“Am I Ready To Retire?”

The Magic Number

“Am I ready to retire?” – is one of the most common questions since everyone wants to retire at some point. Most people take steps to ensure that they can retire but the task can be daunting. And not everyone understands what it takes to build a successful retirement.

Nowadays, thoughts of retirement and financial anxiety appear to go hand-in-hand. Most people are terrified of running out of money in retirement. The anxiety only grows as you approach retirement age. After all, going broke is a far more daunting prospect if you’re unable to work or employability is uncertain.

And it’s this uncertainty that drives the fear. As with most challenges in life, retirement becomes less frightening the more you know about it. That’s why in this article, we’re going to help you reduce that anxiety by helping you create a retirement portfolio.

Retirement Portfolio

A portfolio is defined as a “range of investments held by a person or organization for a purpose.” Similarly, a retirement portfolio is a range of financial resources assembled and designed to help you achieve your retirement goals. It lays out the financial resources you have and how you can use them to meet your expenses in retirement. Let’s look at a few examples.

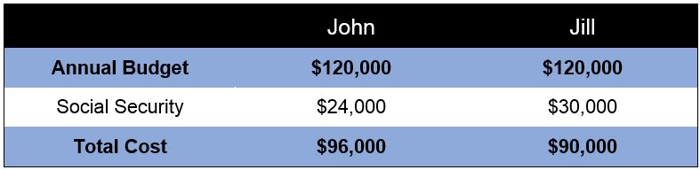

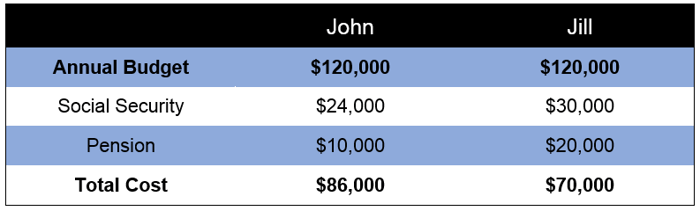

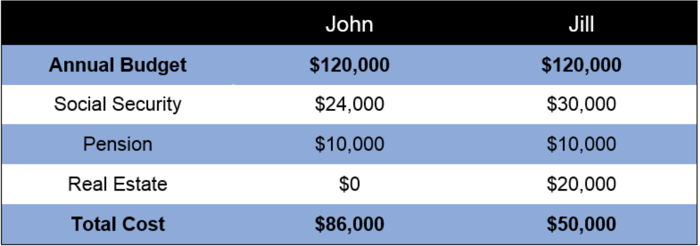

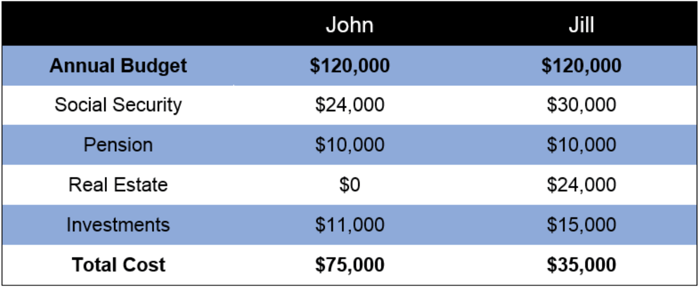

Both John and Jill will need roughly $120,000 a year in retirement. The first step is to review John and Jill’s financial resources to determine how they can be used to pay for their respective retirements.

If you’re interested in finding out how John and Jill were able to assess how much retirement would cost them, please click here.

When planning your income in retirement, it’s best to begin with your stable sources of income. For John and Jill, as well as most of you, that source is Social Security. Social Security is one of the most important resources retirees have access to, as it offers income that you can’t outlive and features a generous Cost of Living Adjustment.

In this example, both John and Jill have an annual income of $150,000, and both put 6.2% of their income into Social Security every year since they were 22 years old. John started receiving Social Security payments at the age of 62. That means that he is receiving a monthly stipend of about $2,000. Over the course of a year, that comes out to $24,000. Jill is deferring her payments until she reaches the age of 70 and will, therefore, receive $30,000 a year when she finally begins to collect her benefits.

This example assumes John and Jill have the same earnings history, and shouldn’t be used for your calculations, even if you’re earning a similar income. If you’re interested in hearing more about how to calculate your Social Security income, and how you can maximize you can maximize the benefit you receive from Social Security, click here.

As you can see, both John and Jill worked for companies that offered an annual pension. Pensions are similar to Social Security in that they provide income that you can’t outlive. Also, most pensions are insured by the Pension Benefit Guaranty Corporation (PBGC), an independent agency of the U.S. government that guarantees your pension regardless of the success or failure of your employer. You can learn more about pensions and their place in your retirement plans here.

Here we see that Jill planned for her future by purchasing property with the goal of renting out to supplement her retirement income. Unfortunately, John didn’t do the same. Therefore, Jill’s Total Cost is reduced to $50,000 while John’s remains the same.

John and Jill both have a substantial amount of savings invested in the form of stocks and bonds. They plan on drawing upon 3% of their principle each year in retirement. However, Jill’s portfolio is more conservative, meaning that she’s certain to receive at least $15,000. John’s portfolio, on the other hand, is more risk tolerant. Therefore, he’s only sure to receive $11,000. While he might earn more than that sum over the years, it’s important to always keep the risk in mind when making a financial plan.

Jill’s retirement portfolio shows that she is much closer to successfully retiring than John. However, they still both have a gap in income. In sum, Jill needs to come up with $750k, while John has a far more difficult task and needs to come up with $1.75 million.

John & Jill now know they’re short of their retirement income goals and they know by how much. This means they have options. For instance, they might consider a reverse mortgage or other financing options. In John’s case, he may have to reconsider what he wants from his retirement.

At this point, the two should make two retirement portfolios, with one focusing on their Needs and the other portfolio on their Wishes. For more information on the Needs-Safety framework, click here.

I hope this article has helped reduce some of the uncertainty and anxiety with planning your retirement income. Remember, a stable, well-organized retirement plan can help you successfully retire, no matter what stage of planning you’re currently in. If you’d like to learn more about developing a retirement income plan and gain access to useful financial tools, I recommend you speak with a financial adviser.