A dividend income strategy can provide you with a fairly predictable monthly income stream.

The dividends are the result of investments in a mix of stocks of stable companies. There are many benefits to the dividend income strategy including it can be tailored to your meet your need-expenses in retirement.

Thirty to forty years ago, many companies offered pensions to retired employees. Combined with social security, workers could expect to receive enough income to cover their expenses in retirement. Today, however, fewer and fewer companies offer pensions. As a result, retirees are left on their own to find ways to achieve a steady source of income for their golden years. The dividend income strategy is designed to meet the financial needs for those in retirement.

HOW DIVIDENDS WORK:

Before we get into the strategy, let’s first explore how dividends work with an example.

Bank of America’s Dividend:

Bank of America is one of the world’s leading financial institutions, providing individual consumers and businesses banking products and services.

If you owned 100 shares of Bank of America today, the bank would pay you a dividend of 48 cents per share on the number of shares you own. In other words, you would be paid $48 annually for owning the shares. Since dividends are paid quarterly, you would receive a $12 payment per quarter.

The dividend yield would be 1.6% annually for owning Bank of America stock. The dividend yield is merely the current stock price of $30 divided by the annual payout of 48 cents. The yield is the annual percentage return you can expect to receive for owning the company’s stock.

With a dividend income strategy, a portfolio is constructed containing shares of companies from various industries that pay quarterly dividends. The goal of the strategy is to create a steady income stream from the portfolio’s overall dividend yield to cover your living expenses in retirement.

BENEFITS OF A DIVIDEND INCOME STRATEGY:

Steady Income Stream:

With dividends, you know the rate of return from each investment. Each quarter, you would receive a dividend payment from the company of which you own shares.

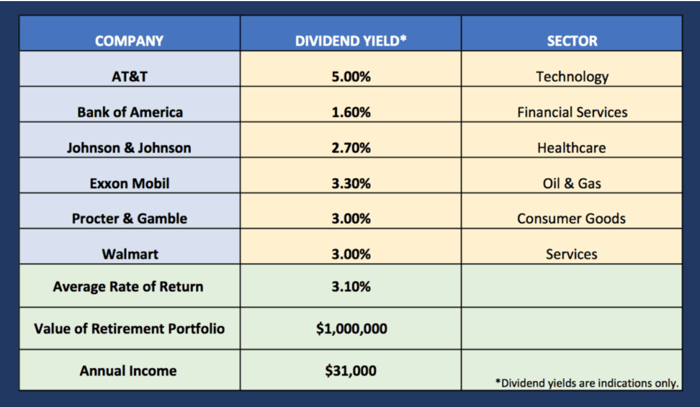

For example, let’s say you have a portfolio with $1MM invested in dividend-paying stocks (see table below).

The $1MM is invested in equal increments between the six companies. The dividend yield is the annual yield paid out by each company.

You can expect to earn $31,000 per year paid out in quarterly dividend payments. The quarterly increments total $7,750 ($31,000/4).

A dividend portfolio can be customized to achieve enough income to meet your financial needs in retirement.

A Dividend Portfolio Preserves Your Retirement Savings:

Ideally, the portfolio can be created in such a way that you can live off a dividend stream of payments without withdrawing from your principal balance. The strategy helps you avoid dipping into your savings thus helping your retirement funds last longer.

Dividend-paying Companies Are Typically High Quality:

In order for a stock to consistently pay a dividend, the company behind the dividend must be profitable and have enough cash to meet their obligations. As a result, companies that pay dividends over long periods of time are considered “safer” and less volatile investments. For example, blue-chip stocks are typically more-established companies with a history of dividend payments.

Some of these blue-chips have a track record of paying dividends for many years. Below are few examples of companies that have paid dividends for over one hundred years.

- Exxon Mobil has paid a dividend since 1882. The original company was Standard Oil Trust, started by John D. Rockefeller.

- Eli Lilly has paid a dividend since 1885.

- Procter & Gamble has consistently paid a dividend since in 1891.

- General Mills has paid dividends since 1898.

With such a proven track record, one can see why retirees looking for stable, predictable income are attracted to a dividend income strategy consisting of well-established companies.

Stock Price Appreciation From Owning Dividend-paying Stocks:

In our earlier example of the $1MM portfolio, in order to receive dividend payments, you would need to own shares in each of the companies.

As a result, when the stock prices rise, so too, does the value of the portfolio. For example, let’s assume all of the stocks in the portfolio averaged a 7% annual return in price appreciation. When combined with the 3.1% average annual dividend yield, the total annual return for the portfolio would be 10.1%.

In short, a dividend income strategy provides two possible sources of income, the quarterly dividend payments and the appreciation in stock price above and beyond the original purchase price.

Favorable Tax Treatment For Dividends And Capital Gains:

When working full time, you’re taxed by the IRS at the income tax rate. The tax rate depends on the total amount of your annual income. As you can imagine, there are various tax rates for different income levels. For example, two common tax rates are 34% and 25% of annual income.

In retirement, however, the tax rate on income from dividends and capital gains (appreciation in stock price) is much lower. In our example of your $1MM portfolio, your dividend income of $31,000 would be taxed at the current 15% capital-gains tax rate, far lower than the ordinary income tax rate.

As a result, the added benefit of the dividend income strategy is more favorable tax treatment versus ordinary income tax rates. Over time, the tax savings help to prolong the life of your retirement portfolio.

DRAWBACKS TO THE DIVIDEND INCOME STRATEGY:

Although there are many positives to investing in dividend-paying stocks as a strategy to generate income, there are some drawbacks that you should be aware of.

A Dividend Portfolio May Not Be Diversified Enough:

Too heavy of an allocation in stocks that share the same characteristics can expose your portfolio to risk and underperformance.

Company size is an important determinant in achieving a balanced portfolio. For example, small companies typically pay lower dividends than large companies. This makes sense since small companies have less cash to pay dividends than their larger counterparts. However, small companies typically have a higher growth rate than more established companies as they build up their business and expand market share. Along with higher growth rates, small-cap stocks typically appreciate at a higher percentage. And since growth is so vital, small companies are tied more closely to the growth in the economy versus large corporations.

If a portfolio is too heavily weighted in stocks of large companies, during periods of robust economic growth, the portfolio would miss out on the higher stock price gains from owning small company stocks.

On the other hand, in times of uncertainty or sluggish economic growth, the performance of small companies would likely suffer the ebbs and flows of the market. If the portfolio was too heavily weighted in small caps, total returns would be more volatile due to the market uncertainty.

By having a balance of stocks of small and large companies in your portfolio, a diversified and stable income stream can be achieved.

Sector diversification is also important to achieving steady income. A retirement portfolio should consist of stocks spread out over various sectors or industries. The reason for this is that individual sectors perform better or worse during various economic conditions.

For example, utilities are typically considered stable and perform well during times of uncertainty, but lag in times of growth. Conversely, technology companies and financials typically perform well during periods of robust economic growth and lag during times of uncertainty.

If your investment portfolio of dividend-paying stocks is not diverse in both company size and sector, you’re at risk of losing out on potential market gains and dividend payouts. Also, the lack of diversification puts your retirement savings at greater risk of losses since it would be overexposed to one industry or one company size.

Dividend payouts rates can fluctuate over time. It’s a popular myth that dividends will always be paid consistently and never decrease as long as you own the stock.

Believe it or not, a dividend can be cut by a company’s management. A dividend payout depends on the financial well being of the company issuing the dividend. If a recession occurs, for example, and the company falls on hard times, it may cut its dividend in order to remain profitable or financially solvent.

HOW LIKELY IS A DIVIDEND CUT?

As stated earlier, Bank of America is one of the world’s leading financial institutions. In October of 2008, as the economy deteriorated from the financial crisis, Bank of America cut its dividend by 50% due mounting loan losses. Then CEO Ken Lewis was quoted had this to say about the economic conditions:

“These are the most difficult times for financial institutions that I have experienced in my 39 years in banking.” He went on to say that the bank needed to “raise capital to very substantial levels in this uncertain environment.”

As a result, one drawback to the dividend income strategy is that dividend payments from a particular company are not guaranteed. It’s important to remember, your dividend income payments are determined by the financial well being of the company as well as the health of the economy.

History Shows Us Dividends Can Be Cut:

To further illustrate how dividend payments can fluctuate over the years, we must first consider another factor that can negatively impact the annual return of a retirement portfolio. This factor is inflation which measures the percentage change prices for goods and services.

Inflation can also be characterized as a measure of rising costs. The components that makeup inflation include food, energy, and healthcare costs to name a few. The various components are all included in the calculation of the annual inflation rate for the U.S. economy.

As prices rise, the purchasing power of a consumer falls. Ideally, the annual dividend yield for a retirement portfolio should exceed the annual inflation rate. However, that has not always been the case throughout history.

From 1979 to 1981, the U.S. economy experienced hyperinflation which led to a severe and protracted recession. Inflation was 13% at one point during this period. Your dividend payments during these years would not have been enough to offset price increases in the economy. To make matters worse, dividend payments were cut as companies struggled to survive the recession.

From 1969 to 1975, the market was even worse for dividend investors. OPEC cut oil production which lead to a global energy crisis.

And with skyrocketing energy prices, the economy slowed and companies struggled to stay profitable. Again, dividends were cut any gains were offset by soaring inflation. In short, dividend investors lost money in the market when factoring the cost of rising inflation and dividend cuts by corporations.

If you’re thinking, the 1970’s and 1980’s were ancient history and declining dividend yields couldn’t possibly happen in modern times, we only have to look to the financial crisis in 2009. Below is a graph showing the annual dividend yield for the S&P 500 along with the annual inflation rate from 1999 to 2010.

In 2009, dividends were cut by 23% and didn’t increase again until 2011.

As we can see below, dividend yields were cut following the Tech bubble collapse in 1999 and continued to be cut by companies through 9/11. It wasn’t until 2003 when companies began raising dividends again.

More recently, from the mid-2000’s going into the financial crisis in 2009, the S&P 500 dividend yield growth rate declined. In other words, companies were decreasing their payouts in the years before the financial crisis.

Inflation is also an important factor. The average inflation rate was roughly 3% annually for the twelve-year period. As a result, only five out of the eleven years from 1999 to 2010 did the dividend yield of the S&P 500 exceeds the inflation rate. In other words, dividend investors made money in only five of the twelve years.

All this to say, dividend payouts can fluctuate with the health of the economy and the financial well being of the company issuing the dividend.

TAKEAWAYS:

Although there are no guarantees in retirement portfolio planning, establishing a dividend income stream that’s customized to meet your financial needs can be an effective strategy.

The dividend income should be derived from a diversified array of stocks in various sectors and in size or market capitalization. Also, by owning shares in the companies, capital gains from stock price appreciation can also be used as in income source. By combining the capital gains and the quarterly dividend payments, as an income strategy, it’s possible your principal balance could remain untouched.

Of course, there is no one size fits all income strategy for retirement. And the risks to any strategy need to be assessed. This is why it’s important to speak with an advisor to assess the factors in deciding if the dividend income strategy is right for you.