WHY ORGANIZE?

“There is no substitute for hard work.” – Thomas A. Edison. America was founded on the dual principles of hard work and innovation. Many Americans hold up persistence as the highest of virtues and laud those who strive to do and achieve more. This mindset can drive people to accomplish incredible feats, but it can also lead to great failures.

One of the main reasons people run out of money in retirement is this mindset. Ironically, many retirees find themselves striving to do and give more than they did when they were employed.

For example, it’s not unusual to hear of retirees who spend the first five years of retirement traveling the world and indulging in activities they didn’t have time for while working. These same retirees might also donate large amounts of money to charity or inheritances for their grandchildren. As a result, they often find themselves without enough money to cover their retirement needs when they live longer than expected. Thankfully, a system exists that prevents such occurrences.

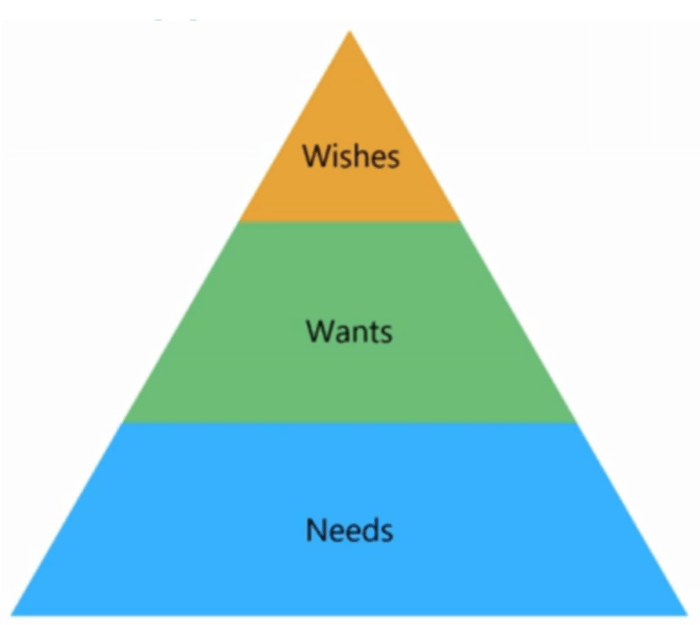

The Needs, Wants, And Wishes Framework

The framework is critical in helping you compartmentalize your retirement costs.

The first step in this system is quantifying your future Needs, Wants, and Wishes and assigning the costs accordingly. If you don’t know how to quantify your retirement costs, click here to learn more.

The Needs, Wants, and Wishes Framework is reminiscent of Maslow’s Hierarchy. It’s also somewhat similar in its approach.

Your Needs have the highest emphasis which includes basic living expenses, healthcare, and local transportation.

Your Wants is the next highest tier and focuses on the things you truly hope to do or achieve during your retirement. Some typical examples of Wants include traveling, helping your grandchildren pay for college, and donating to your favorite charity.

Your Wishes is the last part of the system that includes things you wish to do, but aren’t integral to your retirement plan. The Wish tier usually includes items such as legacies or inheritances.

Now that you’ve organized your retirement costs, it’s time to build two portfolios:

- The Safety-First Portfolio

- The Growth Portfolio

The Safety-First Portfolio should be built with security and stability in mind. It should deal solely with costs associated with your Needs. This portfolio should mainly consist of those sources of income that you can’t outlive or lose. Such resources include Social Security, bonds, and pensions.

The Growth Portfolio, on the other hand, should focus on your Wants & Wishes. As such, it’s more risk-tolerant. This portfolio might depend more on variable sources of income that grow with the market.

The goal of creating these two portfolios is to balance security with growth. Of course, we all hope our investments perform well. However, when it comes to your needs, it’s better to be safe. This system provides you security and peace of mind while allowing you to increase your wealth in retirement.

How Can Safety-First And Growth Portfolios Help You

You’ve been enjoying your retirement for about ten years when suddenly, the market collapses.

Many of your colleagues who are dependent on their portfolio’s performance for income find the market crash has impacted their quality of life. As a result, they struggle to meet their needs.

You, on the other hand, allocated your funds responsibly before the market collapse. Your portfolio still takes a hit, and you may not meet all of your wishes, but since you have secure reserves set aside for your needs, you weather the storm without much difficulty.

And if the opposite scenario occurs and there’s a market upswing after you’ve been retired for ten years, you’ll still be in great shape. You’ll be able to enjoy the benefits just like everyone else. You can feel confident in using your extra money to meet your Wants & Wishes since you will have already accounted for your Needs.

Takeaways

Following the Safety-Growth framework will help you retire successfully and confidently. You can rest comfortably knowing that you won’t run out of money in the future, and you’ll know where every dollar is being allocated. If you’d like to learn more about how to protect your retirement income and build this system, I recommend you meet with a certified financial adviser.