Table of Contents

Picture this: You've just retired after a long and successful career. You've saved diligently, invested wisely, and have a solid financial plan in place. But then, the unexpected happens. The stock market takes a tumble, and suddenly, your carefully crafted retirement plan feels a lot less secure. Or maybe you're hit with a major unexpected expense, like a health emergency or a costly home repair. In moments like these, it's not just your financial preparedness that matters - it's your resilience.

I learned the importance of resilience the hard way. For the first 38 years of my life, I was riding high. I'd achieved a lot of success and felt confident in my abilities. But when I faced some major challenges, I realized I didn't have the tools to cope. My confidence crumbled, and I struggled to bounce back.

That experience taught me a valuable lesson: Resilience isn't just a nice-to-have quality. It's a critical skill that can make all the difference in navigating life's inevitable ups and downs. And nowhere is this truer than in retirement planning.

You see, resilience is the psychological ability to adapt and recover from difficult experiences. It's what allows us to weather storms, overcome obstacles, and emerge stronger on the other side. And while some people may be naturally more resilient than others, the good news is that resilience is a skill that can be developed and strengthened over time.

In this post, we'll explore resilience through the lens of retirement planning. Specifically, we'll look at how cultivating resilience can help you navigate the risks and challenges of this major life transition. We'll start by introducing the concept of a Chief Resilience Officer and how you can apply this role to your own financial planning. Then, we'll dive into the four key choices you have when dealing with risk and the nine major risk factors every retiree should have on their radar.

From there, we'll explore some practical strategies for building financial resilience, including creating an income floor, diversifying your portfolio, and engaging in proactive tax planning. We'll also touch on the crucial role that mindset plays in cultivating resilience and share some tips for developing a more adaptable, growth-oriented perspective.

By the end of this post, I hope you'll have a clear understanding of why resilience is so important in retirement planning and, more importantly, a practical roadmap for building the resilience you need to navigate whatever challenges come your way. So, let's dive in and start exploring how to become the Chief Resilience Officer of your own financial future.

Becoming Your Own Chief Resilience Officer

In the corporate world, many organizations have a dedicated role called a Chief Risk Officer (CRO). The CRO is responsible for identifying, assessing, and managing potential threats to the company's operations, finances, and reputation.

They take a proactive, holistic approach to risk management, looking not just at individual hazards but at how different risks intersect and compound one another.

The CRO's first step is to build a comprehensive risk register – essentially, a master list of all the potential pitfalls the organization could face. This might include everything from natural disasters and cyber attacks to market shifts and regulatory changes. By systematically cataloging these risks, the CRO can then start to analyze and prioritize them based on their likelihood and potential impact.

But the CRO's role doesn't stop there. Once they have a clear picture of the risk landscape, their job is to develop and implement strategies to mitigate those risks. This might involve everything from updating company policies and procedures to investing in new security measures or insurance policies. The goal is to build resilience into the organization's DNA so that it can weather any storm.

So, what does this have to do with your retirement planning? Well, I'd argue that in the context of your financial future, you need to think of yourself as the Chief Resilience Officer of your own life. Just like a CRO maps out potential hazards to an organization, it's up to you to identify and assess the risks that could derail your retirement plans. And, like a CRO, your job is to then put strategies in place to mitigate those risks and build overall resilience.

Adopting this proactive, holistic mindset can be a game-changer when it comes to retirement planning. Rather than simply reacting to challenges as they arise, you're taking a strategic, big-picture approach to risk management. By identifying potential pitfalls early and putting safeguards in place, you can head off problems before they snowball into full-blown crises.

Of course, becoming your own Chief Resilience Officer doesn't mean you have to go it alone. Just like a corporate CRO works with teams across the organization, you can (and should) enlist the help of trusted advisors, like a financial planner, accountant, or attorney. These professionals can provide valuable insights and guidance as you map out your risk landscape and develop your resilience strategies.

Ultimately, taking on the Chief Resilience Officer role in your retirement planning is about empowering yourself to face the future confidently. By proactively identifying and managing risks, you're not just protecting your financial security – you're cultivating the peace of mind that comes from knowing you're prepared for whatever life throws your way.

In the next section, we'll take a closer look at the four key choices you have when dealing with risk, and how each can be applied in the context of retirement planning. By understanding these different approaches, you can start to build a personalized risk management strategy that aligns with your unique goals and circumstances.

The Four Choices for Dealing with Risk

As the Chief Resilience Officer of your retirement plan, one of your key responsibilities is deciding how to handle each potential risk you've identified. While every situation is unique, there are generally four broad strategies you can employ: avoid, assume, mitigate, or transfer. Let's take a closer look at each of these approaches and how they might apply in a retirement context.

Avoid: The first option is to simply eliminate or significantly reduce the chances of the risk occurring in the first place. In a retirement planning context, this might mean choosing not to invest in a particularly volatile stock or deciding to pay off your mortgage before retiring to avoid the risk of losing your home in a financial downturn. Avoidance can be a powerful tool, but it's not always feasible or desirable, as it may mean foregoing potential opportunities or benefits.

Assume: The second approach is to accept the risk and make financial or other preparations to absorb the potential cost. For example, you might assume the risk of market fluctuations by investing a portion of your portfolio in stocks, knowing you have the financial cushion to ride out any short-term losses. Assuming risk can be a smart strategy when the potential rewards outweigh the potential costs, but it's important to carefully assess your tolerance for loss before taking this approach.

Mitigate: The third option is to take actions that reduce the potential impact of the risk, even if you can't eliminate it entirely. In retirement, this might mean diversifying your investment portfolio across different asset classes to mitigate the risk of any one investment underperforming. Or, it could mean opting for a phased retirement where you gradually reduce your work hours over time to mitigate the risk of a sudden drop in income. Mitigation is often a good middle-ground approach when avoidance is not possible or desirable, but you still want to reduce your exposure to potential losses.

Transfer: The final strategy is to pay someone else, like an insurance company, to assume the potential cost of the risk. Common examples in retirement planning include purchasing long-term care insurance to cover the risk of needing extended medical care or buying an annuity to transfer the risk of outliving your savings to an insurance provider. Transferring risk can provide valuable peace of mind, but it's important to carefully weigh the costs and benefits, as insurance policies and other risk transfer mechanisms can be expensive.

The key thing to remember is that there's no one-size-fits-all approach to managing risk. The right strategy will depend on your unique circumstances, including your financial resources, risk tolerance, and personal preferences. In some cases, you may choose to avoid risk entirely, while in others, a combination of assuming, mitigating, and transferring risk may be the best approach.

As you build your retirement risk management plan, carefully consider each potential risk and evaluate which of these four strategies (or combination thereof) makes the most sense for your situation. By being proactive and thoughtful in your approach, you can create a more resilient retirement plan that's better equipped to handle whatever challenges come your way.

Nine Key Risks to Factor Into Your Retirement Plan

Now that we've covered the four broad strategies for managing risk let's take a closer look at some of the specific risks you'll want to have on your radar as you build your retirement resilience plan. While every retiree's situation is unique, here are nine common risks that can have a major impact on your financial security in retirement:

Stock market collapse: A sudden and significant downturn in the stock market can take a big bite out of your retirement savings, especially if you're heavily invested in equities.

Retiring into a brutal bear market (sequence of returns risk): Even if the stock market recovers over the long term, retiring during a downturn can be particularly dangerous, as you may be forced to sell investments at a loss to cover living expenses.

High inflation: If the cost of goods and services rises faster than your investment returns or fixed income sources, it can quickly erode your purchasing power in retirement.

Premature death or disability (income interruption): The unexpected loss of a spouse's income due to death or disability can derail even the most carefully constructed retirement plan.

Longevity (outliving your savings): On the flip side, living longer than expected can also put a strain on your retirement savings, as you may need to stretch your resources over a longer time horizon.

Long-term care needs: The cost of extended medical care, whether in-home or in a nursing facility, can quickly deplete your retirement savings if you're not prepared.

Unforeseen family financial responsibilities: Unexpected expenses, such as supporting an adult child or grandchild, can put a dent in your retirement budget.

Lawsuit liability: Being sued, whether for a car accident, professional liability, or other reasons, can put your assets at risk if you don't have adequate protection in place.

Cognitive decline: Losing the ability to manage your own finances due to cognitive impairment can leave you vulnerable to financial mistakes or exploitation.

Looking at this list, it's easy to see how each of these risks could impact your ability to fund your Needs, Wants, and Wishes in retirement. A stock market collapse or high inflation could jeopardize your ability to cover basic living expenses (Needs), while unforeseen family financial responsibilities could force you to forego travel or other discretionary spending (Wants). And any of these risks could limit your ability to leave a legacy or support charitable causes (Wishes).

Looking for a deeper understanding of retirement risk management? My free course '10 Easy Steps to Retirement Income for Life' shows you how successful retirees build resilience into their plans.

So, what can you do to protect yourself? Here are a few ideas for each risk:

Stock market collapse and sequence of returns risk: Diversify your portfolio across different asset classes and geographies, and consider using a bucket strategy or income floor to cover essential expenses (more on this in the next section).

High inflation: Consider investing in assets that have historically performed well during inflationary periods, such as real estate, commodities, and inflation-protected securities (TIPS).

Premature death or disability: Make sure you have adequate life and disability insurance coverage, especially if you're the primary breadwinner.

Longevity: Consider delaying Social Security to maximize your lifetime benefit, and look into income strategies like annuities that can provide a guaranteed stream of income for life.

Long-term care needs: Consider purchasing long-term care insurance or setting aside dedicated savings to cover potential care expenses.

Unforeseen family financial responsibilities: Build an emergency fund to cover unexpected expenses and set clear boundaries around financial support for family members.

Lawsuit liability: Make sure you have adequate liability insurance coverage (auto, homeowners, umbrella), and consider asset protection strategies like trusts.

Cognitive decline: Put legal documents in place (power of attorney, living will) to ensure your wishes are carried out if you become incapacitated, and consider involving a trusted family member or advisor in your financial decision-making.

Remember, the goal isn't to eliminate risk entirely (which is impossible) but rather to identify the risks that are most likely to impact your unique situation and put strategies in place to mitigate their potential impact.

By being proactive and incorporating these risks into your overall resilience planning, you can help ensure that your retirement stays on track no matter what challenges come your way.

Practical Strategies for Building Financial Resilience

Now that we've identified some of the key risks that can threaten your retirement security, let's dive into some practical strategies you can use to build financial resilience and protect your hard-earned savings.

Create an income floor: One of the most effective ways to build resilience into your retirement plan is to create a guaranteed income floor that covers your essential expenses (Needs). This might include Social Security benefits, a pension, an annuity, or a combination thereof. By ensuring that your basic living expenses are covered no matter what happens in the market, you can help insulate yourself from the impact of stock market volatility and sequence of returns risk.

Maintain an emergency fund: Even in retirement, it's important to have a dedicated emergency fund that can help you weather unexpected expenses without having to tap into your long-term investments. Aim to keep three to six months' worth of living expenses in a highly liquid, low-risk account like a savings account or money market fund.

Craft a diversified investment portfolio: As we discussed in the Investment Portfolio pillar post, diversification is one of the most powerful tools you have for managing market risk. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), geographies (domestic and international), and sectors (technology, healthcare, energy, etc.), you can help smooth out the ups and downs of the market and improve your overall risk-adjusted returns.

Implement a dynamic withdrawal strategy: When it comes to minimizing the impact of sequence of returns risk, how you withdraw money from your portfolio can be just as important as how you invest it. Consider using a dynamic withdrawal strategy that adjusts your spending based on market conditions, such as the "guardrails" approach that increases spending in good years and reduces it in bad years.

Explore insurance solutions: For risks that are too big to self-insure, like premature death, disability, or long-term care needs, insurance can be a valuable tool for transferring risk and protecting your assets. Work with a trusted insurance professional to evaluate your coverage needs and find policies that fit your budget and goals.

Engage in proactive tax planning: As we discussed in the Tax Strategies pillar post, proactive tax planning can help you reduce your overall tax liability and increase your financial flexibility in retirement. Strategies like Roth conversions, tax-loss harvesting, and asset location can help you keep more of your hard-earned money and improve your overall financial resilience.

Establish a trusted power of attorney: To protect yourself and your finances in the event of cognitive decline or incapacitation, it's important to have a trusted power of attorney in place. This legal document allows you to designate someone you trust (a spouse, adult child, or advisor) to make financial decisions on your behalf if you're unable to do so yourself.

The key to building financial resilience is to take a holistic, multi-faceted approach that addresses both the big-picture risks (like market volatility) and the more personal risks (like long-term care needs). By combining these strategies, you can create a more robust retirement plan better equipped to handle whatever challenges come your way.

The Role of Mindset in Cultivating Resilience

While practical strategies like diversification and insurance are important for building financial resilience, cultivating a resilient mindset is equally important. The way you think about and respond to challenges can have a big impact on your ability to bounce back from setbacks and stay on track toward your goals.

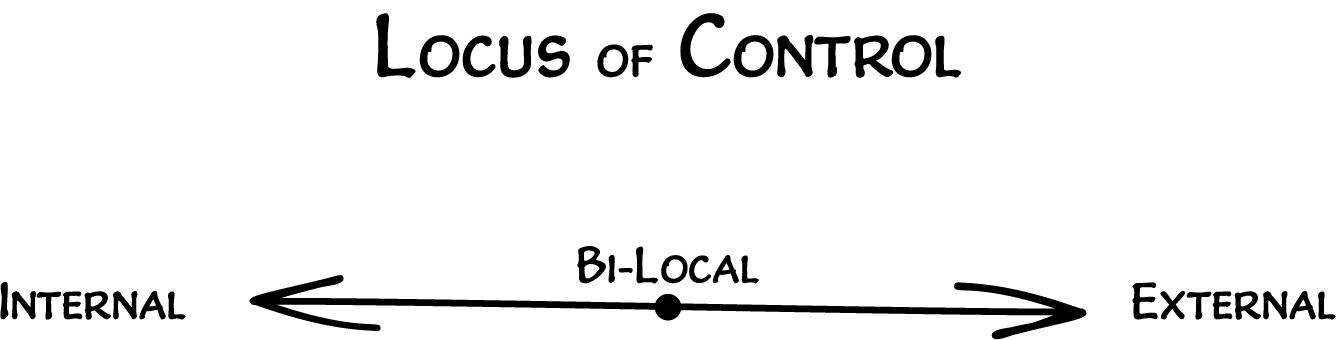

One key aspect of a resilient mindset is your locus of control – that is, the degree to which you believe you have control over the outcomes in your life. People with an internal locus of control tend to believe that their own actions and decisions are the primary drivers of their success, while those with an external locus of control tend to attribute outcomes to external factors like luck or circumstance.

While having an internal locus of control can be empowering, it's important to be realistic about what you can and can't control. This is where the concept of the "illusion of control" comes in – the tendency to overestimate our ability to control outcomes, especially in complex or uncertain situations.

In the context of retirement planning, the illusion of control can lead us to make overly risky investment decisions or to underestimate the potential impact of factors like inflation or longevity. It can also lead to overconfidence and a false sense of security, leaving us unprepared for the inevitable challenges and setbacks that come with retirement.

To cultivate a more resilient mindset, it's important to find a balance between taking ownership of the things you can control and accepting the things you can't. Here are a few tips for developing this kind of balanced perspective:

Focus on process, not outcomes: Instead of fixating on specific investment returns or retirement dates, focus on the process of making sound financial decisions based on your goals and values. This can help you stay grounded and adaptable in the face of changing circumstances.

Practice optimism (but not blind optimism): While it's important to maintain a positive outlook, it's equally important to be realistic about potential risks and challenges. Practice "realistic optimism" by acknowledging potential obstacles but focusing on the steps you can take to overcome them.

Cultivate a growth mindset: Instead of viewing setbacks as failures, try to see them as opportunities for learning and growth. Embrace the idea that your skills and knowledge can always be developed, and look for ways to continuously improve your financial decision-making.

Develop mental agility: The ability to think flexibly and adapt to changing circumstances is a key component of resilience. Practice mental agility by regularly challenging your assumptions, seeking out new perspectives, and being open to changing course when necessary.

Practice visualization: One powerful way to build resilience is to mentally rehearse how you would handle potential challenges or setbacks. Take a few minutes each day to visualize yourself navigating a difficult financial situation with calmness, creativity, and confidence.

Building a resilient mindset is ultimately about developing the mental and emotional tools to navigate life's inevitable ups and downs with grace and grit. By cultivating a balanced, growth-oriented perspective, you can improve your ability to weather any storm and stay focused on your long-term goals.

Putting It All Together: Your Personal Resilience Plan

Congratulations! By making it this far, you've already taken a big step toward building the financial resilience you need to thrive in retirement. You've learned about the key risks that can threaten your retirement security, the practical strategies you can use to mitigate those risks, and the mindset shifts that can help you cultivate greater emotional resilience in the face of challenges.

Now, it's time to put all of these pieces together into a cohesive plan. Here's a step-by-step framework you can use to create your own personal resilience plan:

Identify and assess your key risks: Start by making a list of the risks that are most likely to impact your retirement, based on your unique circumstances and goals. Consider factors like your age, health status, family situation, and financial resources.

Determine your ideal risk management approach: For each risk on your list, decide which of the four risk management strategies (avoid, assume, mitigate, transfer) makes the most sense for your situation. Keep in mind that you may choose to use different strategies for different risks.

Implement specific action steps: Once you've identified your preferred risk management approach, brainstorm specific action steps you can take to implement that approach. For example, if you've decided to mitigate longevity risk by delaying Social Security, your action steps might include updating your retirement income projections and adjusting your savings/spending plan accordingly.

Review and adapt your plan regularly: Remember, your resilience plan is not a one-and-done exercise. As your circumstances and goals change over time, it's important to regularly review and update your plan to make sure it still aligns with your needs. Consider setting a reminder to review your plan at least once a year or whenever you experience a major life change (retirement, birth of a grandchild, death of a spouse, etc.).

While creating a personal resilience plan may feel daunting at first, remember that every small step you take toward building resilience is a step in the right direction.

And you don't have to go it alone – consider enlisting the help of a trusted financial advisor, therapist, or coach to provide guidance and support as you work through this process.

It's also important to remember that building resilience is not about achieving a state of invulnerability or perfection. No matter how well you plan, life will always involve some degree of risk and uncertainty. The goal of resilience planning is not to eliminate risk entirely but rather to develop the tools and mindset to navigate risk with confidence and grace.

Ultimately, the real value of resilience planning lies not just in the practical strategies and action steps but in the sense of empowerment and peace of mind it can provide. By taking proactive steps to identify and manage potential risks, you're not just protecting your financial security – you're cultivating the emotional resilience and adaptability you need to thrive in the face of life's challenges.

So, as we wrap up this deep dive into resilience and risk, I want to leave you with a challenge: Take one small step today toward building your personal resilience plan. Whether it's scheduling a meeting with a financial advisor, reading a book on resilience, or simply taking a few minutes to reflect on your key retirement risks, every action counts.

Remember, resilience is not a destination but a journey. By committing to the ongoing work of building resilience, you're not just securing your financial future – you're cultivating the strength, flexibility, and peace of mind to live your best life in retirement and beyond.

For a deeper look at developing resilience, I've created a course called '10 Easy Steps to Retirement Income for Life' that walks through each concept step by step.