Table of Contents

Imagine for a moment that you're retired and living the life you've always dreamed of.

Picture yourself waking up each morning with a sense of excitement, knowing that the day ahead is yours to fill with the activities and experiences that bring you joy. Maybe it's traveling to new places, spending quality time with loved ones, or pursuing a long-neglected passion.

Now, imagine if you could enjoy this idyllic retirement lifestyle without worrying about how you'll pay for your basic living expenses. Sounds liberating, doesn't it? That's the power of an income floor.

Take Francis and Susan, for example. This 62-year-old couple came to me filled with uncertainty about their fast-approaching retirement. They had saved diligently, but the sheer number of looming decisions – when to retire, when to take Social Security, how much could they afford to spend – left them feeling overwhelmed.

As we dug into their financial situation, I discovered that what Francis and Susan needed more than anything was an ironclad plan for covering their essential expenses. They needed to know that no matter what curveballs life threw at them, they could always keep a roof over their heads, food on the table, and the lights on.

So, we set to work creating an income floor – a reliable stream of lifetime income laser-focused on funding their non-negotiable needs. We maximized their Social Security benefits, thoughtfully deployed their portfolio, and layered on other guaranteed income sources to construct a rock-solid foundation.

The result?

Francis and Susan transitioned into retirement with a newfound sense of relaxed confidence, secure in the knowledge that their needs would be met, come what may. They were now free to spend their time and remaining assets on what matters most to them, without financial anxiety hanging over their heads.

An income floor is one of the most powerful tools at your disposal when it comes to achieving the retirement you've always envisioned. By covering your basic lifestyle expenses with predictable, guaranteed income separate from your investment portfolio, you insulate yourself from the many risks and uncertainties of the market.

What is an Income Floor?

At its core, an income floor is a dependable annual or monthly "paycheck" that covers all your essential living expenses in retirement. Think of it as a base salary, but one you pay yourself using an optimized combination of stable, guaranteed income sources.

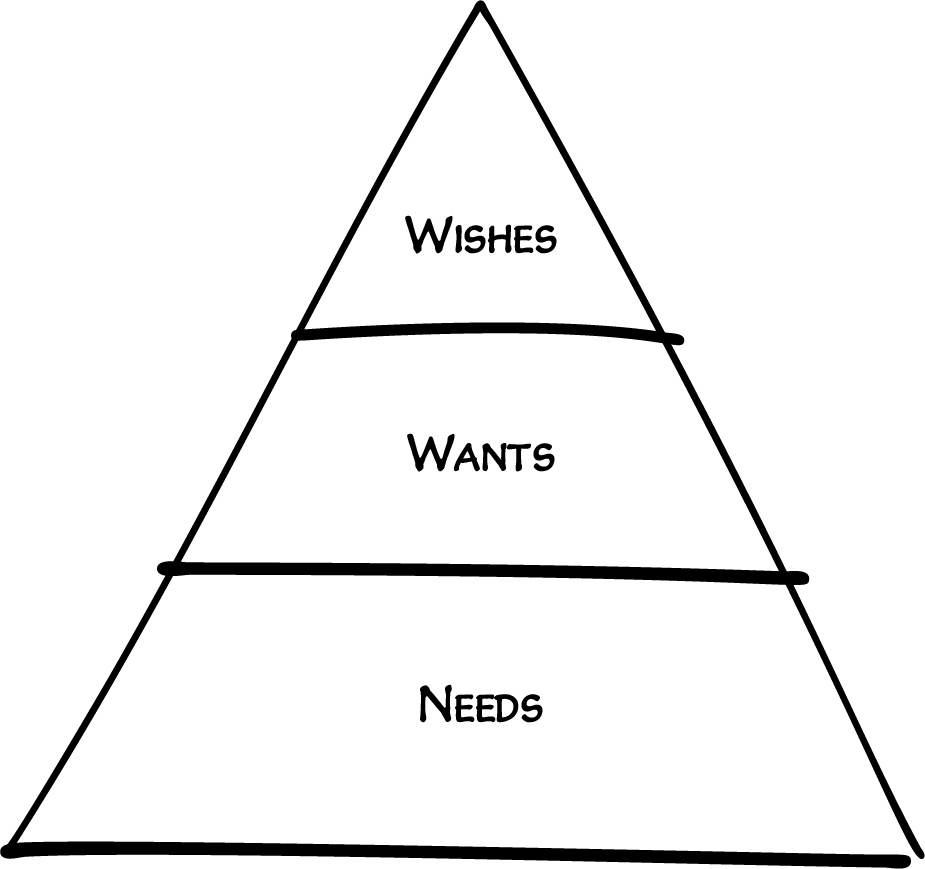

Let's break that down a bit further. In Be the Bird, I introduce the concept of categorizing retirement expenses into "needs, wants, and wishes."

Needs are the non-negotiable essentials required to maintain your basic standard of living – things like housing, utilities, food, transportation, healthcare, etc.

Wants are the extras that make life more comfortable and enjoyable, like travel, hobbies, and entertainment.

Wishes are your legacy goals, such as charitable giving or leaving an inheritance.

The purpose of the income floor is to cover your Needs bucket specifically and completely, ensuring you can always keep the lights on and put food on the table without relying on the ups and downs of your investment portfolio.

Here's a hypothetical to illustrate: Let's say you're nearing retirement with a $3 million nest egg. After careful budgeting, you determine that you need $80,000 per year to cover your essential expenses.

To give yourself a secure income floor, you might carve out $1 million of your portfolio and dedicate it exclusively to generating that $80,000 annually through Social Security, bond ladders, annuities, and the like (more on the specifics later!).

The remaining $2 million stays invested in a diversified portfolio aimed at funding your wants and wishes. The power of this approach is that even if the market takes a tumble and your $2 million balance temporarily drops, you can rest easy knowing your needs are fully taken care of by your income floor.

You might have to temporarily trim back on discretionary spending, but your foundational living expenses are untouched.

Contrast this with the all-too-common approach of relying solely on regular portfolio withdrawals to fund all your retirement expenses. In that scenario, a down market in the early years of retirement could seriously jeopardize your long-term financial security as you're forced to repeatedly sell declining assets to keep up with your cost of living. That's a scary proposition!

An income floor solves this by providing a stable, predictable cash flow regardless of market conditions. It's like building your retirement house on a firm, even foundation rather than shifting sand. With that kind of bedrock beneath you, you can live out your retirement confidently and joyfully, focusing on what matters most to you without money worries constantly lurking in the background.

Now that you understand the basic definition and purpose of an income floor, let's take a closer look at the specific benefits it provides as part of a comprehensive retirement plan.

Needs, Wants & Wishes Framework

Before we dive into the benefits of an income floor, let's zoom out for a moment and look at the bigger picture of how it fits into your overall retirement plan. As I briefly touched on earlier, a helpful framework for thinking about retirement expenses is categorizing them into Needs, Wants, and Wishes.

This may seem like a simplistic approach at first glance but don't underestimate the power of this mental model. By clearly defining which expenses are non-negotiable (Needs), which are important but flexible (Wants), and which are aspirational (Wishes), you gain tremendous clarity on how to optimally allocate your financial resources.

Your Needs form the bedrock of your retirement lifestyle. These are the expenses that, if push comes to shove, you absolutely must be able to cover to maintain a basic quality of life. Think essentials like your mortgage or rent payment, utilities, groceries, healthcare, transportation, property taxes and insurance.

While the exact dollar amounts will vary from person to person, your Needs are typically the expenses that remain relatively stable from month to month and year to year. They're the "must-haves" that your retirement budget is built upon.

Wants, on the other hand, are the "nice-to-haves" – the extras that make life more enjoyable and fulfilling. This might include travel, dining out, hobbies, gifting, and entertainment. Your Wants are more discretionary by nature and often have some built-in flexibility. For instance, if money gets tight, you could choose to take a more budget-friendly vacation or eat out less frequently without derailing your overall financial plan.

Finally, Wishes are your most aspirational expenses – the "would n't-it-be-nice" items that you'd love to be able to fund if your resources allow. These are often legacy-focused goals like leaving an inheritance to your children, making substantial charitable contributions, or establishing a family foundation. While meaningful, they're the expenses that aren't essential to your immediate quality of life.

The power of dividing your expenses into these buckets is that it provides a clear hierarchy for deploying your income and assets. The income floor's role is to fully and reliably cover your needs, effectively taking those essential expenses off the table so you can focus on the more discretionary Wants and Wishes that bring joy and meaning to your retirement.

The Power of an Income Floor

As you've probably gathered by now, an income floor is a powerful tool for creating a stress-free and fulfilling retirement. Providing a stable foundation that covers your non-negotiable living expenses offers a myriad of benefits that touch on the financial, psychological, and behavioral aspects of this exciting but often uncertain life phase.

Let's unpack each of those benefit categories to understand how an income floor can be so transformative.

Mitigating Big Financial Risks

One of the most crucial benefits of an income floor is that it helps protect you against three major financial risks that can derail even the best-laid retirement plans:

Sequence of Returns Risk: This is the risk that a significant market downturn in the early years of retirement, coupled with ongoing withdrawals to fund living expenses, could permanently cripple your portfolio and increase the likelihood that you outlive your money.

Think of it this way: If you retire at the onset of a major bear market and are relying solely on your investment portfolio to cover your expenses, you'll be forced to repeatedly sell assets at depressed prices just to keep up with your cost of living. That leaves you with less capital to benefit from an eventual market recovery, jeopardizing your long-term financial sustainability.

An income floor is like a shield against this risk, providing a reliable cash flow to cover your essential needs regardless of short-term market gyrations. That way, you can let your remaining investment portfolio recover untouched during a downturn without locking in unnecessary losses.

Interest Rate Risk: This is the risk that rising interest rates will negatively impact the value of bonds and other fixed-income assets in your portfolio. If interest rates spike and bond values dip right when you need to sell those holdings to fund expenses, it could seriously deplete your retirement nest egg.

Longevity Risk: This is the risk that you simply live longer than your money lasts – an increasingly common concern as life expectancies continue to rise. An income floor can include sources like Social Security, pensions, and income annuities that provide a lifetime stream of income you can't outlive, no matter how long you live.

By mitigating these risks, an income floor provides a solid financial foundation that can weatherproof your retirement, even in the face of economic uncertainty. But the benefits go beyond just dollars and cents.

If you're curious about how other retirees create reliable income, I explore this in detail in my book 'Be The Bird', including examples of building retirement income floors.

Providing Psychological Security

An income floor also offers immense psychological and emotional benefits that can't be overstated.

By providing a predictable, worry-free cash flow to cover essential expenses indefinitely, it instills a deep sense of financial security and confidence, even for diligently saved retirees.

When you know you'll always be able to keep a roof over your head and food on the table; you're free to relax and enjoy this exciting new chapter without constantly worrying if you're spending too much or if the market will have other plans.

So, how exactly do you construct an income floor? In the next section, we'll break down the key building blocks and explain how to tailor them to your specific needs and goals.

Build Better Behaviors

An income floor also provides behavioral benefits by giving you permission to spend more freely in retirement. When your daily needs are fully covered by reliable income sources, you can enjoy your discretionary spending without worrying about depleting your portfolio too quickly. This behavioral benefit is key to achieving the relaxed confidence of knowing your lifestyle is secure.

Building Blocks of an Income Floor

Now that we've explored the transformative benefits an income floor can provide, let's dive into the nuts and bolts of how to construct one. While the specific components will vary based on your unique financial situation and goals, four primary building blocks often form the foundation of a sturdy income floor.

Social Security: The Bedrock

For most retirees, Social Security benefits will form the bedrock of their income floor. As a source of guaranteed, inflation-adjusted lifetime income backed by the U.S. government, Social Security is hard to beat when it comes to providing a reliable foundation for your essential expenses.

The key is to maximize your benefits through smart claiming strategies. In general, it pays to defer claiming as long as possible (up to age 70) to lock in a higher monthly benefit for life.

For married couples, having the higher earner delay benefits while the lower earner claims earlier can often be a smart way to maximize lifetime benefits while still bringing in some income early in retirement.

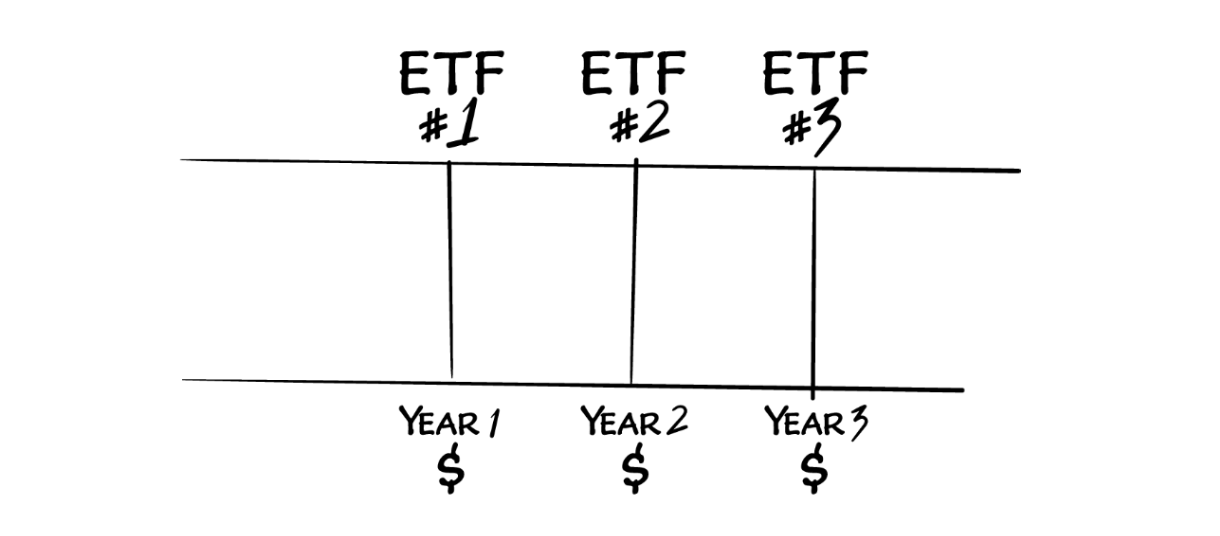

Bond Ladders: Filling in the Gaps

While Social Security is a great start, most people will need additional income sources to cover their Needs bucket fully. This is where bond ladders can come in handy.

A bond ladder is a portfolio of individual bonds or bond ETFs that mature at regular intervals, providing a predictable income stream over a set period. For example, you might build a 10-year ladder with bonds maturing each year, allowing you to fill in any gaps between your Social Security benefits and your essential expenses.

The beauty of a bond ladder is that it provides a steady cash flow while also mitigating interest rate risk. Because you're holding the bonds to maturity, short-term fluctuations in value due to rising rates won't impact your income stream.

You can reinvest the proceeds from maturing bonds to extend the ladder and keep the income flowing.

Consider MYGAs as Another Ladder Option

In addition to bond ladders, another option to consider is a Multi-Year Guaranteed Annuity (MYGA) ladder. MYGAs function similarly to bond ladders but are issued by insurance companies and offer a fixed rate of return for a set period. They can provide a higher guaranteed return than bonds but require committing your funds for the annuity term.

How to Choose Your Ladder

There are two common approaches to implementing a ladder strategy. A "bridger" uses the ladder to cover living expenses only until Social Security or other income sources kick in, allowing the ladder to unwind over time. A "replenisher" continues to add new rungs to the ladder throughout retirement, providing an ongoing income stream to supplement other sources.

Pensions: A Dying Breed

For the lucky few who still have access to a traditional pension, this can be a valuable addition to an income floor. Like Social Security, pensions provide a guaranteed lifetime income stream that's not dependent on market performance.

There are two main types of pensions – pure and mixed.

A pure pension, like a Single Premium Immediate Annuity (SPIA) or Deferred Income Annuity (DIA), provides a guaranteed lifetime income stream in exchange for an irrevocable premium payment. A mixed pension, like a Fixed Indexed Annuity with an income rider, offers a combination of lifetime income and an account value that can be surrendered if needed.

If you have a pension, consider taking the monthly annuity payments rather than a lump sum to maximize the income floor potential. While the lump sum can seem tempting, folding that guaranteed income into your floor can provide valuable security and peace of mind.

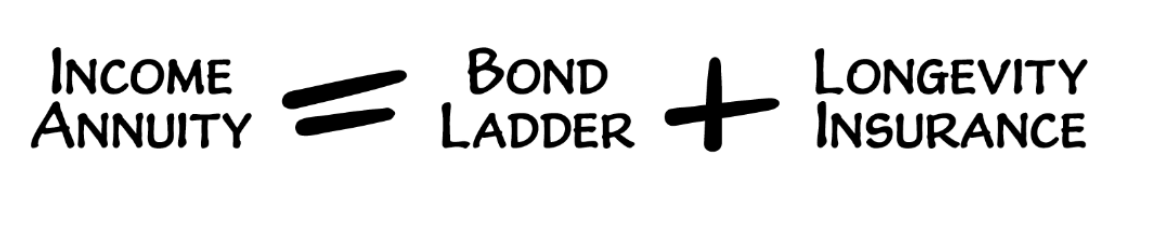

Income Annuities: A DIY Pension

For those without a traditional pension, building your own "personal pension" through an income annuity can be a smart move. Essentially, you give an insurance company a lump sum of money in exchange for a guaranteed lifetime income stream – effectively creating your own pension-like cash flow.

There are two main types of income annuities to consider:

Single Premium Immediate Annuities (SPIAs): With an SPIA, you pay a lump sum premium to the insurance company and start receiving monthly payments immediately. The payments are guaranteed for life, no matter how long you live.

Deferred Income Annuities (DIAs): With a DIA, you pay a premium now but defer the start of payments until a later date, often 5-20 years in the future. By deferring payments, you can lock in a higher monthly benefit down the road, which can be helpful for covering expenses later in retirement.

One key feature to look for is a "cash refund" option, which ensures that if you pass away before receiving at least the amount of your original premium, the difference will be paid to your beneficiaries. This can provide valuable peace of mind and legacy potential.

By combining some or all of these building blocks in a way that's tailored to your specific needs and goals, you can construct a robust income floor that will provide the security and confidence to fully enjoy your retirement years.

How to Build Your Income Floor

So, you're sold on the benefits of an income floor and ready to start building one for yourself. Great! Here's a step-by-step guide to creating a customized income floor that will give you the financial confidence to thrive in retirement.

Step 1: Quantify Your Essential Expenses

The first step is to get crystal clear on how much income you'll actually need your floor to generate. Start by creating a detailed budget of your non-negotiable living expenses – your "Needs" bucket. This should include costs like:

Housing (mortgage or rent)

Utilities

Groceries and household supplies

Transportation

Healthcare premiums and out-of-pocket costs

Insurance (property, auto, umbrella liability)

Taxes (property, income)

Debt payments

Basic clothing and personal care

Be realistic but conservative in your estimates. The goal is to arrive at the minimum annual income needed to maintain your basic standard of living without relying on your investment portfolio.

Step 2: Assess Your Guaranteed Income Sources

Next, take inventory of any guaranteed income sources you'll have in retirement, such as:

Social Security benefits (yours and your spouse's)

Pensions (if applicable)

Existing annuities

Rental income (if stable and reliable)

Estimate the total annual income you can expect from these sources. If you haven't claimed Social Security yet, you can get a personalized benefit estimate from the Social Security Administration website based on different claiming ages.

Step 3: Determine Your Income Gap

Subtract your estimated guaranteed income from your essential expenses. The difference is the income gap your floor will need to fill from additional sources.

Let's look at a hypothetical example:

Imagine Mike and Julie estimate they'll need $80,000 per year to cover their essential expenses in retirement. They expect the following guaranteed income:

Mike's Social Security (age 67): $30,000/year

Julie's Social Security (age 66): $20,000/year

Mike's small pension: $10,000/year

Total Guaranteed Income: $60,000/year

To calculate their income gap, they'd subtract their guaranteed income from their essential expenses:

$80,000 - $60,000 = $20,000/year

So, Mike and Julie will need to generate an additional $20,000 per year from other income floor sources to fully cover their Needs bucket.

Step 4: Fill the Gap with Additional Income Sources

The next step is to allocate a portion of your assets to generate the additional income needed to fill your income gap. This is where supplemental income floor solutions like bond ladders and income annuities come into play.

Continuing with Mike and Julie's example above, let's say they have a $1 million nest egg. To generate the extra $20,000 per year needed to complete their income floor, they could allocate a portion of their savings to a bond ladder, income annuity, or a combination of the two.

For instance, they might put $400,000 into a 20-year bond ladder with bonds maturing each year to generate the additional $20,000 of annual income needed.

Or, they could use $300,000 to purchase a joint lifetime income annuity that pays out $20,000 per year for as long as either of them is alive.

The specific approach will depend on factors like their age, risk tolerance, and legacy goals. The key is to allocate enough assets to generate the supplemental income needed to fill the gap, without over-allocating and leaving their portfolio underfunded.

Step 5: Stress Test Your Income Floor

Before implementing your income floor, it's crucial to pressure test it under various market conditions and life scenarios. Use robust financial planning software or work with a qualified professional to model how your income floor would perform under different assumptions, such as:

Poor market returns in the early years of retirement

Higher-than-expected inflation

Long-term care needs

The death of a spouse

The goal is to ensure your income floor is resilient enough to withstand a range of challenging circumstances while still meeting your essential spending needs.

*Consider a Bond Tent

Another strategy to consider when stress testing your income floor is the "Bond Tent" approach. This involves temporarily increasing your allocation to bonds in the years leading up to and immediately following retirement.

By doing so, you create a protective cushion against sequence of returns risk during this vulnerable period before gradually shifting back to your target asset allocation over time.

Step 6: Implement and Adjust as Needed

Once you've designed an income floor that can weather a variety of storms, it's time to put it into action. This means claiming Social Security at the planned time, purchasing any necessary annuities, building your bond ladder, and so on.

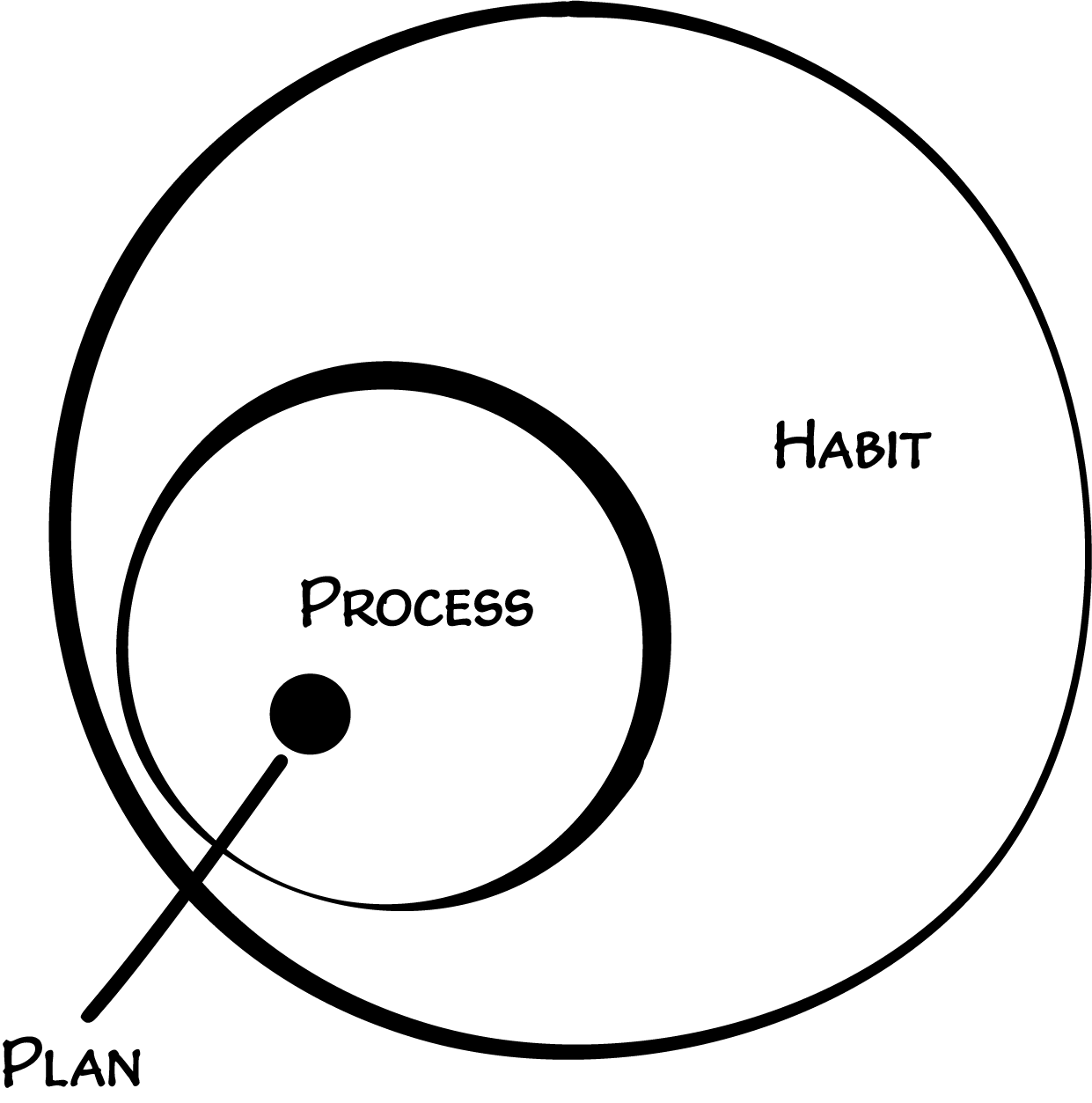

But remember, your income floor isn't a "set it and forget it" proposition. It's important to

periodically review and adjust your plan as your life circumstances and goals evolve over time.

Regularly monitoring and tweaking your income floor in response to changing needs can ensure it remains a reliable foundation for a confident and fulfilling retirement.

The key is to approach your income floor not as a one-time exercise but as an ongoing process of aligning your assets and income with your most essential spending goals.

Bottom Line

We've seen how an income floor can shield you from the risks and uncertainties that can derail even the best-laid retirement plans, from sequence of returns risk to the fear of outliving your money.

But perhaps most importantly, we've discovered how an income floor can provide the priceless gift of relaxed confidence – the ability to fully enjoy your retirement without the constant worry that comes with relying solely on a volatile portfolio.

Of course, building an income floor takes careful planning and disciplined saving. It requires a clear assessment of your true spending needs, a strategic approach to claiming Social Security and deploying your assets, and the diligence to periodically review and adjust your plan as your circumstances evolve.

But for those willing to put in the effort, the rewards can be immeasurable. The ability to wake up each day knowing your basic needs are covered, no matter what the future holds, is a gift that keeps on giving.

Remember, you don't have to go it alone. Engaging a qualified professional who understands the power of an income floor can be invaluable in helping you design and implement a plan tailored to your specific goals.

So go ahead and give yourself permission to dream big. With a solid income floor beneath your feet and a smart spending plan for your remaining assets, you can embrace this new chapter with the confidence, excitement, and joy you deserve.

For a deeper look at these income planning strategies, I've created a course called '10 Easy Steps to Retirement Income for Life' that walks through each concept step by step.