By now you’ve likely heard the term “wealth management.”

And if you’re like most people, you probably assume that it’s an investment management service for rich people.

And it’s true. A lot of money managers that target the affluent call themselves “wealth managers.” So we associate the term with something affluent people need. But within this mess, an extremely powerful idea gets lost.

I call it true wealth management.

A POWERFUL IDEA

True wealth management isn’t a just service for rich people. It’s an idea for everyone.

It’s an approach that helps you achieve your life goals through the combination of two approaches – investment consulting and financial planning.

Even if you don’t work with a true wealth manager, you can benefit from the approach.

True wealth management starts with your life goals and translates them into financial goals. And then it works to achieve your financial goals in an integrative, holistic and strategic way.

MORE THAN MANAGING YOUR MONEY

Many financial advisors are money managers.

They focus on growing your portfolio, or a subset of your portfolio (like a hedge fund manager.)

True wealth managers also manage your money. But they do it in the service of your life and financial goals:

- Do you plan to use this money for retirement?

- What do you want retirement to look like?

- What about your kids and grandkids?

- Do you plan to give money to charity?

- How much do you plan to spend while you’re alive and how much do you want to give away after you’re gone?

- Do you want to buy a vacation home?

- How much do you want to travel?

- What are your most pressing concerns?

These are the types of questions that must be considered. And regular money managers don’t always consider them. A true wealth manager always does. When they design an investment portfolio, it’s with your life & financial goals in mind.

But their services don’t stop there. They also help you take a holistic approach by working across the industry.

SMASHING SILOS

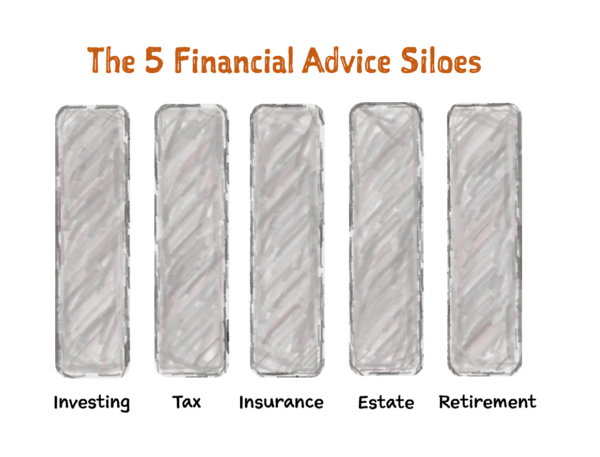

When you really think about, the financial advice industry is made up of 5 major silos:

You’ll work with products and people from all 5 of these silos at some point.

These silos are perfectly natural – it’s how different groups and industries form organically. But they can also be problematic because they lead to silo’d thinking.

Think about it.

Your life doesn’t happen in 5 convenient silos. It happens horizontally.

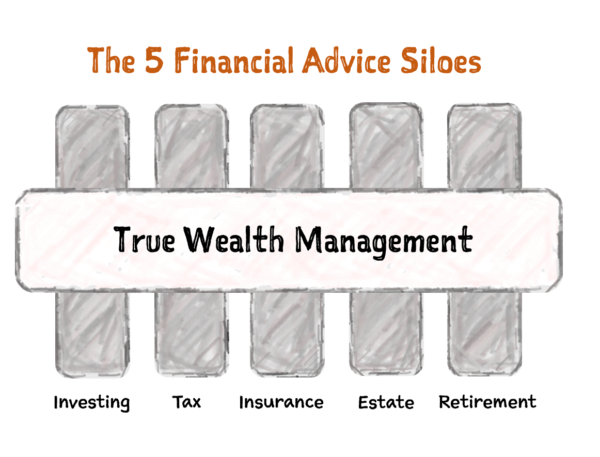

Your goals cut across industry silos, and so does a true wealth management mindset!

True wealth management works across multiple disciplines. It’s integrative. As a true wealth manager, I always try to see things “horizontally.”

Helping a client achieve a retirement goal, for example, requires working across all 5 industry silos. It requires investing for retirement and tax considerations in retirement. And of course, it also requires insurance considerations and estate planning strategies.

Another example is tax preparation.

Unfortunately, tax preparation generally happens only within the Tax silo. But true tax planning can be entirely different. Enlightened tax planning is about helping clients manage their future tax liability. It incorporates rules, assumptions and strategies across all 5 industry silos.

YOUR TEAM

You probably haven’t given much thought to your wealth management team. But you have one (even if you’re playing some of the roles yourself).

Your wealth management team is made up of 5 core members:

- You (the client)

- Wealth Manager

- Accountant

- Insurance Agent

- Estate Planning Lawyer

Perhaps the best way to think about a true wealth manager is as the primary care physician for your wealth. Like a primary care physician, a true wealth manager understands your complete financial picture and is able to handle most financial advice situations, but will refer out to specialists when appropriate. He’ll even help you coordinate with those specialists if necessary.

WEALTH MANAGEMENT 2.0?

I wouldn’t call myself a grand visionary, but I do believe the financial advice industry can transform into a helping profession (like medicine) by embracing the concept of true wealth management.

To me, that means building wealth management practices that:

- Integrate investment management and financial planning in support of clients’ life goals

- Embrace evidence-based investing

- Offer fixed flat fee compensation for practitioners to minimize conflicts of interest

I’ve designed my practice to be consistent with this vision, and I believe more and more wealth managers will do the same over time.

WHAT’S NOT TO LOVE?

As you can probably tell, I love the promise of true wealth management. It’s the only way to ensure your life and financial goals are being met. And even more exciting than that, is anyone can benefit from this approach, whether you work with an advisor or not.

You simply won’t find a better way to approach your finances. And that’s why I do what I do.

I love it because I get to help my clients replace their anxiety around money with a feeling of relaxed confidence.

So what are you waiting for? True wealth management will help you ensure your money is actually being used to reach your financial and life goals. Give me a call and let’s talk about what true wealth management could do for you and your family.