And What You Can Do About It

Inflation erodes the rate of return on your retirement portfolio over time. Some investments are affected more so than others by rising prices. However there are solutions available to help you win the fight against inflation.

Inflation measures price increases of goods and services. As inflation rises, it erodes your rate of return on your investments since it offsets your gains. For example, if you earn a 5% return on your portfolio this year and inflation is 2%, your net return is 2.94% after adjusting for inflation.

Conventional wisdom tells us that our investment strategy must account for inflation. Some investments fare better in an inflationary environment while others perform poorly.

Just how high can inflation go? And what investments do we include in our portfolio to help offset the negative effects of rising prices? First, we’ll take a look at how much inflation has fluctuated over the years and where it stands today.

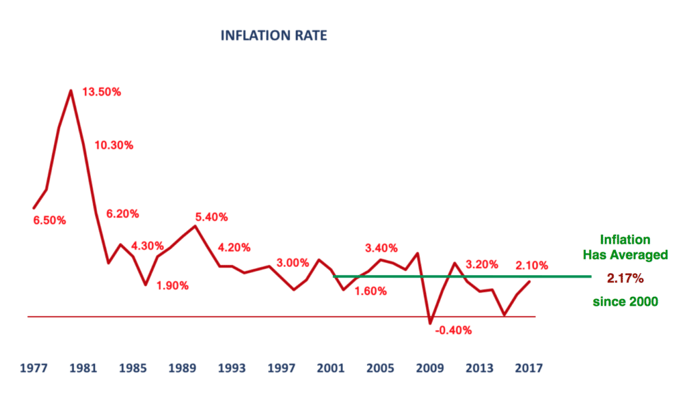

INFLATION OVER THE YEARS

- Although inflation has been less of a factor over the last few years, it was very high in the 1970’s, and early 80’s when it exceeded 13% (see graph below).

- At its highest levels, a 20% gain in your portfolio would have been eroded by a 13% inflation rate. Even in the early-to-mid 1990’s, your 20% gain would have been eroded by 3% to 5% due to inflation.

- However, the inflation rate has leveled off over the past fifteen years. Since the year 2000, inflation has averaged roughly 2% per year (green line).

CPI data obtained from BLS.gov. Chart by Bradley Clark

DOES INFLATION MATTER ANYMORE?

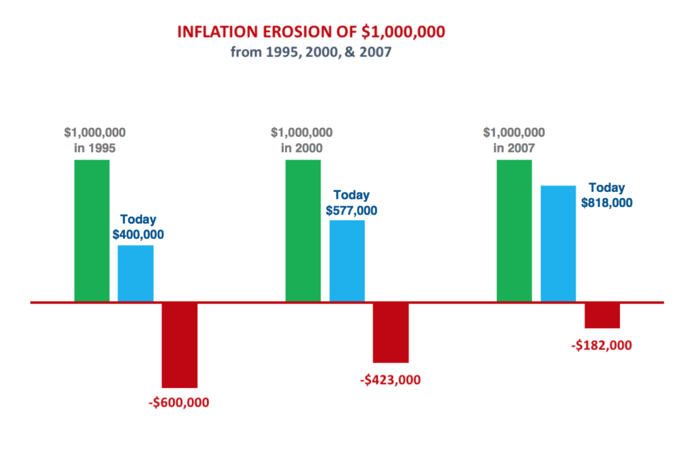

Although 2% inflation has been the norm for the last fifteen years or so, it’s important to factor in its damaging impact over time. Remember the inflation rate is an annual percentage increase meaning that prices have risen 2% each year since the turn of the century.

Of course, not all inflation is created equal. For example, rising healthcare costs and college tuition costs have had a far more damaging effect than rising food prices on the consumer. The annual inflation rate consists of an average of price increases for many goods and services.

How damaging is inflation to your purchasing power? In the example below, we calculated the purchasing power of a $1,000,000 portfolio over the years.

- We can see below that if you started retirement in 1995 with $1,000,000, it has the same purchasing power as $400,000 today or a reduction of $600,000 due to inflation over the years.

- Even in 2007, only ten years ago, your portfolio has lost $182,000 in purchasing power because of inflation since then. In other words, even a low inflation rate of 2% per year adds up to a lot of money over the course of a decade.

When you’re in retirement, you don’t receive pay raises or promotions as you did when working. Your income is fixed and based mostly on how your investment portfolio performs.

As a result, retirees stand to lose the most from rising prices. It’s essential that you know which investments are more negatively impacted by rising prices than others. From there, you can create a balanced-diversified portfolio that allows you to earn a steady income while accounting for any inflation over time.

INVESTMENTS & INCOME NEGATIVELY IMPACTED BY INFLATION:

Savings Accounts

Savings accounts and certificate of deposits pay some of the lowest interest rates of all investments on the market today. As you can imagine, a 1% interest rate on your savings account at your local bank is easily wiped out by a 2% inflation rate. This isn’t to say that you shouldn’t have any money invested in cash, but only that you should be aware that your bank accounts may not keep up with inflation over time.

Pensions

Pensions without a cost-of-living adjustment are susceptible to inflation erosion too. Since your pension income is determined by your salary before you retire, you won’t be able to offset any spikes in inflation in retirement with a promotion or increase in pay.

Bonds

Bonds pay a yield for holding them until maturity. The yield is based on the nominal interest rate for the bond minus any inflation. For example, if your bond pays 3.5% and inflation is 2.5%, your real yield is 1%. If inflation rises to 3.5% or more, you will have lost any gain on your investment.

Even your returns on a bond ladder can get hurt by inflation since you’re typically purchasing all the bonds on day one to create your income stream. A bond ladder is a portfolio of bonds that mature each year to match income to your financial needs in that year. Upon maturity, the total value of the bond is cashed out, and the income is used to cover your retirement expenses.

If your retirement portfolio is invested in bonds, inflation can be a significant drag on your rate of return.

INVESTMENTS & INCOME TO HELP YOU BEAT INFLATION:

Social Security

Although not an investment per se, Social Security is a fixed income payment, but its cost-of-living-adjustment (COLA) acts as a hedge against rising prices. With so many in retirement using Social Security for income, these increases can have a positive impact over time.

In 2025, if you’re collecting Social Security, you’ll get a 2.5% cost-of-living-adjustment to help combat any increases in inflation. If you recall the higher inflation of 2021 and 2022, the subsequent years COLAs were 5.9% and 8.7% respectively.

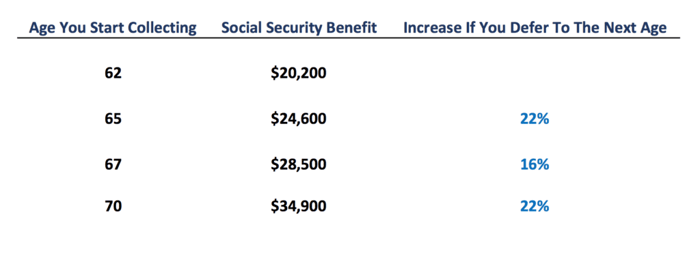

There’s another way Social Security can help you beat inflation in retirement. By delaying Social Security benefits, you can give yourself a raise in later years. You can check your benefits at various ages by accessing Your Social Security Statement on ssa.gov.

In the table below, we see just how much of a raise you can give yourself by deferring benefits to later years. In this example, we assumed you’re earning $45,000 per year today.

- If you’re 62 years old and you retire early, you’ll get the lowest benefit of $20,200.

- If you’re 65 and you wait for two years to collect, you’ll get an extra 16% in annual income. If you’re 67 years old and you defer until you’re 70, you’ll get an extra 22% more income than if you had collected at 67.

- And by waiting until your 70 to collect, you’ll receive $15,000 more per year than if you had started collecting at 65 years old. The power of deferring Social Security can help your portfolio combat inflation as well as any market downturns.

Social Security data obtained from ssa.gov. Chart by Bradley Clark

Stocks And Mutual Funds

Stocks have historically delivered the highest returns and having them in your portfolio can help you win the battle against inflation. Of course, if you’re already retired or close to it, you want to be wary of investing too aggressively in stocks since the market can fall just as hard as it can rise.

However, a portfolio that’s too conservative in its investments can be just as damaging in the long-term as one that’s too aggressive. For example, if you’re withdrawing 4% per year from your investments and your rate return on your portfolio isn’t keeping up with inflation, you increase your chances of running out of money in retirement.

Don’t forget dividends. The right mix of investments in stocks for growth and dividend-paying companies is an effective strategy for beating inflation. Companies from various industries pay quarterly dividends that can range from 3% to 5% per year. With dividends, retirees earn a rate of return or income from their stock holdings in addition to any appreciation in the stock price. A well-balanced portfolio of stocks that deliver healthy returns and dividends can help you offset inflation.

Treasury Inflation Protected Securities (TIPS)

TIPS are U.S. Treasury bonds that are designed to protect investors against unexpected inflation. As inflation rises, TIPS adjust with rising prices, increasing your principal to offset the negative effects of inflation.

U.S. Treasury Bonds including TIPS have lower default risk since they’re backed by the full faith and credit of the U.S. government. TIPS come in various maturity dates and can easily be matched to your financial needs in any given year. As a result, TIPS are a great way to diversify your portfolio and protect your returns against inflation.

Rental Income

Retirees often turn to real estate to generate income. It’s estimated that one in ten retirees supplement their income with rental properties.

Rental income typically pays a higher annual yield than dividend income and bond yields. In general, income yield from investment properties can be anywhere from 6% to 8% per year.

Rental income can also be a great hedge against inflation. For example, if your stock and bond portfolio generates an 8% return and inflation is 2%, the net rate of return is 5.88% for the year. Rental income from investment properties, on the other hand, will rise over time along with inflation.

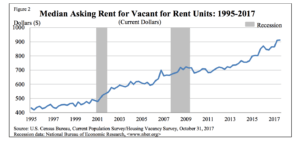

Since 1995, rents have steadily risen.

With a rental property, your income stream may increase over the years if you raise rent or after you've paid off your mortgage.

Owning rental properties as an income source in retirement may offer you a steady stream of income to hedge against inflation while simultaneously diversifying your assets beyond stocks and bonds.

TAKEAWAYS:

Everyone’s retirement strategy is unique, and your income from your investment portfolio, pension, or Social Security must cover your need expenses while also adhering to your risk tolerance levels. By creating a balanced, diversified portfolio and making appropriate adjustments to your investments, you can keep up with or beat inflation and enjoy a healthy income stream throughout your retirement.