yearly spending

For example, a $1 million portfolio suggests $40,000 first-year spending. Subsequently, increase yearly withdrawals by the rate of inflation while sustaining the portfolio.

This 4% guideline establishes your preliminary "Needs" spending capacity for core essentials like housing, utilities, and food. As you shape goals, sculpt "Wants" and "Wishes" accordingly.

Originally derived from research by William Bengen, the 4% Rule postulates that retirees will have sufficient money for the rest of their lives when they withdraw less than 4.2% from their retirement portfolio the first year of retirement and annually adjust the withdrawal rate during subsequent years by the rate of inflation, assuming a well-diversified portfolio.

The 4% Retirement Spending Rule: Some Caveats

The concept of the 4% Rule is only a starting point. It has some important caveats.

First, it assumes withdrawal amounts are after advisory fees and before taxes. That would mean the theoretical first year’s withdrawal rate of a $1,000,000 portfolio would be slightly less than $40,000, accounting for these items.

Second, market returns do not always adhere to historical averages. Flexibility helps respond to volatility. Market volatility could increase the sequence of returns risk, which could impact your ideal withdrawal rate in the earliest years of your retirement.

The 4% Rule applies only to your retirement savings reservoir. Other retirement income like pensions and Social Security expands your spending potential beyond 4%.

Those retiring early may need to use portfolio funds as an income bridge until claiming Social Security.

Categorize Your Retirement Goals: Needs, Wants, and Wishes

Using some variation of the 4% Rule as your back-of-the-envelope spending estimate, thoughtfully divide your prospective retirement spending into Needs, Wants, and Wishes.

Categorizing retirement goals into essential Needs, flexible Wants, and legacy Wishes is a core tenet of our planning process. This framework underpins our approach because each spending category aligns with a different funding source, enabling comprehensive financial plans.

Let's look at each category.

Needs

Non-discretionary spending for basic living expenses and healthcare. Needs are essential costs you must afford for life. They form the foundation enabling all other goals.

Needs are funded by guaranteed income sources like pensions to create a secure income floor.

Wants

Discretionary spending that adds comfort and joy, like vacations, hobbies, and entertainment. Wants are flexible - they can adapt to market volatility if needed.

Wants are funded through balanced investment portfolios aimed at growth.

Wishes

Wishes include funds you allocate for your heirs and other causes you believe in. In other words, the world beyond you. Wishes enable meaningful goals like charitable giving.

Wishes are made possible by protecting and preserving wealth through legacy planning.

Estimate Your Spending Power

Before detailing comprehensive retirement goals, estimate your spending ability. The 4% Rule provides a great starting point. Here's how it works:

Total your retirement portfolio value

Multiply this sum by 4% to initially estimate sustainable yearly spending

For example, a $1 million portfolio suggests $40,000 first-year spending. Subsequently, increase yearly withdrawals by the rate of inflation while sustaining the portfolio.

This 4% guideline establishes your preliminary "Needs" spending capacity for core essentials like housing, utilities, and food. As you shape goals, sculpt "Wants" and "Wishes" accordingly.

Originally derived from research by William Bengen, the 4% Rule postulates that retirees will have sufficient money for the rest of their lives when they withdraw less than 4.2% from their retirement portfolio the first year of retirement and annually adjust the withdrawal rate during subsequent years by the rate of inflation, assuming a well-diversified portfolio.

The 4% Retirement Spending Rule: Some Caveats

But the concept of the 4% Rule is only a starting point. It has some important caveats.

First, it assumes withdrawal amounts are after advisory fees and before taxes. That would mean the theoretical first year’s withdrawal rate of a $1,000,000 portfolio would be slightly less than $40,000, accounting for these items.

Second, market returns do not always adhere to historical averages. Flexibility helps respond to volatility. Market volatility could increase the sequence of returns risk, which could impact your ideal withdrawal rate in the earliest years of your retirement.

The 4% Rule applies only to your retirement savings reservoir. Other retirement income like pensions and Social Security expands your spending potential beyond 4%.

Those retiring early may need to use portfolio funds as an income bridge until claiming Social Security.

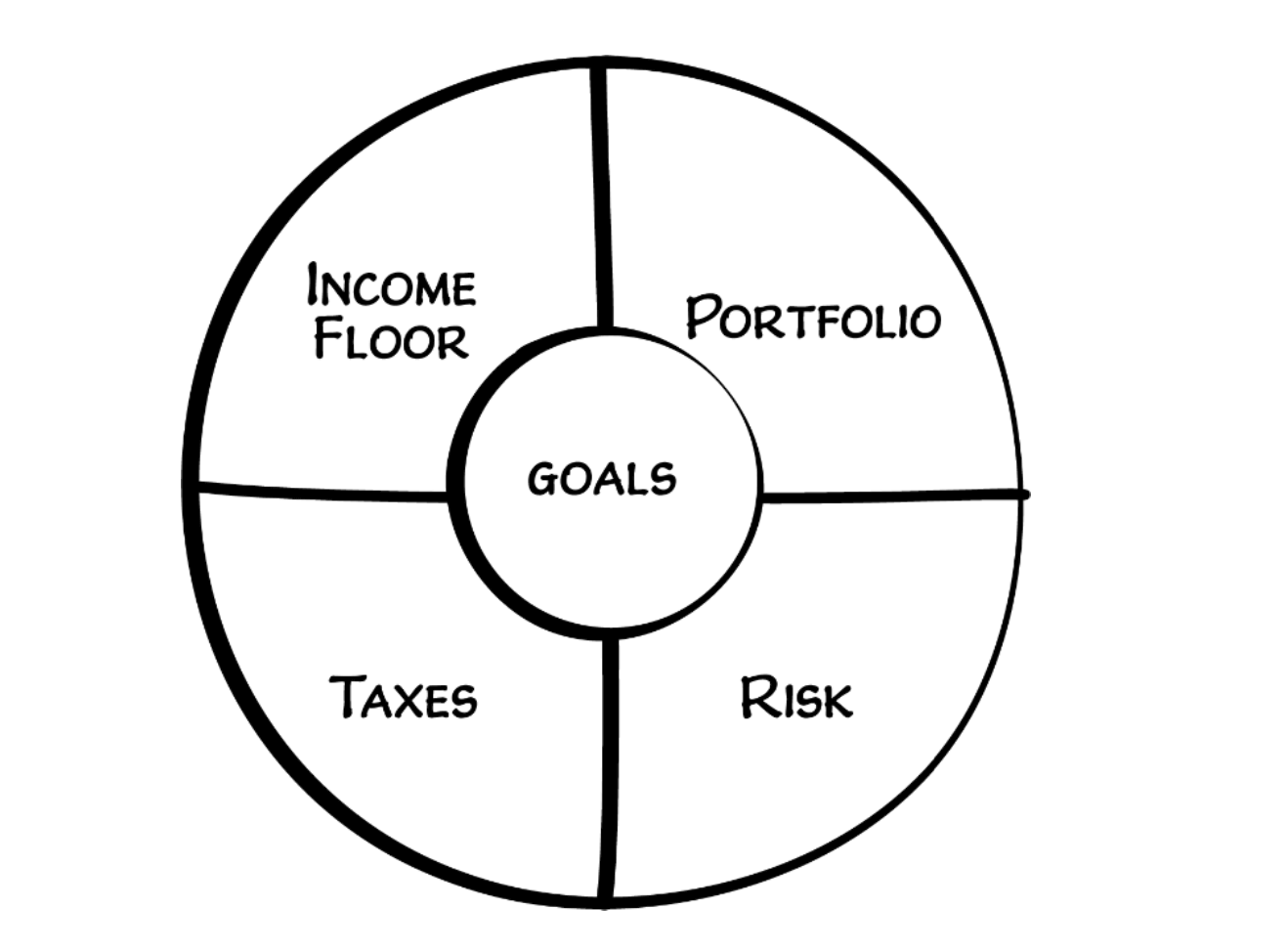

Lean on Four Pillars to Support Your Retirement Goals

Bringing your retirement goals to life requires planning across four key pillars working in harmony.

Guaranteed Income

Make sources like pensions, Social Security, and annuities the core of what you use to cover essential spending needs. This enables confidently pursuing additional goals.

Guaranteed income covering needs may allow more aggressive investing to fund wishes.

Strategic Investing

Invest surplus assets beyond guaranteed income into a tax-efficient, diversified portfolio designed to fund your wants and wishes.

Tax Minimization

Be proactive in minimizing taxes that could inhibit aims through asset location, structured withdrawals, and strategic gifting. You may be able to use Roth Conversions effectively in a tax-minimization strategy.

Consult an expert for guidance.

Risk Mitigation

Identify key risks that could derail plans. Get insurance for potential losses you wouldn’t be able to personally bear. Insurance can limit out-of-pocket costs after catastrophic losses.

Insuring costly wishes may warrant higher premiums than flexible wants. Coordinate efforts based on your categorized goals.

Recognize the Implicit Goals Guiding You

In addition to your explicit aims, reflect on unspoken goals shaping your path. These could look like:

Preserving assets to pass on

Maintaining lifestyle continuity

Retaining reserves to navigate pivots

Enjoying hard-earned leisure time

You may not have explicitly stated "leave an inheritance for heirs" as a goal. However, protecting wealth to pass on implicitly guides your financial decisions. Recognizing implicit goals like this and incorporating them intentionally into your planning process can make it more efficient.

In another example of how implicit retirement goals may guide you, wanting the financial flexibility to handle surprise costs and catastrophes might be underfunded in your retirement unless you specifically plan for it.

Articulating the unspoken creates balance and makes your plan that much more powerful.

The Bottom Line: Values-Driven Retirement Goals Lead to Relaxed Confidence

When goals steer each day toward purpose, retirement becomes your true north. Defining aims rooted in your values liberates potential. Pursuing passions breeds contentment.

Yet, few reach this destination alone. If you find yourself adrift, ask:

Are my retirement goals aligned with my values?

Have I planned holistically to achieve them?

What trade-offs make retirement goals attainable?

These questions can help you focus on the retirement that works best for you.

Check out my book 'Be the Bird' for a deeper exploration of planning concepts that offer valuable insights into building your best retirement.