Table of Contents

- Essential Tools for Retirement Success

- Understanding True Confidence in Retirement

-

- The Science of Optimism

- The Confidence-Optimism Connection in Retirement Planning

- Common Confidence Killers in Retirement Planning

- Building Your Confidence in Retirement Toolkit

- Challenge Your Money ‘Stories’

-

- Cultivating Optimism in Retirement

- The Path Forward

Think about watching a bird sitting on a branch. Notice how it's completely at ease, not frantically clinging or worrying about whether the branch will hold. That bird has what I call "relaxed confidence,” not because it trusts the branch but because it trusts its own wings. In the same way a bird learns to believe in its own abilities, you can build confidence in retirement.

This same kind of relaxed confidence is crucial for retirement planning, yet it's something many of my clients initially struggle with. Even highly successful professionals like Terri, a CalTech-educated senior executive, can find their confidence shaken when facing the complexities of retirement planning.

Why?

Because confidence in retirement isn't about knowing everything or having absolute certainty. It's about building trust: trust in your plan, trust in your preparation, and trust in your ability to adapt when things change.

Essential Tools for Retirement Success

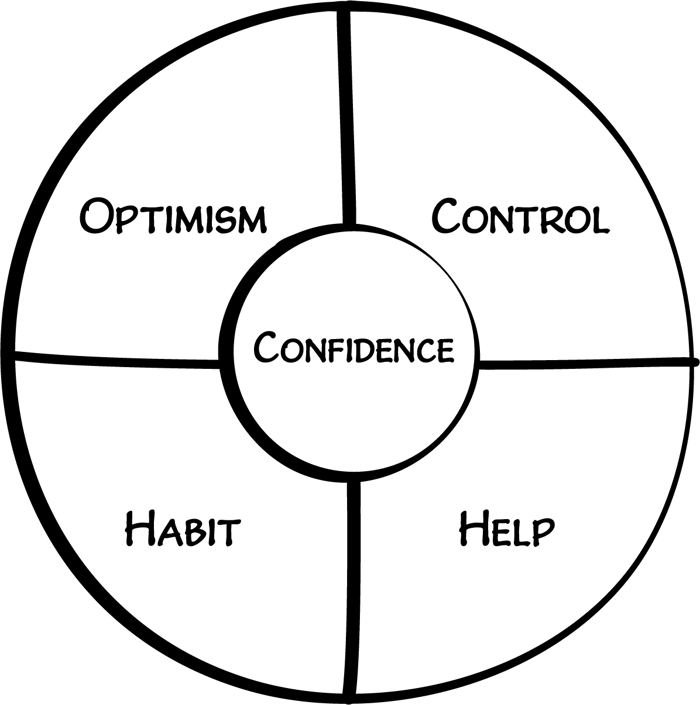

Today, I want to explore how confidence and optimism work together as essential tools for retirement success. These aren't just feel-good concepts or personality traits you're either born with or without. They're skills that can be developed, strengthened, and rebuilt when shaken.

Understanding True Confidence in Retirement

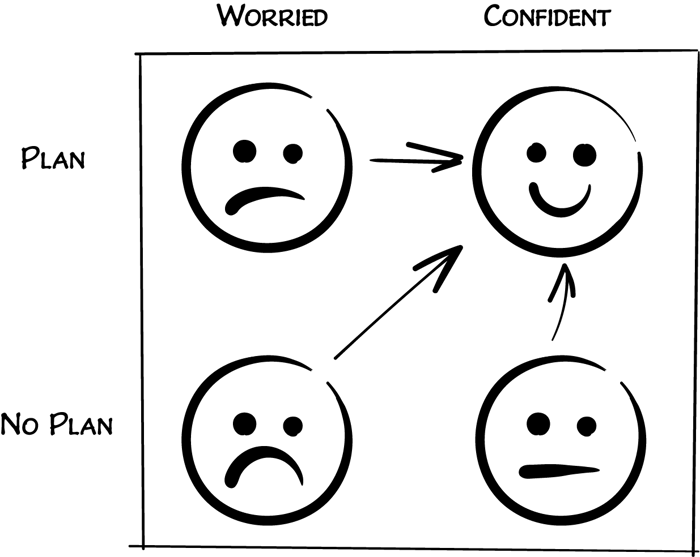

Let's be clear about something: true confidence in retirement planning isn't about knowing everything or never feeling uncertain. It's about developing what I call "relaxed confidence" or the ability to move forward thoughtfully even when you can't predict every outcome.

Think back to our bird metaphor. The bird isn't confident because it has analyzed every possible way the branch might break. It's confident because it knows that even if the unexpected happens, it has the ability to adapt and fly.

This type of confidence comes from three key sources:

Trust in your preparation and planning

Understanding what you can and cannot control

Having a solid foundation beneath you (like an income floor for your essential expenses)

The difference between true confidence and false confidence is crucial here. False confidence often comes from ignoring risks or believing you can control everything. True confidence acknowledges uncertainty while trusting in your preparation and ability to adapt.

The Science of Optimism

Optimism isn't just positive thinking. It's a powerful psychological tool backed by decades of research. Studies show that optimistic people tend to live longer by about half a decade, according to an article by the National Institute of Aging.

But here's the key insight: Optimism is learnable. Psychologist Martin Seligman's research shows that we can develop what he calls "learned optimism" - the ability to see setbacks as temporary and specific rather than permanent and pervasive.

This doesn't mean wearing rose-colored glasses. Instead, it means developing what I call realistic optimism: acknowledging challenges while maintaining faith in your ability to overcome them. For retirement planning, this means:

Accepting market volatility while trusting in long-term growth

Acknowledging uncertainties while preparing for multiple scenarios

Focusing on what you can control rather than what you can't

The Confidence-Optimism Connection in Retirement Planning

When confidence and optimism work together, they create something powerful: resilience. Think about how this plays out in retirement planning. A confident, optimistic retiree doesn't panic during market downturns because they understand the market's cycle. More importantly, they've built their retirement plan to weather these storms.

Remember our "Needs, Wants, and Wishes" framework? When you've built a solid income floor to cover your essential needs, you can remain confident even when markets get choppy. This isn't blind optimism. It’s well-founded confidence based on careful planning.

Optimism in Practice

Let's look at how this works in practice. One of my clients, Wayne, approached retirement with natural optimism but needed help building justified confidence. After selling his business for less than expected during the COVID-19 pandemic, he could have let anxiety take over. Instead, we worked together to develop a plan that matched his entrepreneurial spirit, including real estate investments that gave him both financial returns and the hands-on involvement he craved.

Common Confidence Killers in Retirement Planning

Even the most carefully laid plans can be shaken by what I call "confidence killers." You should watch out for these confidence killers, because they can drive you to make suboptimal decisions in retirement planning.

Information Overload

People today have access to more information than ever before. While generally a good thing, too much information can cause problems, such as analysis paralysis. Information can also be wrong or right but used in the wrong context.

Here are some examples of “too much information” that can undermine your confidence in retirement:

Conflicting advice from so"experts"

Too many investment options

Contradictory economic predictions

Market Volatility

Fear of another 2008-style crash

Worry about timing retirement wrong

Sequence of returns risk

Measuring your retirement against others

Social media pressure about what retirement "should" look like

FOMO about investment opportunities

Future uncertainties

Health concerns

The confusing financial advice industry

Longevity risk (outliving your money)

Family responsibilities

So many things to worry about, right? Not if you build a bulletproof plan for confidence in retirement.

You’ll have reason to be optimistic.

Building Your Confidence in Retirement Toolkit

Like any valuable skill, confidence can be developed through specific practices and tools. Here's a practical toolkit drawn from my years helping clients achieve relaxed confidence in retirement.

The Lazy River Exercise

When financial anxiety strikes, try this powerful mindfulness technique: Imagine you're floating on a lazy river, watching your thoughts and worries drift by like leaves on the water. You don't need to grab them or fight them– just observe them passing. This creates separation between you and your financial concerns, allowing you to respond thoughtfully rather than react emotionally.

Challenge Your Money ‘Stories’

Many of us carry limiting beliefs about money and retirement. Maybe you've internalized messages like "the market is too risky" or "I'll never have enough." Challenge these thoughts by:

Examining the evidence for and against them

Looking for examples that contradict them

Replacing them with more balanced perspectives

Scenario Planning

Nothing builds confidence like preparation. Work through different scenarios:

What if the market drops 30% the year you retire?

What if you need long-term care?

What if you live to 95?

Having contingency plans for these scenarios creates genuine confidence - not because you can predict the future, but because you're prepared for multiple possibilities.

Want to learn more about retirement income risks so you can plan for them? Check out our free guide on retirement income risks.

Cultivating Optimism in Retirement

Optimism, like confidence, is a skill you can strengthen. You can cultivate it specifically for retirement by implementing key strategies.

Practice Financial Gratitude

Start by acknowledging what's working in your financial life:

Recognition of past smart decisions

Appreciation for current financial stability

Awareness of opportunities ahead

Reframe Challenges

Instead of seeing retirement planning as overwhelming, view it as an opportunity to:

Design your ideal next chapter

Create a lasting legacy

Master new financial strategies

Build Your Support System

Surround yourself with positive influences:

Connect with successfully retired peers

Engage with knowledgeable advisors

Seek out educational resources

Maintain Flexibility

Remember, a good retirement plan isn't set in stone. Build in regular review points to:

Adjust for changing goals

Over the span of your life, your goals change. That doesn’t stop at retirement. Finding your true retirement goals helps you maintain course and remain optimistic and confident in retirement.

Incorporate new opportunities

Respond to life changes

The Path Forward

True retirement confidence comes from knowing you have both wings and roots– the ability to adapt when needed (wings) and a solid foundation supporting you (roots). Your wings are your optimism and adaptability; your roots are your careful planning and preparation.

Remember, you don't have to do this alone. Whether you're a:

Soloist managing your own finances

Validator seeking professional confirmation

Delegator wanting comprehensive guidance

The key is building genuine confidence based on preparation rather than prediction.

Start today by taking one small step toward stronger retirement confidence. Whether that's reviewing your income floor, practicing the Lazy River exercise, or challenging an old money story, remember this: confidence, like the bird's trust in its wings, comes from preparation and practice, not perfection.

If you are ready to take the next step towards optimism and confidence in retirement, just answer a few quick questions to see if we're a mutual fit below.