And What You Can Do About It

When it comes to retirement planning, we’re taught to plan for the long term. Over many years, the markets should perform well and on average deliver a stable rate of return. However, there are risks that can quickly derail your chances of having enough saved for retirement.

Although past results are no guarantee of future returns, conventional wisdom teaches us that if we save for the long haul, we’ll be ok in retirement.

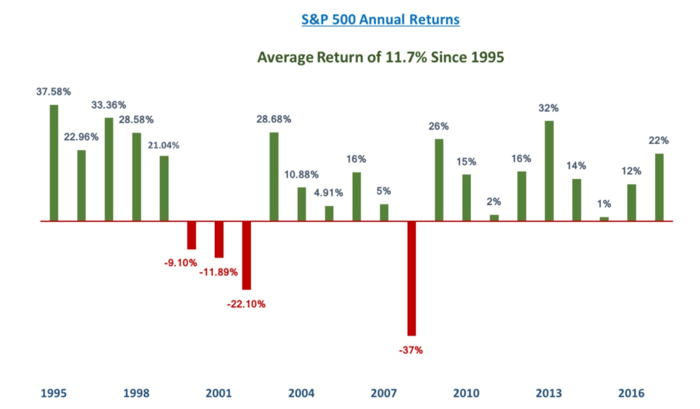

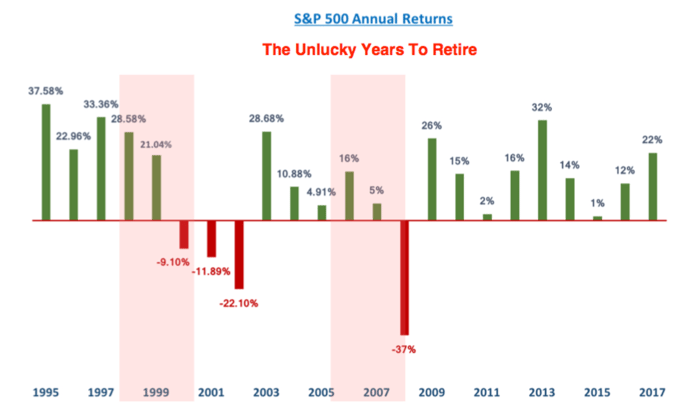

And in looking at the historical performance of the stock market since 1995, there certainly is a case for that equity markets have performed well over the long-term.

On average, the S&P 500 has returned 11.7% each year since 1995 and hasn’t endured a prolonged correction for more than three years.

It certainly appears on the surface that equities will deliver a stable return in the long term and the risks of running out of money in retirement are relatively small.

SEQUENCE OF RETURNS RISK

Despite the positive historical performance of equity markets, if you’re invested in the market, your portfolio is exposed to two types of risk.

The first risk is the risk of losses due to financial market downturns or market risk. The risk of market downturns can increase or decrease over time depending on prevailing market conditions. However, market risk is prevalent for as long as you’re invested in the market.

The second risk is called sequence of returns risk, and it comes into play as you enter retirement and the years shortly after. Sequence risk as it’s often called is the risk your portfolio suffers a loss in the early years of retirement while you’re simultaneously withdrawing money for income. Sequence risk is important because suffering an investment loss earlier on in retirement increases the risk of depleting your savings than if you had suffered the loss years later.

In other words, the sequence or order in which your percentage gains or losses occur in the first several years of retirement can make or break your chances of having enough savings to last your golden years.

While market risk is the risk of losses in any year you’re invested, sequence risk is the risk of investment losses in the early years of retirement.

As part of our continuing series on Generating Income In Retirement, we’ll delve into how sequence of returns risk can negatively or positively impact your portfolio. We’ll also provide tips on avoiding sequence risk and preserving your savings throughout retirement.

The Unlucky Years To Retire

When you retire has a lot to do with luck since you can’t change the year you were born nor can you change the year you turned 65 years old.

For those who happened to be one of the unlucky ones who retired just before that last two bear markets saw unprecedented losses in their portfolios within a couple of years.

Highlighted in red shows 1998 and 2007 as the two years where you would have had the most sequence risk if you were one of the unlucky ones.

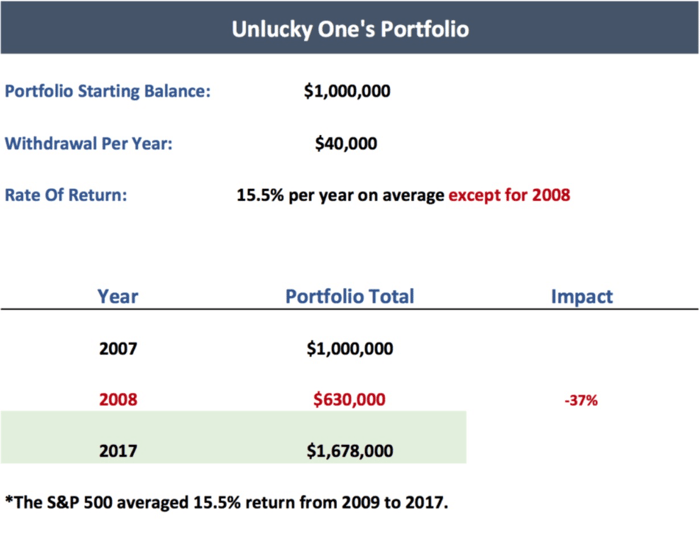

For example, if you were unlucky enough to retire in 2007 with $1,000,000 saved, you would have lost $370,000 a year later.

The 2008 financial crisis caused the markets to plummet by 37% by the end of ‘08.

However, if you had invested the remaining money or $630,000 from 2009 to 2017, your portfolio would have recovered somewhat and finished with $1,678,000.

It turned out that the markets recovered nicely after 2008. The S&P 500 averaged over 15% per year from 2009 to 2017 providing the unlucky ones with some much-needed relief.

Whether you’re one of the lucky or unlucky ones, sequence risk can impact your retirement strategy. Next, we’ll look at a couple of examples of how sequence of returns risk can play out under less extreme market corrections.

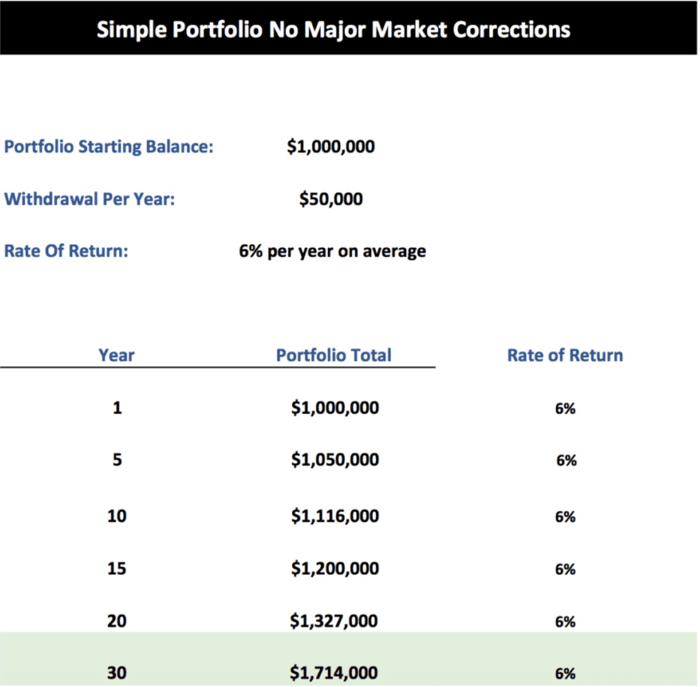

Retirement Portfolio With No Market Corrections:

The table below shows a portfolio with $1,000,000 invested at the start of retirement.

Every year $40,000 is withdrawn for income. The portfolio averaged 6% per year with no major market downturns and after 30 years, ended with roughly $2.5mm.

Of course, no market corrections over 30 years is unrealistic, but it illustrates how much money would be earned if the market performed well for 30 years.

Retirement Portfolios With Market Corrections:

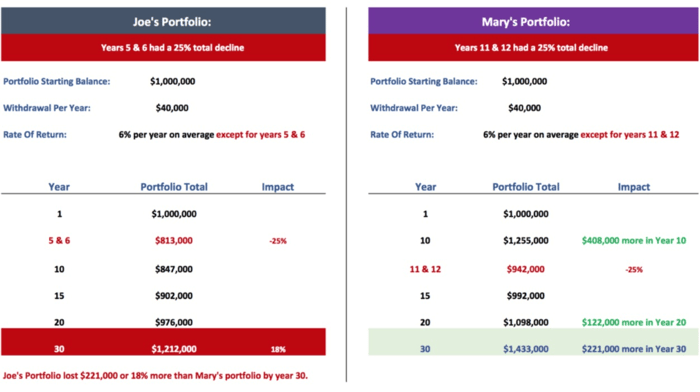

Both Joe and Mary retired in the same year with $1,000,000 saved. Both withdrew $40,000 per year for income, and both suffered a 25% market correction for a two-year period. In all the other years, both portfolios earned an average rate of return of 6% per year.

The only difference between Joe and Mary’s portfolios are the years in which they suffered their market corrections.

Joe’s portfolio suffered market corrections early in his retirement or the 5th and 6th years.

Mary’s portfolio didn’t suffer a correction until years 11 and 12 of her retirement.

The negative impact of sequence risk on Joe’s savings can be seen in year 10 where Joe has $408,000 less in savings than Mary.

Mary’s balance suffers a 25% total market decline in years 11 and 12, but since Mary’s balance was higher before the correction, she fared better than Joe.

In year 15, Mary has $992,000 which is still much higher than Joe’s $902,000 despite both of them suffering a two-year market correction of 25%.

Joe eventually closes the gap somewhat but never completely. By year 30, he has approximately 18% less money than Mary.

FACTORING SEQUENCE RISK INTO YOUR RETIREMENT PLANNING

Both Joe and Mary’s retirement savings endured market corrections, unlike the simple portfolio that averaged 6% per year and ended with roughly $2.5mm by the 30th year.

The contrast between the three portfolios demonstrates why it’s so important to not to use simple calculations in planning your income in retirement.

In which years a correction occurs following the start of your retirement either enhances or diminishes your chances of your savings lasting. Realistically, Joe and Mary’s portfolios would likely suffer more than two years of corrections over 30 years. Another 20% correction later in retirement would only compound Joe’s sequence risk and possibly deplete his savings prematurely.

Joe and Mary’s portfolios also show that market performance in the first 7 to 10 years is critical to determining whether you have enough funds to last your retirement.

WHAT YOU CAN DO ABOUT SEQUENCE RISK

Bond Ladders

Bonds provide a safe, stable income stream that can help avoid sequence risk particularly if invested in U.S. Treasuries since they carry zero-default risk.

A bond ladder is a portfolio of bonds that you purchase up front and mature each year to match an income steam to your financial needs. Upon maturity in each year, the total value of the bond is cashed out, and the income is used to cover your retirement expenses.

With a bond ladder, you can create stable income for the first seven to ten years of your retirement preventing sequence risk from any equity market losses during that time. The remainder of your portfolio could be invested in stocks benefiting from market gains over the long term.

Establish A Safe Withdrawal Rate For Your Retirement Income

The safe withdrawal rate strategy and its variations are designed to prevent you from withdrawing too much income, particularly against the backdrop of a declining stock market.

The withdrawal rate is the result of a 1994 study that found that retirees can “safely” withdraw a maximum of 4% of their starting balance each year for 30 years and not run out of money, provided the portfolio is invested in a mix of stocks and bonds.

The 4% rule as it’s now dubbed, reduces sequence of returns risk by keeping your annual income withdrawals conservative in the early years of your retirement. Although the rule states you should only withdraw a maximum of 4% of your starting balance, adjusted higher for inflation, there are flexible alternatives to the rule.

Adding a portfolio balance contingency to withdrawal rates is one variation of the 4% rule. With this strategy, you can increase your withdrawal rate only if your retirement portfolio has grown by 50% from the starting balance. This strategy allows your savings to grow for a few years before you can withdraw any additional income. The balance contingency helps preserve your savings and avoid sequence of returns risk since you’ll be withdrawing less money in the early years when your portfolio is most vulnerable to market corrections.

A base pay with a market-performing bonus is another variation of the safe withdrawal rate. With this strategy, you start with a low withdrawal rate of 3% as your base pay. However, you have the option of increasing your withdrawal rate in the years the market performs well. This strategy allows you to cover basic expenses and avoid sequence risk since you’ll reduce your withdrawals early on. As a result, your portfolio will be able to better withstand a market correction in the early years since less money will have been withdrawn.

It’s important to remember that sequence risk includes both a loss in portfolio value in the early years of retirement while you’re simultaneously withdrawing money for income. The withdrawals compound the sequence risk since you’ll have less savings to invest when the market recovers. Safe withdrawal rate strategies help address the withdrawal portion of sequence of returns risk.

Don’t Increase Your Income To Adjust For Inflation

Most withdrawal strategies have an inflation-adjusted mechanism whereby you increase your income each year by the inflation rate. In other words, you give yourself a cost of living adjustment. If inflation rises by 2% each year, you would typically increase your income by 2% each year. Sounds harmless but it adds up over time. If you find yourself in a bear market and your portfolio is taking a hit, don’t increase your withdrawal amounts to compensate for inflation. You need to be flexible with your income and spending by making adjustments from time to time.

Be Prepared To Go Back To Work

Avoiding sequence risk is all about being prepared, and if financial markets decline for the first few years of your retirement, you have to be prepared to go back to work.

Getting a full-time or part-time job can alleviate sequence risk since your income will reduce your withdrawal amounts. If the market declines, you won’t be compounding the situation with income withdrawals reducing your portfolio size.

Let’s say you’re semi-retired at 62 years old.

You’re working part-time and earning $20,000 per year.

You’re also withdrawing 3% of your $1,000,000 portfolio or $30,000 for a total income of $45,000 per year. A 3% withdrawal rate is fairly conservative. Remember, the 4% rule is the maximum withdrawal rate to allow your savings to build and last throughout retirement. So a 3% rate should help your savings endure.

By combing part-time income and a conservative withdrawal rate, you give your portfolio a chance to grow and build up enough capital to withstand market volatility and withdrawals later in your retirement.

Deferring Social Security until later years can give you an added income stream in case your portfolio suffers a correction in the first seven to ten years.

- If you’re 62 years old, you’ll get the lowest benefit of $20,200.

- If you’re 65, you’ll get $24,600, and if you wait until you’re 67 years old, you’ll receive $28,500 per year.

- And by waiting until your 70 to collect, you’ll receive $34,900 or $15,000 more than if you had started collecting at 65 years old.

By deferring Social Security, you have more flexibility with your income later on. For example, you can quit the part-time job at 65 or 67 years old and use the deferred Social Security benefits to supplement the lost part-time income.

Whether you decide to go back to work full time or part time, you’ll help your portfolio withstand any market corrections if you’re unlucky enough to retire going into a declining market.

And if you decide to defer Social Security until you’re 65 years old or later, you give yourself a stable income stream later on in retirement when you’re no longer able to work, and you need that income more than ever.

Income Annuities

Annuities can provide a stable income stream and reduce sequence risk. The income from the annuity allows your portfolio to grow since you’ll be withdrawing less money from your savings.

One drawback to the flexible withdrawal rate strategies is that you have to decrease your income if the market performs poorly. By adding an income annuity on a portion of your balance along with your equity investments, you don’t have to lower your standard of living if the market does poorly in the first seven to ten years of your retirement. With an income annuity included in your portfolio, you can rest easier knowing that you’ll have a fixed monthly income stream despite stock market volatility.

TAKEAWAYS & TIPS

Before making adjustments to your withdrawal rate or your retirement plan, it’s important to consult a financial planner to develop a strategy. Here are a few takeaways as you enter or continue your retirement.

Not every market decline is a catastrophe. Global events and the resulting market volatility don’t always have lasting impact on the U.S. or your portfolio.

In 2015 for example, the S&P 500 rose by only 1% due to concerns the poor growth in China might derail the global economy. China bounced back and so did the S&P 500 with a 12% gain in 2016. The market gains in 2016 came despite volatility and uncertainty surrounding Britain leaving the European Union or more commonly known as Brexit. Although the global markets braced for impact from a Brexit fallout, the effects were negligible on U.S. markets.

All this to say, not all global events impact U.S. companies and ultimately your portfolio. Sure there’ll be market volatility and market declines. But U.S. companies didn’t stop paying dividends because of Brexit or because of concerns over China’s economic growth. As these events unfold, it’s important to put them in perspective and ask yourself, will they have a lasting and long-term impact on my portfolio?

Watch for a 20-25% decline in your portfolio in the first seven years. As mentioned earlier, events can unfold dragging the market down by 5-10% for a year or two. Usually, your portfolio can weather these types of declines, even if you’re in the early years of retirement. What you need to watch out for are the 20-25% declines in your portfolio over the first seven to ten years. If this occurs, please consult your financial planner because adjustments will likely be needed to ensure your savings last throughout your retirement.

To beat sequence of returns risk, be flexible in the first seven to ten years of your retirement. By investing and withdrawing conservatively early on, your portfolio’s vulnerability to market corrections reduces dramatically. The goal is to give your investments a chance to grow and become stable enough to weather any market declines in the later years of your retirement.