I just got a surprise in the mail.

My first employer has offered to send me a check for $28,205.97 to buy out my pension.

Should I accept the offer?!

One of the big financial decisions many people need to make is whether to take a lump sum payment from their pension plan, or to stick with the pension payments.

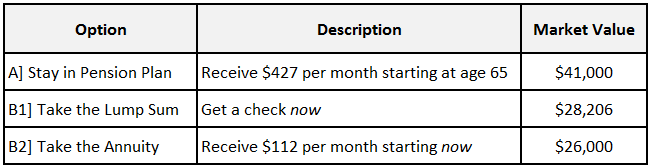

Before we dive into the analysis, let’s make sure my choices are clear:

A] I can remain in the pension plan, and receive a monthly benefit of $427.50 starting at age 65.

B] I can accept the “Offer” and elect:

- B1] A lump sum of $28,205.97, OR

- B2] A Single life annuity payment of $111.70 per month starting now

SO WHAT ARE EACH OF THESE OPTIONS “WORTH” IN TODAY’S DOLLARS?

A great resource to check out is www.immediateannuities.com which gives the current market value of a simple annuity. It can help me understand the “market price” of my options. (I’ll ignore the impact of taxes in this analysis, since my plan for the lump sum would be to roll it over into my IRA.)

Here’s what my options are “worth” according to the site.

It would cost me about $41,000 to purchase an annuity that approximates my pension benefit, but my previous employer is only offering me $28,206. Huh? This makes me consider keeping my pension! And if I do take the offer, it looks like the lump sum is more generous than the annuity that starts now.

Is this enough information to make a decision? Not so fast…

WHAT IF I TAKE THE LUMP SUM AND INVEST IT?

Let’s say I take the lump sum and invest it. What type of returns would I need to enjoy to be able to replicate my pension benefit? (For my finance-oriented readers, I just need to calculate the IRR of investing $28,206 today and then receiving $427 per month for life, starting at age 65).

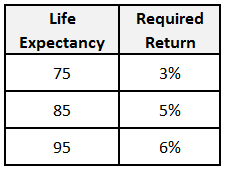

As you can see, the returns I’d need to enjoy depends significantly on how long I end up living!

If I live to be 95, I would need to earn 6% per year on my $28,206 to replicate my pension benefit.

But If I only live to be 75, I would only need to earn 3% per year on my $28,206 to replicate my pension benefit.

It’s obviously a lot easier to earn 3% than to earn 6%, so having a point of view on your life expectancy is an important part of the decision when considering a lump sum.

So what types of returns should I expect?

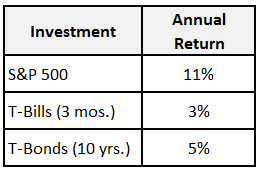

Let’s start with historical returns (from 1928-2016):

If you believe we’re going to enjoy historical returns going forward, it certainly argues to take the lump sum.

But lots of stock market analysts are bracing for lower returns in the coming years:

- Vanguard – 6-8% annual returns on stocks during the next decade

- Charles Schwab – 3% annual returns for the S&P 500 during the next 10 years

- Research Affiliates – 3-4% annual returns for the S&P 500 during the next 10 years

- GMO – 0-1% annual returns for large cap stocks during the next 7 years

I don’t know how stocks will do over the next 10-30 years. The historical 11% does seem high, but I remain a big believer in the global economy, and that the stock market is still a great long-term way to build wealth.

WHAT ELSE SHOULD I CONSIDER BESIDES “THE MATH”?

It’s tempting to just try and “run the numbers” to make the “lump sum vs. pension” decision. But there are plenty of soft factors that are very important as well.

Pension Plan “Health.” If you’re concerned about the viability of your pension plan, you can do a little research. Get your hands on the plan’s “Pension Funding Notice.” You can also check out www.FreeErisa.org and get a copy of the plans Form 5500.

Income Sources In Retirement. I really like the idea of having some income streams that I can’t outlive, which argues for declining the lump sum offer. You can think of this as “product diversification.” It’s good to have both safe products like pensions and growth products like a stock portfolio.

Inflation. If you’re concerned about inflation, strongly consider taking the lump sum and investing it in stocks or real estate, both of which have offered good inflation protection. Unlike social security, which has a cost of living adjustment (COLA), most corporate pensions do not.

Investing Acumen and Behavior. This is a big one. Are you a disciplined investor? What has your behavior been? What do you think it will be? Do you stay the course when things get tough? Do you take ill-advised risks?

Survivor Benefits. Does your pension benefit come with a spousal benefit? What is it exactly? What’s your point of view on your spouse’s life expectancy?

These factors are pretty hard to quantify, but they are important. Don’t ignore them!

WHAT I DECIDED

I decided on the lump sum, but it was a tough decision.

I really like the concept of having income streams I can’t outlive (in addition to Social Security). But ultimately, it came down to my point of view on my own life expectancy (shorter lives on my father’s side), coupled with my long-term confidence in the global economy, and my ability to stay invested for the long-term.

IT MIGHT BE A “NO BRAINER” FOR YOU

For some folks, this decision is a no brainer. Does either of these describe you?

Take the Lump Sum if:

- You’re bullish on the stock market (and your ability to enjoy market returns)

- You don’t expect to live into your 90’s

- You expect your “safe” sources of income (social security, other pension, etc.) to be sufficient to cover your Needs

- You’re skeptical about the health of your former employer’s pension plan

- You’re worried about inflation

Keep your Pension if:

- You expect to live to be very old

- You’re skeptical about long-term stock market returns

- You really value the peace of mind of having income that you can’t outlive

SEEK (OBJECTIVE) PROFESSIONAL ADVICE

A Financial advisor could help you make this decision, but be very careful.

Almost all financial advisors have a vested interest in you taking the lump sum, since almost all advisors make money on commissions and percentages on the lump sum! This is a significant conflict of interest, and it bothers me.

If you’re looking for a truly unbiased view, seek out financial advisor who works on an hourly, project, or retainer basis. I actually charge a fixed flat fee in my practice so I can avoid troubling conflicts of interest like advising on a lump sum decision while being compensated based on the commissions and/or percentages from that lump sum.