I’m sure your financial advisor is a nice person.

But that doesn’t mean you aren’t being taken to the cleaners!

Let me just get to the point.

The larger your portfolio, the more outrageous the fee is that you are probably paying your advisor.

I’m not talking about a few hundred, or even a few thousand bucks. I’m talking about hundreds of thousands of dollars – OR MORE – in the coming years.

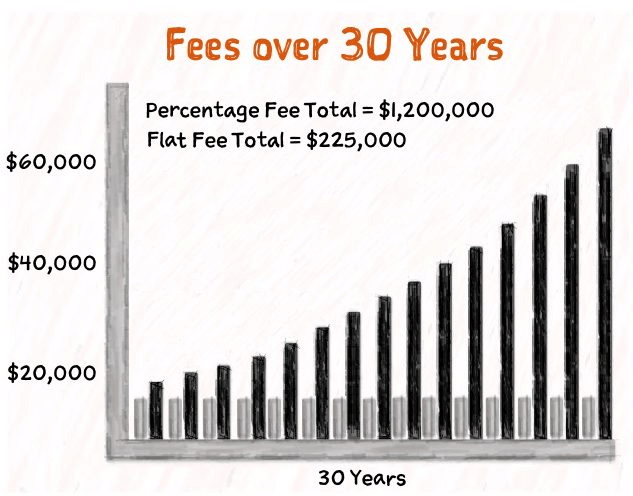

A $2 million portfolio growing at a modest 5% generates a staggering $1.2 million in advisory fees over 30 years.

…WHAT?!

Let me explain the 3 main reasons the fees are so high, and what you can do about it!

REASON #1 – HIDING IN PLAIN SITE

95% of investment advisory firms charge their clients about 1% of their portfolio.

While paying a 1% management fee to a financial advisor won’t kill you, it certainly can be a lot more dangerous than it looks.

My instincts told me that there was something amiss with the 1% fee, so I studied it. The more I looked into it, the more I realized that little 1% fee was amazing for financial advisors…but not for clients.

Whoever came up with the 1% fee must have been a brilliant marketer, psychologist, or both. They’ve done a simply incredible job of making this fee seem like a great deal.

But in reality, the 1% fee is actually pretty sneaky.

Scientists and psychologists would say the 1% fee has low “salience.” This just means that it’s hard for us to see. Since that 1% fee appears tiny relative to our entire portfolio, our brains tend to ignore it. It becomes invisible.

But what if we took the same 1% and reframed it?

- On a $2 million portfolio, that 1% fee represents $20,000 per year. It doesn’t seem quite as small now, does it?

- If your gross annual return is 6%, that 1% fee represents one-sixth of your portfolio growth. In other words, your advisor is taking 16 cents of every dollar your portfolio earns.

- If your net after-tax annual return is 4%, now that 1% fee represents one-fourth of your growth. Your advisor is taking 25 cents on the dollar.

By simply re-framing that 1% fee and showing what else it represents, we can see how big it really is. All of a sudden it looks a lot more salient!

But you need to do this re-framing for yourself because no percentage advisor is going to do it for you.

And as big as $20,000 looks, look what happens over time. As I said above, for a $2 million portfolio growing at 5% over 30 years, that little 1% fee works out to $1.2 million.

I’m sure he’s a nice and competent guy, but $1.2 million? That’s just crazy.

Yet people pay it every day. Even though a flat fee of $9,500 would only cost you $285,000 during that same time period. The flat fee doesn’t grow over time.

Which brings us to the next problem, that your advisor’s fee grows along with your portfolio.

The percentage fee is built on a lie.

The lie is that large portfolios take more effort to manage than smaller portfolios. It turns out this just isn’t true.

Consider examples from other parts of your life:

- If your income doubled, would you expect your accountant to charge you twice as much to prepare your taxes? No way.

- If your net worth doubled, would you expect an estate planning attorney to charge you twice as much to prepare your estate planning documents? Not in a million years.

- If you have a bigger TV than your neighbor, would you expect the cable company to charge you more for the same channels your neighbor has? Never.

So why would it make sense for your advisor to double his fee just because your portfolio doubled?

For some reason, the industry has just asserted that advisors deserve to share in the growth of their clients’ portfolios. And unfortunately, clients by-and-large have not challenged this.

But when you consider this payment model in the broader context of how you pay for other services, it just starts to look silly.

Then when you consider that the work is no different on a $2 million portfolio compared to a $1 million portfolio you start to see how unfair percentage pricing really is.

(You might be thinking that I’m ignoring the possibility that your advisor is a brilliant stock picker. If he is, then maybe he should be rewarded for his market-beating returns. But if you actually believe an advisor can consistently pick market-beating stocks, I don’t think I can help you.)

REASON #2 – SELF-JUSTIFICATION

Most advisors believe they are ethical. Heck, most of us believe we are ethical. Believing anything else would be too psychologically uncomfortable.

Advisors look around and see 99% of their peers and competitors charging 1%, so they just do it too! It literally doesn’t occur to most advisors that charging $40,000 for financial advice might be “wrong” or “unethical.” Everyone else is doing it, so why shouldn’t I.

Advisors also justify their fees because they believe clients would be lost without them. While it is true that some clients would engage in self-sabotaging financial behavior without an advisor, the reality is that most clients would not.

Sure, an advisor can add value….but $40,000 per year?

There’s even some fascinating evidence that shows a willingness and tendency to overcharge the affluent.

Gino & Pierce (2010) analyzed the vehicle emissions testing market, and were actually able to show that inspectors tended to be more lenient with less affluent people, and less lenient with more affluent people. In other words, they illegally failed more affluent car owners more often, of course resulting in more costly repairs. The authors explain that “envy and empathy” explain the effect.

Could it be that financial advisers are self-justifying outrageous fees on the “affluent” because they believe quietly withdrawing these fees is a victimless crime? That their affluent client can afford it?

REASON #3 – INEFFICIENCY

Financial advisory practices tend to be inefficient and high-cost, which helps advisors justify their fee (in their own minds).

After all, all that wine and cheese they buy for their clients is expensive. And those dinners. And all that golf. And that beautiful office. And that (unnecessary) staff!

But do you really even want to be friends with your financial advisor? I’m sure you have plenty of friends.

If you take a minute to think about it, I bet you would much rather get excellent advice – at a fair price. Pretty simple. Pretty reasonable.

THERE MUST BE A BETTER WAY!

Hopefully, I’ve convinced you that the seemingly harmless 1% fee has several major problems for clients.

But as a client, what are you supposed to do about it? It’s not like the industry is going to change overnight. Especially with how incredibly lucrative the 1% fee is for advisors.

However, there is hope that the tides are beginning to turn. There are currently a few hundred advisors across the country who have rejected the prevailing percentage approach.

In my practice, for example, I charge a fixed flat fee of $9,500 per year. This flat rate includes two ongoing services – investment management and financial planning.

I will never charge a percentage and my rates never change regardless of how large your portfolio grows.

In designing my service offering and fee schedule, I worked hard to avoid the problems that I walked you through above.

But there are other fee structures out there as well. If you’d like to learn more about them, download my free report 4 Ways to Pay for Financial Advice. Give me just a few minutes, and I’ll make you a much savvier client for years to come.