When my wife told me she was pregnant with our first child, I was excited and nervous. Like any father-to-be I guess.

But then I did something that would seem unusual to most people.

I wrote the state of Utah a check for $140,000.

We lived in Virginia at the time. Heck, I’d never even been to Utah and I didn’t owe them a dime.

But Utah has an awesome 529 plan. So I wrote the $140,000 check, and it felt great. (I’ll give you the details of why $140,000 a little later in the post).

So, maybe I was a little eager. We hadn’t even told anyone my wife was pregnant! Utah found out before our family and friends.

So why did I do it?

Two (of my favorite) little words…

TAX. ALPHA.

I’ve been obsessed with tax alpha for a long time, which explains my behavior after hearing the great news from my wife.

But you might be wondering what it is exactly.

I define tax alpha as “boosting your long-term wealth accumulation efforts through aggressive tax planning.” We borrow the term alpha from investing, where it just means “outperformance.”

Basically, this just means that by implementing specific strategies into your overall financial plan, you can significantly reduce the amount of taxes you owe and simultaneously increase your net worth.

I’ll tell you a little more about some of my favorite strategies later, but first I want to show you just how powerful this can be.

$1.3 MILLION MORE NET WORTH….VIRTUALLY RISK-FREE?

Let’s take my typical client, Tom & Joanna:

- Age 52 and 54

- $2.5 million in net worth, growing at 5% per year

- 30% blended tax rate

Let’s say we can knock Tom & Joanna’s blended rate (across all types of taxes – income, capital gains, AMT, state, dividends, estate taxes) down from 30% to 20%, with aggressive planning.

It turns out this is worth an additional $1.3 million in net worth to Tom & Joanna after 30 years. That’s enough to pay for a few college tuitions for grandchildren, lots of family memories, or any number of things I bet you can come up with.

And I want you to remember, all of this comes virtually risk-free.

I’m not talking about taking any more investment risk, or different kinds of investment risk. This can all be achieved through smart, aggressive tax planning.

Now obviously, each person’s situation will be different, but I just want to help you grasp the magnitude of planning and how important it is. If you’re interested in computing what tax alpha could be worth to you, drop me an email and I’d be happy to help you figure it out.

WHY YOU (PROBABLY) HAVEN’T HEARD OF IT

If the promise of tax alpha is really so amazing then why don’t many people pursue it?

I see 4 reasons:

- Many investors and financial advisors aren’t aware of the true long-term power of it.

- Even for investors and advisors who understand it theoretically, it tends not to be the focus.

- It requires a long-term commitment to little wins.

- Your accountant is probably not positioned to help you maximize tax alpha.

Unfortunately, most people find tax alpha pretty darn boring compared to focusing on picking winning stocks. (The irony is that chasing alpha generally backfires because stock picking is a zero sum game. On the other hand, pursuing tax alpha is smart because it’s available to all of us!)

On top of these strategies seeming more boring, in order to do this well, you’ve got to be in it for the long haul. Generating tax alpha isn’t something you do overnight. It requires focusing on little wins across multiple intricate planning areas that add up over time in a profound way.

Because of this, it’s very difficult for your accountant to have the time for tax planning. If you use prep software, you’re obviously not getting any planning. If you use a human accountant, he or she may not really have tax planning skills. And even if he or she does, you’re probably not paying your accountant for holistic planning.

It’s this distinction between preparation and planning that’s so critical to understand because most people don’t even realize tax planning exists.

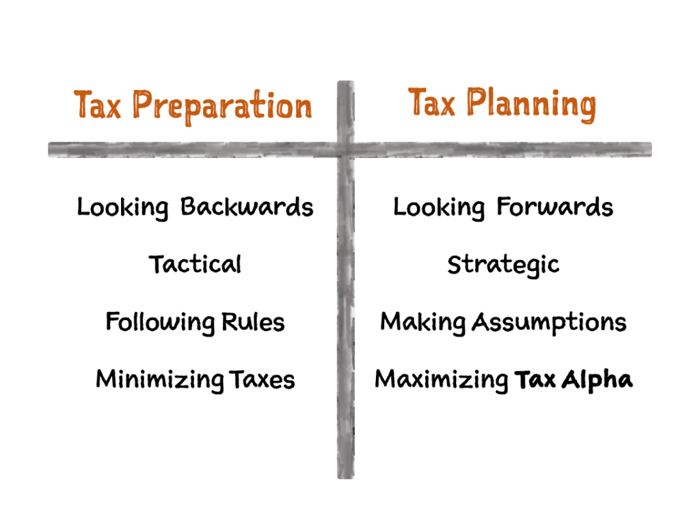

PREPARATION ISN’T PLANNING – NOT EVEN CLOSE

Normally, we think of preparation and planning going hand in hand.

But when it comes to taxes, that’s not how it works… not even close.

You’re obviously very familiar with preparation. After all, 130 million of us participate in the ritual of preparing returns for the IRS every single year.

But there’s an important difference to make:

- Tax preparation is about minimizing last year’s burden by following the rules in the most advantageous way possible. It’s tactical. We keep score with our refund.

- Tax planning, on the other hand, is about managing your future liability to maximize long-term wealth accumulation by making assumptions and acting accordingly. It’s strategic. We keep score with our net worth 30 years from now.

Here are a few more distinctions to help you see the difference:

Tax planning takes a completely different mindset or mental space than preparation. To be clear, I’m not saying planning is better or more important than preparation.

I’m saying that it’s completely different.

And completely underappreciated.

A WORD OF WARNING

Before you rush out and start buying “tax-advantaged” financial products, I owe you a major caveat.

A huge warning actually.

Just because a financial product has a favorable tax characteristic, doesn’t mean you should buy it! I’ll mention a couple examples from the world of insurance….

- Permanent life insurance is often pushed based on the fact that it grows tax-free. The problem is that the overall after-tax return on permanent life insurance is usually lower than the after-tax return on most taxable investments. So purchasing permanent life insurance usually doesn’t achieve tax alpha, and therefore doesn’t help you long-term.

- Variable annuities are often pushed based on their tax-deferred growth. But there’s more to the story. The expenses can be very high, and the growth will eventually be taxed at ordinary income rates. So purchasing a variable annuity often doesn’t result in tax alpha.

Remember, tax alpha is the increase in wealth accumulation through planning. It’s not the increase of tax-advantaged products inside your portfolio.

The point here is just because a financial product has some “favorable” tax characteristics, does not necessarily mean that buying the product makes sense.

MY (NOT SO SECRET) OBSESSION

As you can tell, I firmly believe that each of us should aggressively pursue tax alpha. Because of that, I’ve made integrated tax planning a centerpiece of my own practice. I work hard to develop a holistic picture of my clients’ financial lives, which gives me a big leg up.

So finally, some of my favorites…

5 OF MY TAX ALPHA FAVORITES

While I can’t step through all of my strategies in this article, I will give you 5 of my favorites.

Step On Up.

- At the end of your life, some of your appreciated assets pass tax-free to your heirs, but others don’t. The good news is that the baseline or initial value of these assets will actually “step up” at your death. Instead of your heirs paying taxes based on what that asset was worth when you initially purchased it, they get to step up to the current market value. This can be an incredible deal. Let’s say you have an investment worth $1 million that has a cost basis of $200,000. If you sell it while you are alive, you could pay $200,000 in taxes. But if you own it at your death, your $200,000 basis “steps up” to the $1 million dollar market value.

Location, Location, Location.

- You’re certainly aware of asset allocation by now, but you may not know much about asset location. While asset allocation answers the question “How much of what should we own?” asset location answers the question “Where should I own it?” REITs, for example, belong in tax-deferred accounts like 401ks and IRAs. This strategy alone can quietly add hundreds of thousands of dollars of wealth over a 30-year period.

The World’s Most Generous Retirement Plan.

- This gem is hiding in plain sight. It’s hiding because it is called a health savings account, so it sounds like it doesn’t have anything to do with retirement. But don’t let the name fool you. This is the world’s most generous retirement plan, because unlike every other retirement plan or account, you are literally never taxed on the money. Read that again… You literally never pay taxes. You contribute pre-tax dollars, those dollars then grow in a mutual fund tax-free, and then your withdrawals are tax-free. It doesn’t get much better than this. You can have your cake and eat it too.

Go Ahead and Convert It.

- Sometimes you can generate alpha by paying taxes sooner rather than later. But even if converting part of your IRA from a traditional to a Roth ends up being “tax alpha neutral,” it can still be a no-brainer. When you make this conversion, you are practicing tax diversification. Since you don’t know what’s going to happen to brackets and rates, you can diversify the different types of tax advantages you take.

The $140,000 Check.

- I’ll round out my top 5 strategies by explaining that $140,000 check I wrote to the state of Utah. You see, the IRS allows you to accelerate 5 years’ worth of gifts into one large 529 contribution for college savings. So two parents (or grandparents) can gift $140,000 to a 529 plan for one child (or grandchild) all at once. That’s 2 parents * $14,000 per gift * 5 years = $140,000. The power of tax-free growth starts on the full $140,000 right away.

WHAT ARE YOU WAITING FOR?

Tax Alpha is extremely powerful and these are just 5 of the many strategies I use for my clients. If you would like to learn more about my specific strategies, click below to schedule a complimentary call. On the call, we can discuss the specific strategies and checklist I use with all of my clients to make sure we maximize their net worth by generating tax alpha.

Do you have questions about tax planning? Please feel free to reach out!